Special Disabled Trustor Contract For The Future

Description

How to fill out Special Needs Irrevocable Trust Agreement For Benefit Of Disabled Child Of Trustor?

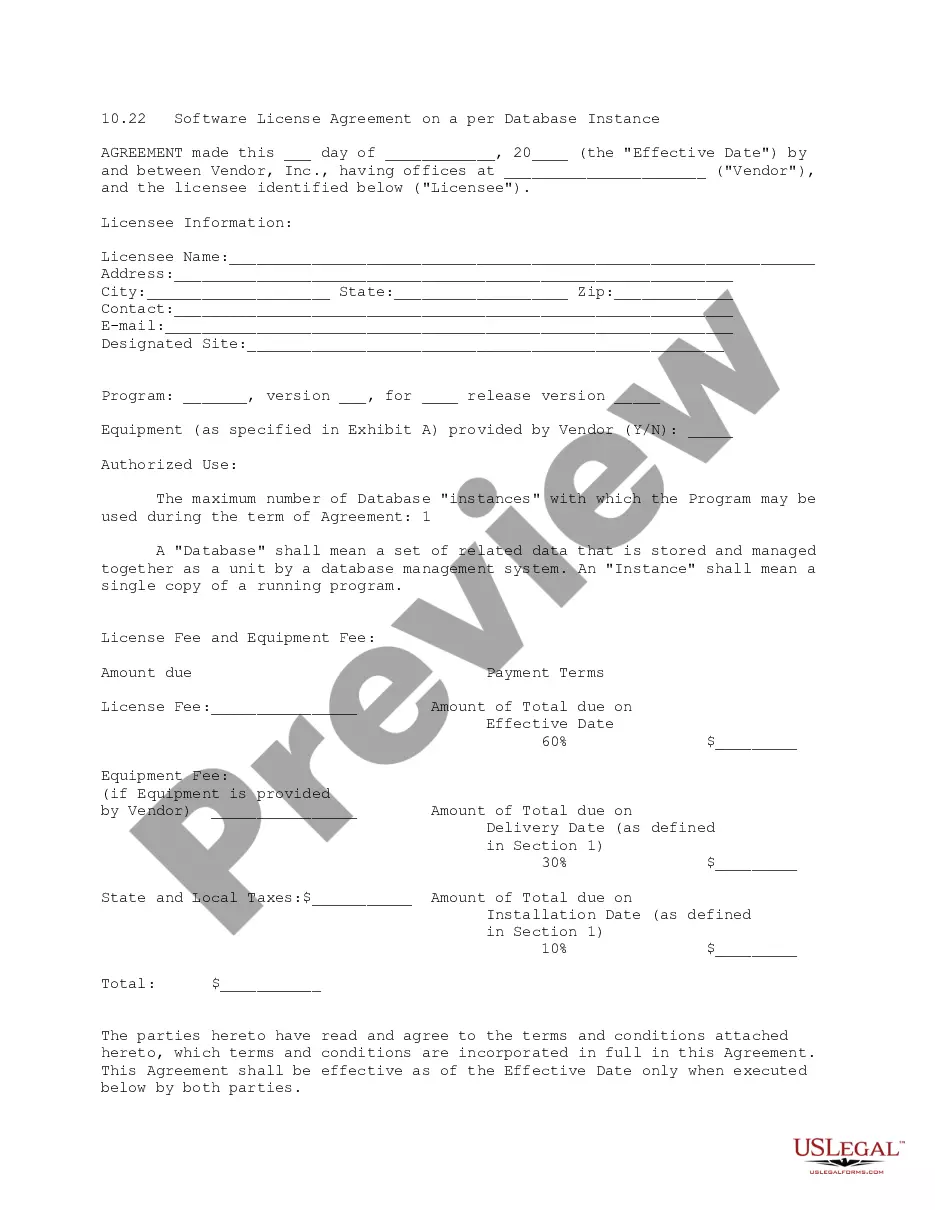

- Log in to your US Legal Forms account if you are an existing user. Ensure your subscription is active, or renew it if necessary.

