Benefit Trust Company For Gdl

Description

How to fill out Crummey Trust Agreement For Benefit Of Child With Parents As Trustors?

Finding a reliable resource for the latest and suitable legal templates is a significant part of navigating bureaucracy.

Identifying the correct legal documents requires precision and carefulness, which is why sourcing Benefit Trust Company For Gdl exclusively from reputable sites, like US Legal Forms, is crucial. An incorrect template may squander your time and prolong the process you’re facing.

Eliminate the hassle associated with your legal documents. Explore the extensive US Legal Forms library to locate legal templates, verify their suitability for your circumstances, and download them instantly.

- Utilize the library navigation or search bar to find your template.

- Examine the description of the document to ensure it aligns with the stipulations of your state and locality.

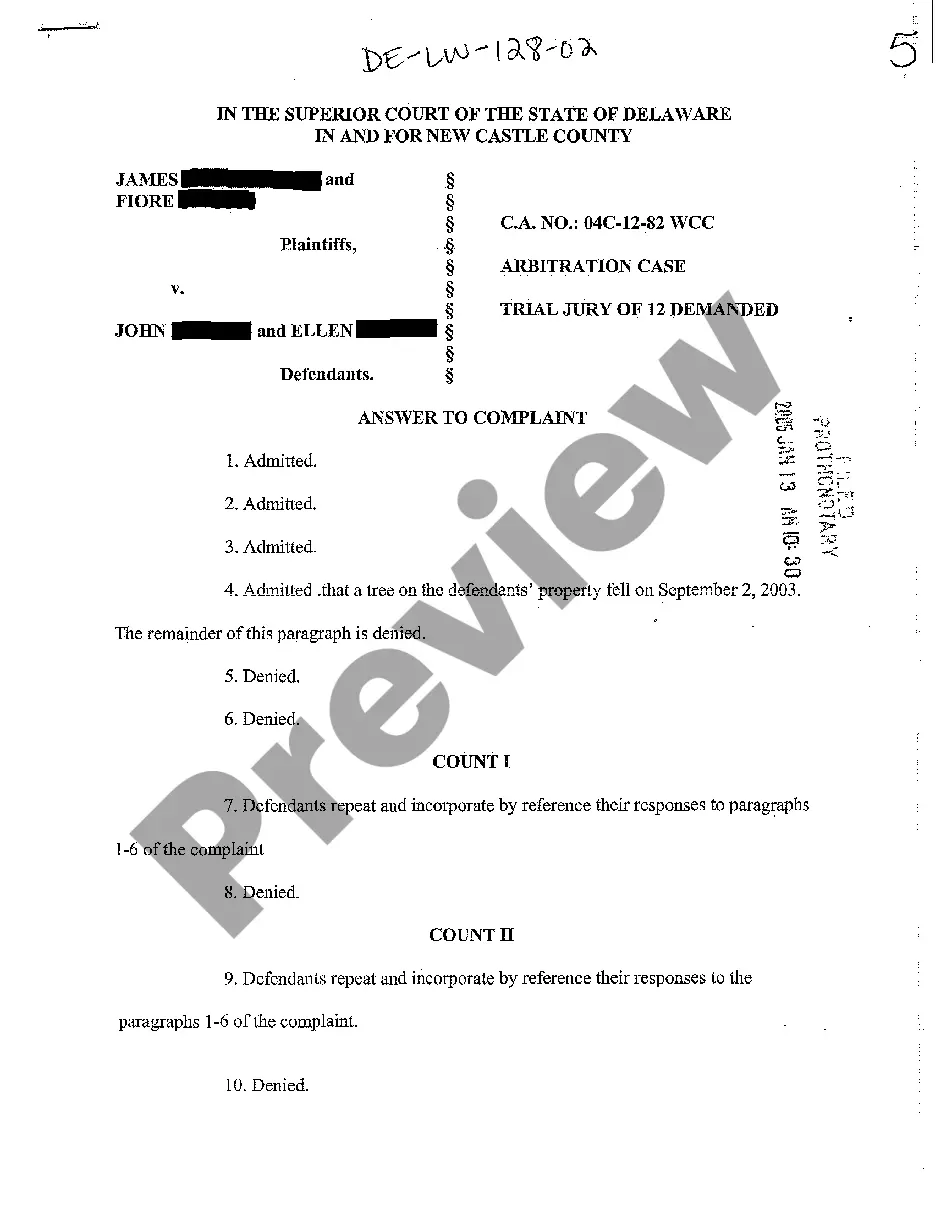

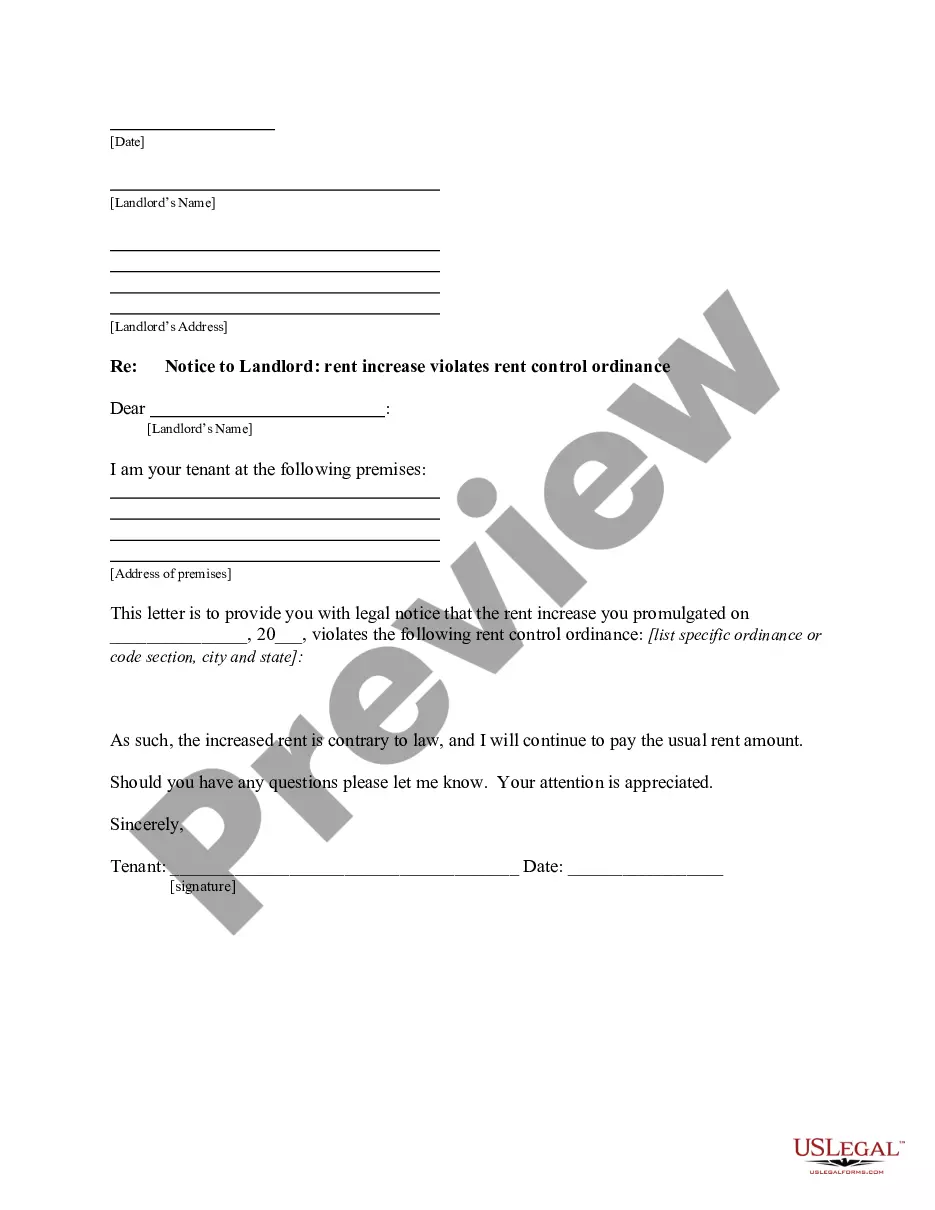

- Preview the document, if accessible, to confirm that this is indeed the form you seek.

- Return to the search if the Benefit Trust Company For Gdl does not fulfill your requirements.

- If you are certain about the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your chosen forms in My documents.

- If you lack an account, click Buy now to acquire the form.

- Select the payment plan that best fits your needs.

- Proceed with the registration to complete your purchase.

- Finalize your payment by selecting a transaction method (credit card or PayPal).

- Choose the document format for downloading Benefit Trust Company For Gdl.

- After saving the form on your device, you can modify it using the editor or print it out and fill it in manually.

Form popularity

FAQ

You cannot put a 401(k) in a living trust or other tax-deferred plans, for that matter. Why? If you change the ownership structure of your 401(k), the IRS will regard it as an early withdrawal. Unfortunately, that money will be fully taxable in the year that that transfer takes place.

Benefit Trust was formed with the single-minded fiduciary focus of delivering services to corporations, institutions and executives. Our core offerings include custom benefit plans, trustee and custodial services, trading platforms, portfolio unitization, investment management, and collective trust services.

An employee benefit trust is an investment plan where funds contributed by an employer and an employee are held in a trust. It usually applies to retirement plans because most other employee benefits are services that the employer pays as they are used.

Trust Agreement The trustee essentially has legal title to the plan assets. The plan's assets are protected from the creditors of the Plan Sponsor. As such, if the employer was to become financially insolvent, the assets would be available to the plan participants and their beneficiaries.

How to initiate a distribution or roll over. If you are eligible for a distribution, then a banner should appear at the top of your Guideline dashboard. You can request a cash distribution or outbound rollover to a new provider by selecting the ?Choose Rollover Option? button.