Special Needs Trust Definition For Child

Description

How to fill out Special Needs Irrevocable Trust Agreement For Benefit Of Disabled Child Of Trustor?

Regardless of whether it is for commercial aims or personal matters, everyone must handle legal scenarios at some point in their lives.

Completing legal documentation demands meticulous focus, starting from selecting the correct form sample.

Once it is saved, you can complete the form using editing software or print it and finish it by hand. With a vast US Legal Forms catalog available, you do not need to waste time looking for the suitable template across the internet. Utilize the library's straightforward navigation to find the correct template for any event.

- For example, if you select an incorrect version of the Special Needs Trust Definition For Child, it will be rejected when you submit it.

- Thus, it is vital to have a reliable source of legal documents such as US Legal Forms.

- If you need to obtain a Special Needs Trust Definition For Child template, follow these straightforward steps.

- Locate the template you require by using the search bar or catalog navigation.

- Review the form's details to ensure it aligns with your circumstances, state, and locality.

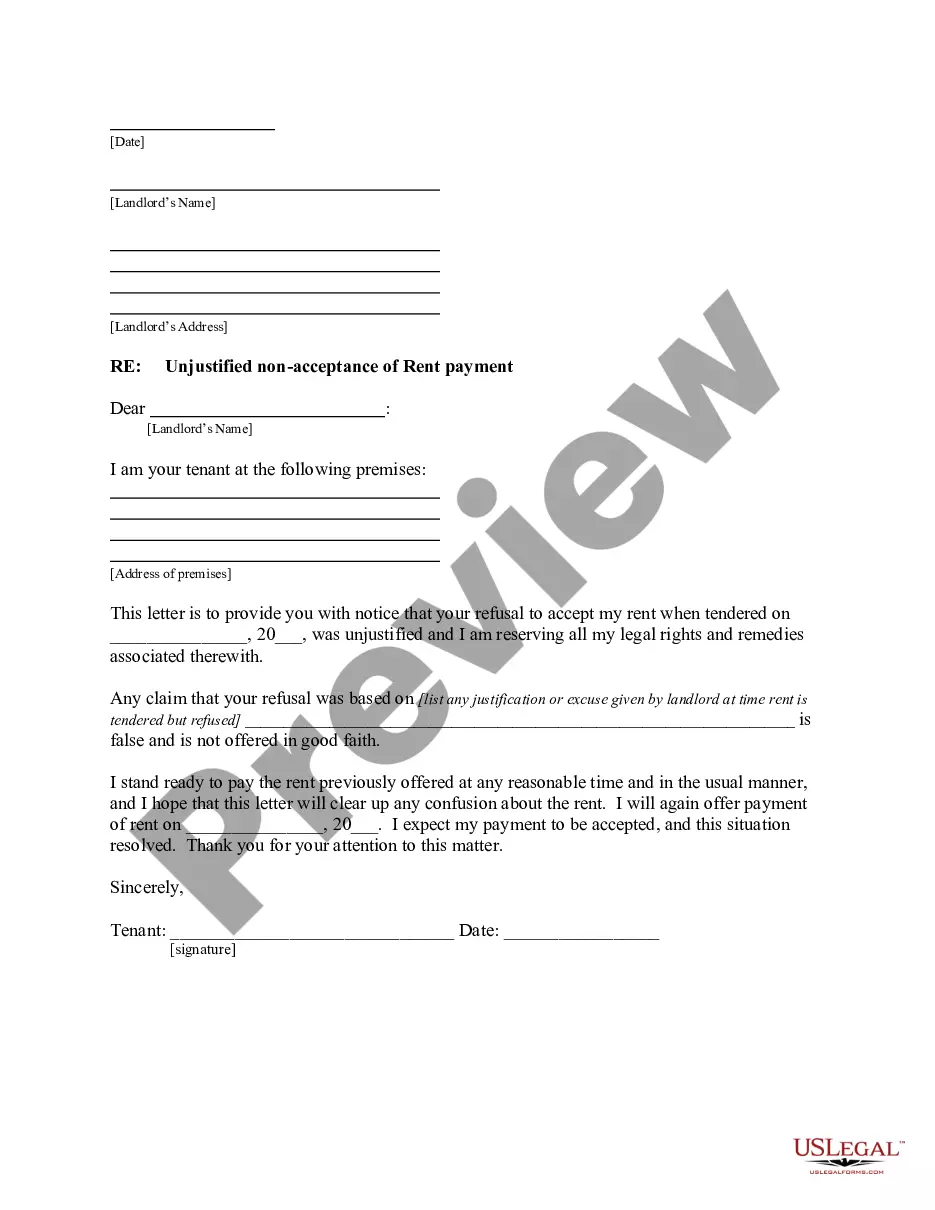

- Click on the form's preview to view it.

- If it is the wrong document, return to the search feature to find the Special Needs Trust Definition For Child template you need.

- Download the file if it meets your specifications.

- If you possess a US Legal Forms account, simply click Log in to access saved documents in My documents.

- If you do not have an account yet, you can obtain the form by clicking Buy now.

- Select the appropriate pricing option.

- Fill out the profile registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the file format you desire and download the Special Needs Trust Definition For Child.

Form popularity

FAQ

A special needs trust is a legal arrangement designed to benefit a child with disabilities while preserving their eligibility for government assistance programs. For instance, if you set up a special needs trust for your child, the trust can hold assets like funds for education, therapy, or medical expenses without jeopardizing their access to benefits like Medicaid or Supplemental Security Income. This type of trust ensures that your child receives the necessary support while maintaining their eligibility for vital services. To create a special needs trust tailored to your child's needs, consider using US Legal Forms for guidance and resources.

The advantages of a special needs trust include safeguarding your child's access to government benefits while providing additional financial resources for their care and quality of life. However, it is essential to consider the potential downsides, such as the complexity of setting up the trust and the costs associated with its management. By evaluating the special needs trust definition for child, you can better navigate these pros and cons. Platforms like US Legal Forms can help you create the necessary documents, making the process smoother.

