Assignment Llc Interest Trust With Employees

Description

How to fill out Assignment Of LLC Company Interest To Living Trust?

Whether for commercial reasons or for personal affairs, everyone must navigate legal matters at some stage in their life.

Filling out legal documents requires meticulous attention, starting with selecting the correct form template.

Once it is saved, you can complete the form using editing software or print it out and finalize it by hand. With a comprehensive US Legal Forms catalog available, you do not need to waste time searching for the correct sample online. Leverage the library’s user-friendly navigation to find the right form for any circumstance.

- For instance, if you select an incorrect version of the Assignment Llc Interest Trust With Employees, it will be rejected upon submission.

- Thus, it is imperative to have a trustworthy source of legal documents like US Legal Forms.

- If you need to obtain an Assignment Llc Interest Trust With Employees template, follow these straightforward steps.

- Use the search bar or catalog navigation to find the sample you require.

- Review the details of the form to ensure it matches your situation, state, and county.

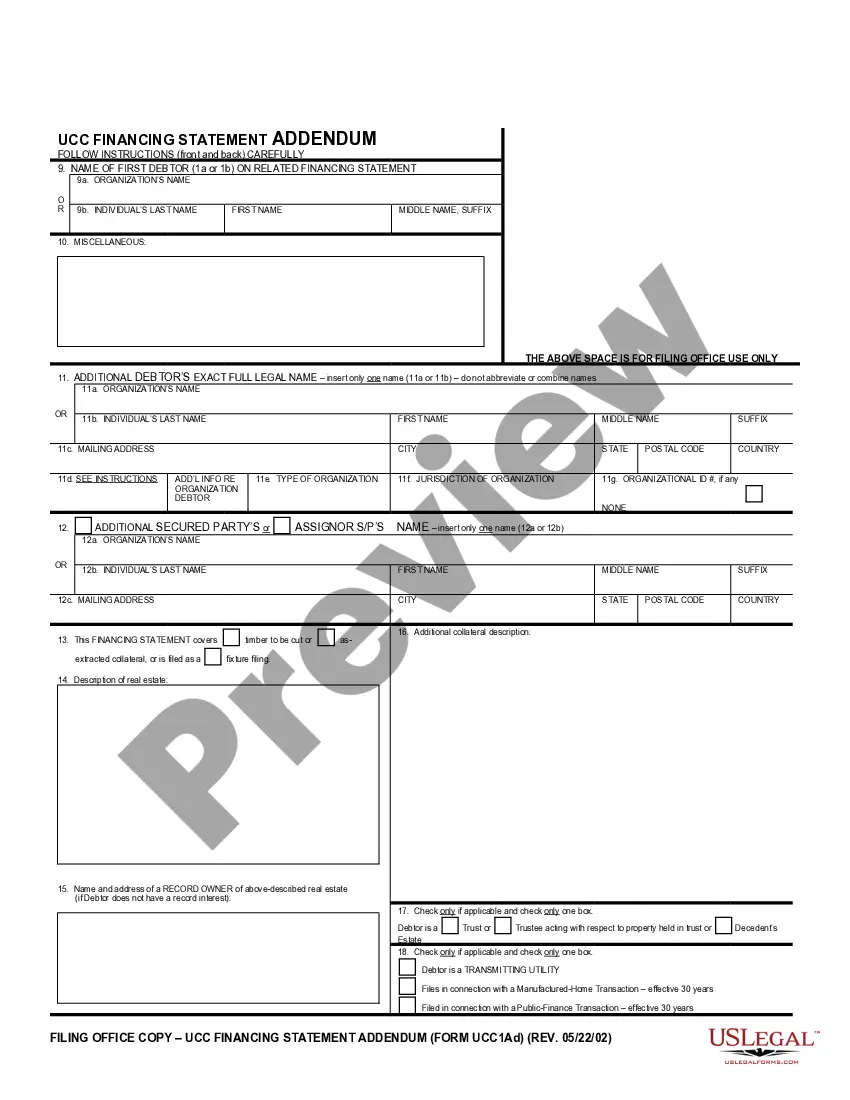

- Click on the form’s preview to review it.

- If it is the wrong form, return to the search feature to find the Assignment Llc Interest Trust With Employees template you need.

- Acquire the template when it aligns with your needs.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- If you do not have an account yet, you can procure the form by clicking Buy now.

- Choose the suitable pricing option.

- Complete the profile registration form.

- Select your payment method: utilize a credit card or PayPal account.

- Choose the file format you desire and download the Assignment Llc Interest Trust With Employees.

Form popularity

FAQ

Forming a trust for an LLC involves several steps including defining the trust's purpose, selecting a trustee, and drafting a trust document. You will also need to transfer the LLC interests into the trust properly. Consulting with legal professionals can help ensure that you follow all necessary regulations and meet your objectives. Incorporating an assignment LLC interest trust with employees will enhance the trust's functionality and security.

To assign LLC interest to a trust, create a written assignment that clearly states the transfer of interest. Ensure that both the LLC and the trust are properly identified in the document. It’s also crucial to update the LLC’s records and notify other members of the change. By following these steps, you can effectively use an assignment LLC interest trust with employees to manage your assets.

Yes, you can assign your interest in a trust, but the process often depends on the trust’s terms and regulations. This assignment may involve legal documentation to ensure clarity and compliance. It’s advisable to consult with a legal expert to navigate potential complexities and ensure that the assignment is valid. The assignment LLC interest trust with employees can provide a framework for these transactions, ensuring smooth operations.

Yes, a trust can own an LLC interest, which allows for flexible management of assets. This arrangement enables the trust to benefit from the LLC’s profits while providing asset protection. Moreover, it simplifies the transfer of ownership, as the trust continues to exist regardless of changes in its beneficiaries. Understanding the assignment LLC interest trust with employees can enhance the operation and benefits of this structure.

To transfer LLC interest to a trust, you typically need to draft an assignment document that details the transfer. This document should include information about the LLC and the trust, ensuring clarity and legality. After completing the assignment, update the LLC’s operating agreement to reflect the trust as the new member. Utilizing an assignment LLC interest trust with employees can help make this process more efficient and secure.

Assigning your LLC to your trust can provide several benefits, such as asset protection and streamlined inheritance processes. It allows for a smoother transition of ownership upon your passing. However, it is essential to consider your specific circumstances and consult with a professional to ensure this decision aligns with your long-term goals. An assignment of LLC interest trust with employees can facilitate these advantages effectively.

One significant mistake parents often make is failing to clearly define the purpose of the trust. Without a clear intention, the trust may not meet the family's needs. Additionally, neglecting to involve all relevant family members in the discussion can lead to misunderstandings and conflict. Understanding the assignment of LLC interest trust with employees can help ensure proper management and distribution of assets.