Special Needs Trust Definition With Irs

Description

How to fill out Special Needs Irrevocable Trust Agreement For Benefit Of Disabled Child Of Trustor?

Obtaining legal templates that meet the federal and state regulations is essential, and the internet offers a lot of options to pick from. But what’s the point in wasting time searching for the correctly drafted Special Needs Trust Definition With Irs sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the most extensive online legal catalog with over 85,000 fillable templates drafted by attorneys for any business and life situation. They are easy to browse with all documents arranged by state and purpose of use. Our experts keep up with legislative updates, so you can always be confident your paperwork is up to date and compliant when getting a Special Needs Trust Definition With Irs from our website.

Obtaining a Special Needs Trust Definition With Irs is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the right format. If you are new to our website, follow the steps below:

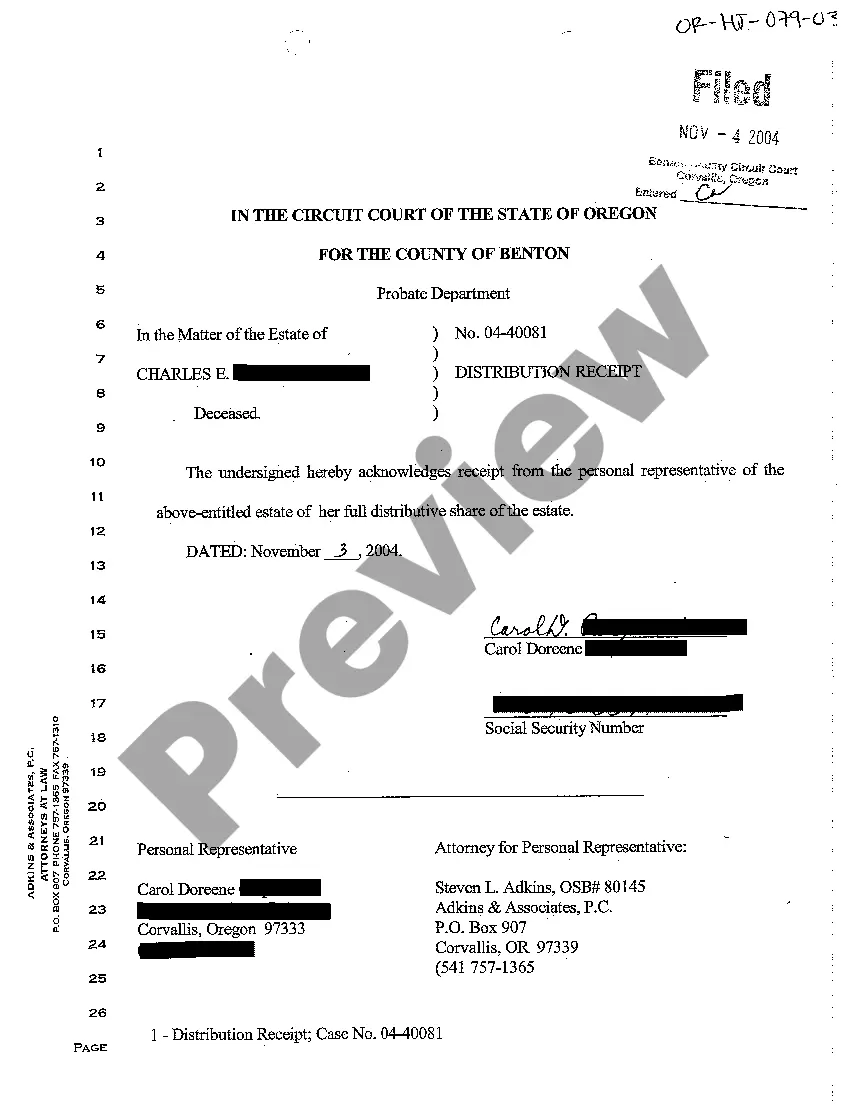

- Analyze the template using the Preview option or through the text outline to make certain it fits your needs.

- Browse for a different sample using the search function at the top of the page if necessary.

- Click Buy Now when you’ve located the suitable form and opt for a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Pick the format for your Special Needs Trust Definition With Irs and download it.

All documents you locate through US Legal Forms are reusable. To re-download and fill out previously saved forms, open the My Forms tab in your profile. Benefit from the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

Taxation of Trusts To the extent that the income of the trust is not covered by an exemption, the income will be taxed in a manner similar to an Association of Persons (AoP). Hence, for an income of up to Rs. 2.5 lakh rupees, there will be no need to pay tax.

In general, a trust is a relationship in which one person holds title to property, subject to an obligation to keep or use the property for the benefit of another. A trust is formed under state law. You may wish to consult the law of the state in which the organization is organized.

It is important to remember that the SNT cannot deduct expenses like rent and food. Deductions can be for medical care, custodial care, support services, and similar care not provided by public benefits programs.

In the case of third party special needs trusts, if the trust is considered a grantor trust, all items of income, deduction and credit are generally taxed to the individual(s) who created and funded the trust (typically parents or other relatives of the individual with a disability).

In these circumstances, the Form 1041 is very simple to complete. The trustee will check the box on Form 1041 indicating that the trust is a grantor trust and provide some general information about the trust (name, address, tax identification number, and the date the trust was established).