Trust Special Needs Benefit Withdrawal

Description

How to fill out Irrevocable Trust Agreement Setting Up Special Needs Trust For Benefit Of Multiple Children?

Legal administration may be perplexing, even for the most seasoned professionals.

When you are looking for a Trust Special Needs Benefit Withdrawal and do not have the opportunity to devote time searching for the correct and updated version, the process can be challenging.

Access a valuable resource repository of articles, guides, and materials pertinent to your situation and requirements.

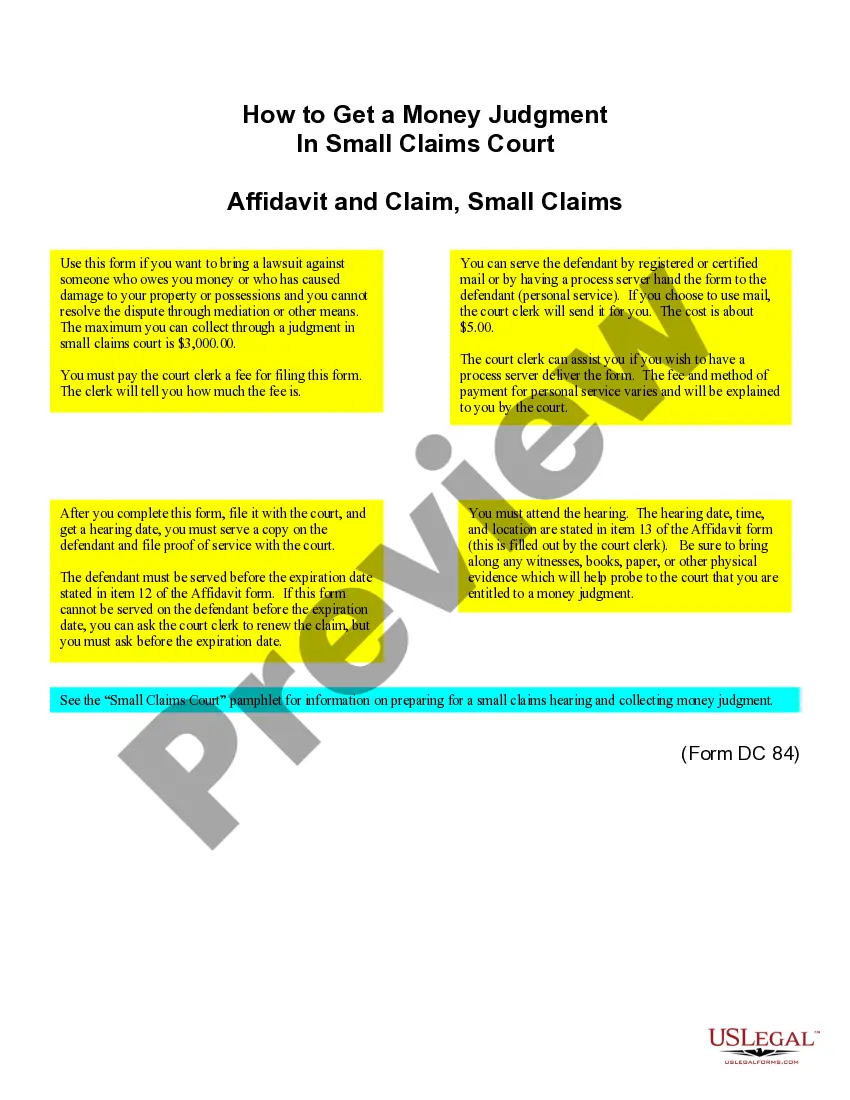

Save time and energy searching for the documents you require, and utilize US Legal Forms’ advanced search and Review tool to locate Trust Special Needs Benefit Withdrawal and download it.

Ensure that the sample is accepted in your state or county. Choose Buy Now when you are ready. Select a monthly subscription plan. Choose the file format you require, and Download, complete, sign, print, and send your documents. Enjoy the US Legal Forms online library, supported by 25 years of experience and reliability. Streamline your daily document administration into a straightforward and user-friendly process today.

- If you have a membership, Log In to your US Legal Forms account, search for the form, and download it.

- Check the My documents tab to view the documents you have previously saved and manage your folders as you see fit.

- If this is your first time with US Legal Forms, create an account and gain unlimited access to all platform benefits.

- Here are the steps to take after obtaining the form you need.

- Confirm that this is the correct form by previewing it and reading its description.

- Access state- or county-specific legal and business documents.

- US Legal Forms addresses any needs you might have, from personal to business documentation, all in one place.

- Utilize advanced tools to execute and manage your Trust Special Needs Benefit Withdrawal.

Form popularity

FAQ

Most Trusts take 12 months to 18 months to settle and distribute assets to the beneficiaries and heirs.

SSDI does not depend upon having limited assets, and it is not affected by distributions from a Disability Trust.

Just choose your preferred account on the ATM screen. If you use the credit card function on your Trust card at an ATM, this means you are taking a cash advance. Note that supplementary cardholders cannot take out a cash advance. If you use the debit card function, you are withdrawing cash from your savings account.

It depends on the terms of the trust. It may happen quickly or it could take years or even decades to distribute. It's important to point out that the longer it takes to distribute the assets, the more money it will cost to keep the trust active since you must pay for maintenance and trustee fees.

The trustee works in very close contact with the beneficiary and/or their caregiver to manage the trust and its financial distributions to pay for these things. The main takeaway regarding distribution of SNT funds is this: The beneficiary never sees the money directly, but the money is used to pay for their needs.