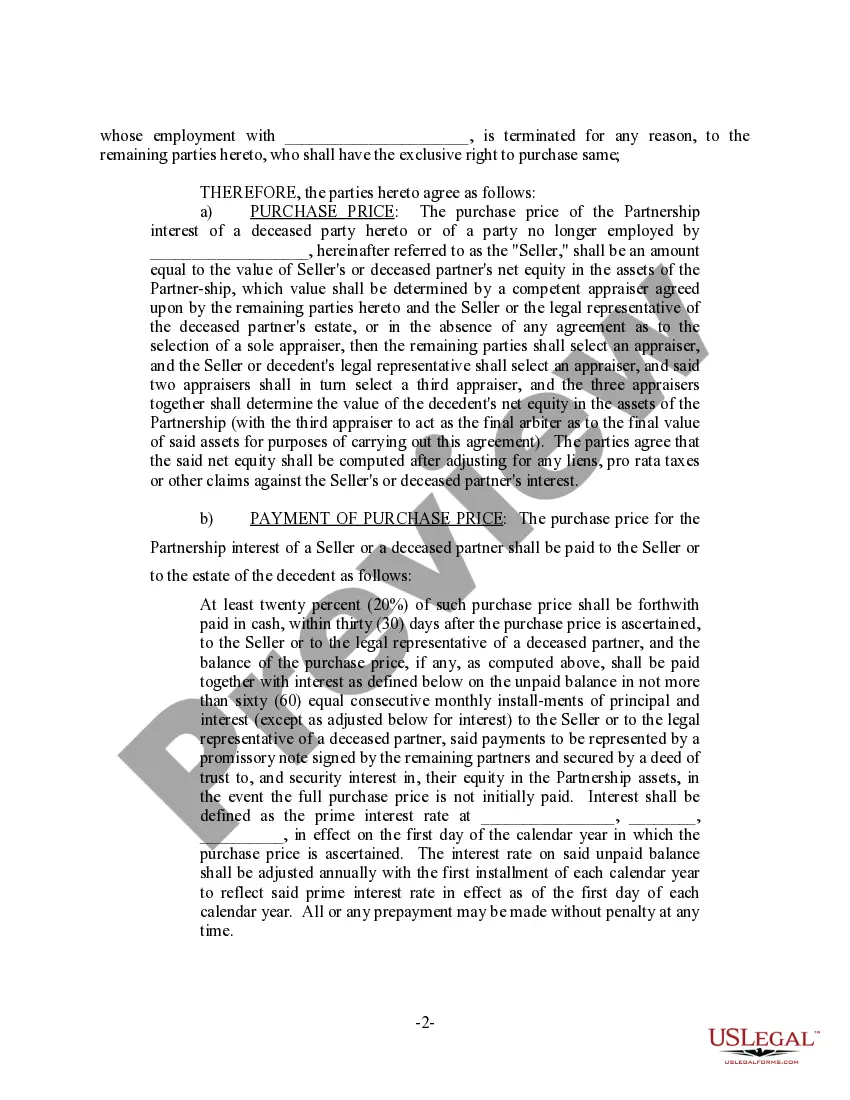

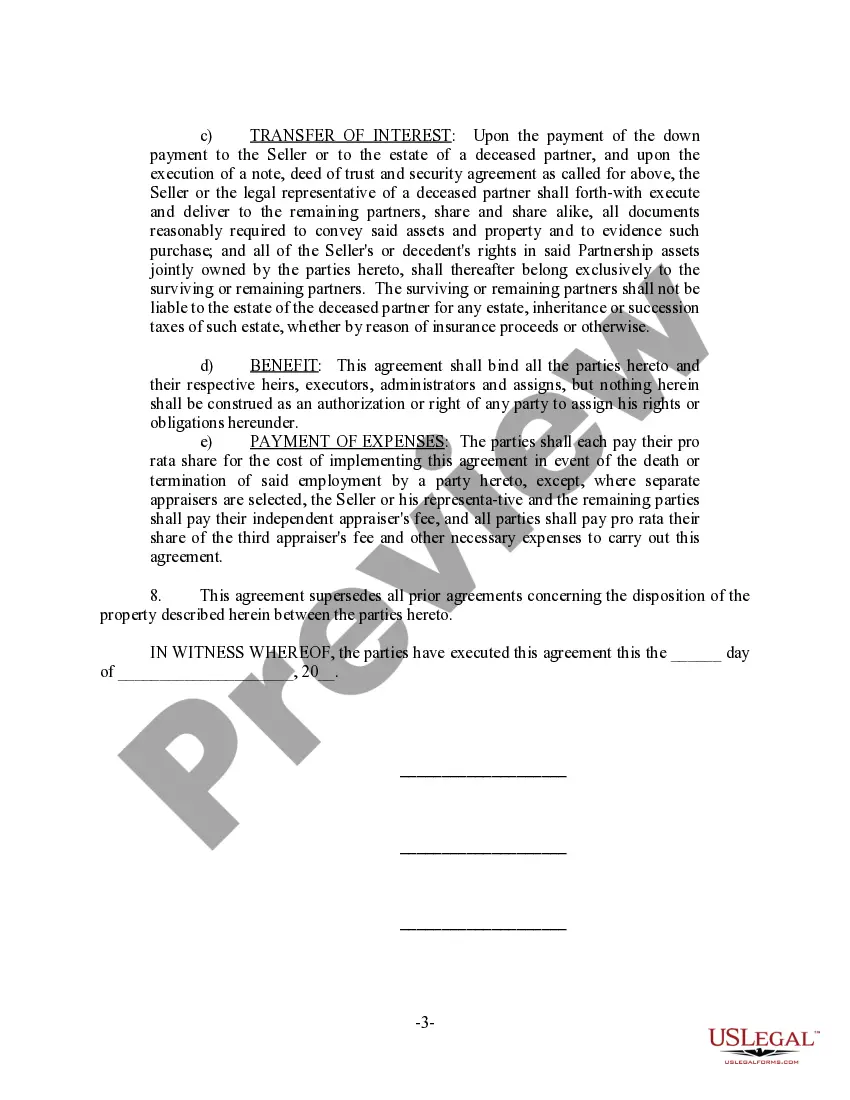

Partnership Professional Agreement For Llc

Description

How to fill out Partnership Agreement For Professional Practice?

It’s widely known that you cannot instantly become a legal expert, nor can you comprehend how to swiftly create a Partnership Professional Agreement For LLC without possessing a specific skill set.

Assembling legal documents is a labor-intensive task that necessitates a particular level of education and expertise. So why not entrust the formulation of the Partnership Professional Agreement For LLC to the specialists.

With US Legal Forms, one of the most comprehensive legal document databases, you can find everything from judicial papers to templates for internal business communications. We understand the significance of compliance and alignment with federal and state regulations. That’s why, on our platform, all documents are location-specific and current.

You can revisit your documents from the My documents section at any time. If you’re a returning customer, you can simply Log In and locate and download the template from the same section.

Regardless of the intent of your documentation—whether it’s financial and legal or personal—our platform caters to your needs. Give US Legal Forms a try now!

- Locate the document you require using the search feature at the top of the page.

- Review it (if this option is available) and examine the accompanying description to ascertain if Partnership Professional Agreement For LLC is what you need.

- Start your search anew if you desire a different template.

- Create a free account and select a subscription plan to purchase the document.

- Click Buy now. Once the payment is finalized, you can obtain the Partnership Professional Agreement For LLC, fill it out, print it, and deliver it or send it via mail to the appropriate parties or organizations.

Form popularity

FAQ

What Should Be Included in a Settlement Agreement? Identifying information for all involved parties. A description of the issue you're seeking to settle. An offer of resolutions that both parties agree to. Proof of valid consideration from both parties without coercion or duress. Legal purpose.

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

Your debt settlement proposal letter must be formal and clearly state your intentions, as well as what you expect from your creditors. You should also include all the key information your creditor will need to locate your account on their system, which includes: Your full name used on the account. Your full address.

Write a debt settlement letter to your creditor. Explain your current situation and how much you can pay upfront. Also, provide them with a clear description of what you expect in return, such as the removal of missed payments or the account shown as paid in full on your report.

When drafting a debt settlement agreement, it is essential to include the following: Necessary information about the loan agreement. The contact information of both parties. The date of the agreement. The terms of the agreement. The amount of debt.

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

You can hire a debt settlement company who will negotiate with your creditor for a fee, or you can cut out the middleman and do it yourself. Debt settlement is commonly used when the borrower can no longer afford the high interest on credit card debt, coupled with the amount owed.