A special needs trust is a legal arrangement designed to benefit a child with disabilities without jeopardizing their eligibility for government assistance programs. This trust allows you to set aside funds for your child's care and support while ensuring they can still receive benefits like Medicaid or Supplemental Security Income. In essence, understanding the special needs trust definition for child helps you secure your child's financial future while protecting their essential services.

Setting up a trust for a special needs child involves several important steps. First, understand the special needs trust definition for child to ensure it meets legal requirements and protects government benefits. Next, consult with an attorney who specializes in estate planning to draft the trust document. Finally, consider using US Legal Forms to access customizable templates that can streamline the setup process and provide peace of mind.

Filing taxes for a special needs trust requires careful attention to detail. A special needs trust definition for child specifies that the trust is designed to benefit a child with disabilities while maintaining their eligibility for government benefits. Typically, the trust must file a tax return using IRS Form 1041, reporting income generated by the trust assets. For the best guidance, consider using platforms like US Legal Forms, which can help simplify the process with easy-to-follow templates.

Use ?child-first? language. Talking about a ?child with a special need? is more appropriate than a ?special-needs child,? because it emphasizes that he or she is a child first. Be sure to name or describe the disability, rather than label the child, when you talk about a child with a special need.

What Is a Beneficiary of Trust? A beneficiary of trust is the individual or group of individuals for whom a trust is created. The trust creator or grantor designates beneficiaries and a trustee, who has a fiduciary duty to manage trust assets in the best interests of beneficiaries as outlined in the trust agreement.

Special Needs Trust (SNT): What It Is And How It Works. Cassidy HortonContributor. Cassidy Horton is a finance writer who specializes in insurance and banking.

A special needs trust (SNT) is a trust that will preserve the beneficiary's eligibility for needs-based government benefits such as Medicaid and Supplemental Security Income (SSI). Because the beneficiary does not own the assets in the trust, he or she can remain eligible for benefit programs that have an asset limit.

A spendthrift trust is a trust designed so that the beneficiary is unable to sell or give away her equitable interest in the trust property. The trustee is in control of the managing the property. Thus, the beneficiary of the trust is not in control of the property and her creditors cannot reach those assets.