Company Trust Form Document Format

Description

How to fill out Assignment Of LLC Company Interest To Living Trust?

Managing legal documents and procedures can be a lengthy addition to your day. Company Trust Form Document Format and similar forms generally require you to locate them and determine the best method to fill them out correctly. Consequently, whether you are addressing financial, legal, or personal issues, utilizing a comprehensive and user-friendly online directory of forms at your disposal will greatly assist you.

US Legal Forms is the premier online resource for legal templates, featuring over 85,000 state-specific documents and various tools to help you complete your paperwork effortlessly. Explore the collection of relevant documents available with just one click.

US Legal Forms offers you state- and county-specific forms available for download at any time. Safeguard your document management processes with a high-quality service that enables you to prepare any form within minutes without any additional or concealed fees. Simply Log In to your account, find Company Trust Form Document Format, and obtain it immediately from the My documents section. You can also access previously saved forms.

Is it your first time using US Legal Forms? Sign up and create a free account in just a few minutes to gain access to the form catalog and Company Trust Form Document Format. Then, follow the steps below to fill out your form.

US Legal Forms boasts 25 years of experience assisting users with their legal documentation. Find the form you need today and streamline any process effortlessly.

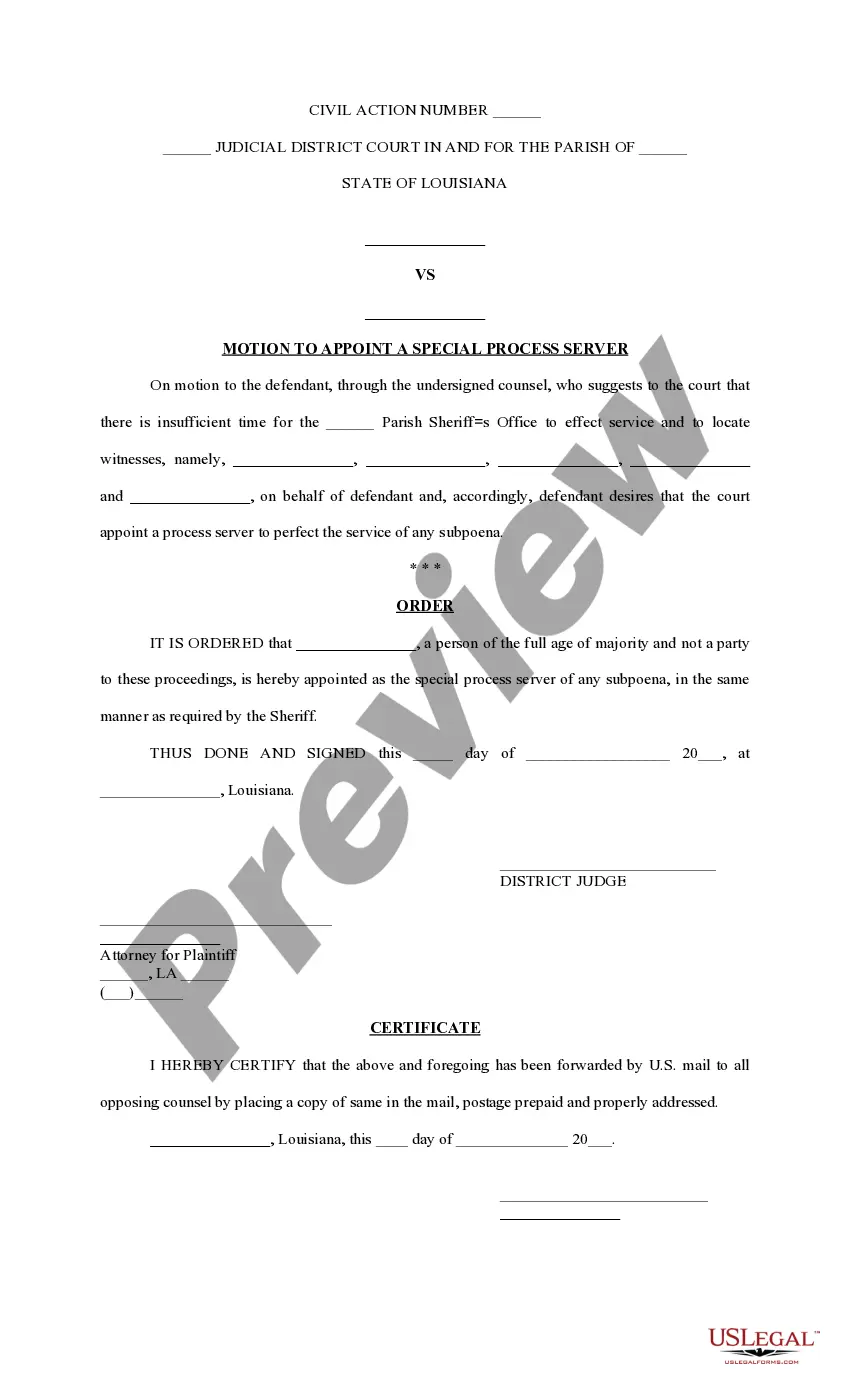

- Ensure you have the correct form using the Preview feature and reviewing the form details.

- Select Buy Now when ready, and choose the subscription plan that fits your needs.

- Click Download then fill out, eSign, and print the form.

Form popularity

FAQ

A simple example would be the situation in which one member of a family advances money to another and asks the second member to hold the money or to invest it for him. A more complicated example of an implied trust would be the situation in which one party provides money to another for the purchase of property.

A trust agreement is a legal document containing, terms, conditions and provisions that allows the trustor to transfer the ownership of assets to the trustee to be held for the trustor's beneficiaries.

A declaration of trust legally establishes a new trust. In doing so, it specifically defines the trust's beneficiaries, the trustees and the terms of the new trust. The trustees then manage the trust ing to the terms laid out in the declaration, on behalf of the beneficiaries defined in the declaration.

The most common example of when a declaration of trust is used is the situation where an adult son or daughter borrows money for a deposit on a first house from his or her parents. The parents may have a mortgage already, and the terms of that mortgage prevent them from borrowing under another.