- If you're a first-time user, start by browsing the extensive library. Review the preview mode and form descriptions to find the right document that fits your local jurisdiction.

- If needed, utilize the Search tab to find alternative templates that may suit your requirements better.

- Once you've selected the proper document, click on the Buy Now button to choose a subscription plan that works for you. Make sure to register an account.

- Complete your purchase by entering your payment details. Options include credit card or PayPal for secure transactions.

- Finally, download your form and save it on your device. You can also access it anytime in the My Forms menu on your profile.

By utilizing US Legal Forms, you gain access to a vast collection of over 85,000 editable legal forms, outpacing most competitors in variety and affordability.

Take charge of your legal document needs today. Visit US Legal Forms to streamline your process and ensure your documents are accurately filled and compliant.

Form popularity

FAQ

Upon the death of the beneficiary, the funds in a special needs trust are handled based on the directives outlined in the trust agreement. If the special disabled trustor contract for the future includes specific provisions for disbursement, those guidelines will dictate how the funds are to be allocated. Legal assistance may be necessary to ensure compliance with regulations and to manage any potential claims from government agencies or creditors.

When the beneficiary of a special needs trust passes away, the assets within the trust are typically subject to the terms set in the trust document. If the special disabled trustor contract for the future specifies beneficiaries or contingent beneficiaries, the remaining assets will be distributed according to those instructions. It is essential to review the trust provisions to ensure proper management and distribution after the beneficiary’s death.

One of the biggest mistakes parents make when setting up a trust fund is failing to consider the long-term needs of their disabled child. Inadequate funding or vague trust terms can lead to complications down the road. Another common pitfall is not reviewing the trust regularly to ensure it meets evolving needs. Keeping these factors in mind can lead to better outcomes under a special disabled trustor contract for the future.

Yes, a special needs trust generally requires a separate tax identification number, and it must file its tax returns. Depending on the income generated by the trust, it may also be necessary to report taxable earnings. Maintaining compliance with tax laws is essential in order to ensure the trust operates smoothly and aligns with the special disabled trustor contract for the future.

Setting up a special needs trust can present various challenges. One major con is the potential high costs associated with legal fees and ongoing administration. Moreover, inflexibility can arise once the trust is established, not allowing changes easily to adapt to the beneficiary's evolving needs. Being aware of these cons can help you make informed decisions about a special disabled trustor contract for the future.

To set up a trust fund for a disabled person, begin by choosing the right type of trust, such as a special needs trust. Work with a qualified attorney to draft the trust document, clearly stating how the funds should be managed and distributed. Be sure to name a trustworthy trustee who understands the needs of the beneficiary. This process is key to fulfilling the objectives of the special disabled trustor contract for the future.

Setting up a special needs trust involves several essential steps. First, consult with a legal professional who specializes in estate planning and disability law. Next, outline the trust’s purpose and beneficiaries, followed by drafting the trust document. Finally, ensure that you fund the trust appropriately, keeping in mind the guidelines of the special disabled trustor contract for the future.

The primary downside of a special needs trust is the complexity involved in setting it up and maintaining compliance. Trusts require ongoing management, which can incur additional costs and legal fees. Additionally, if not properly administered, the trust can jeopardize eligibility for government benefits. Understanding these aspects is crucial for anyone considering a special disabled trustor contract for the future.

One alternative to a special needs trust is a pooled trust. A pooled trust allows multiple beneficiaries to combine their resources while providing individualized management. This option can be more affordable and offers professional investment help. However, it is essential to understand how each option aligns with the specific needs of the disabled individual and the goals of the special disabled trustor contract for the future.

Starting a special disabled trustor contract for the future involves a few steps. First, gather necessary information about the beneficiary and your financial goals. Then, consult with an attorney or use user-friendly services like uslegalforms to create a tailored trust document. Finally, fund the trust appropriately to ensure it meets its intended purpose of supporting the beneficiary.