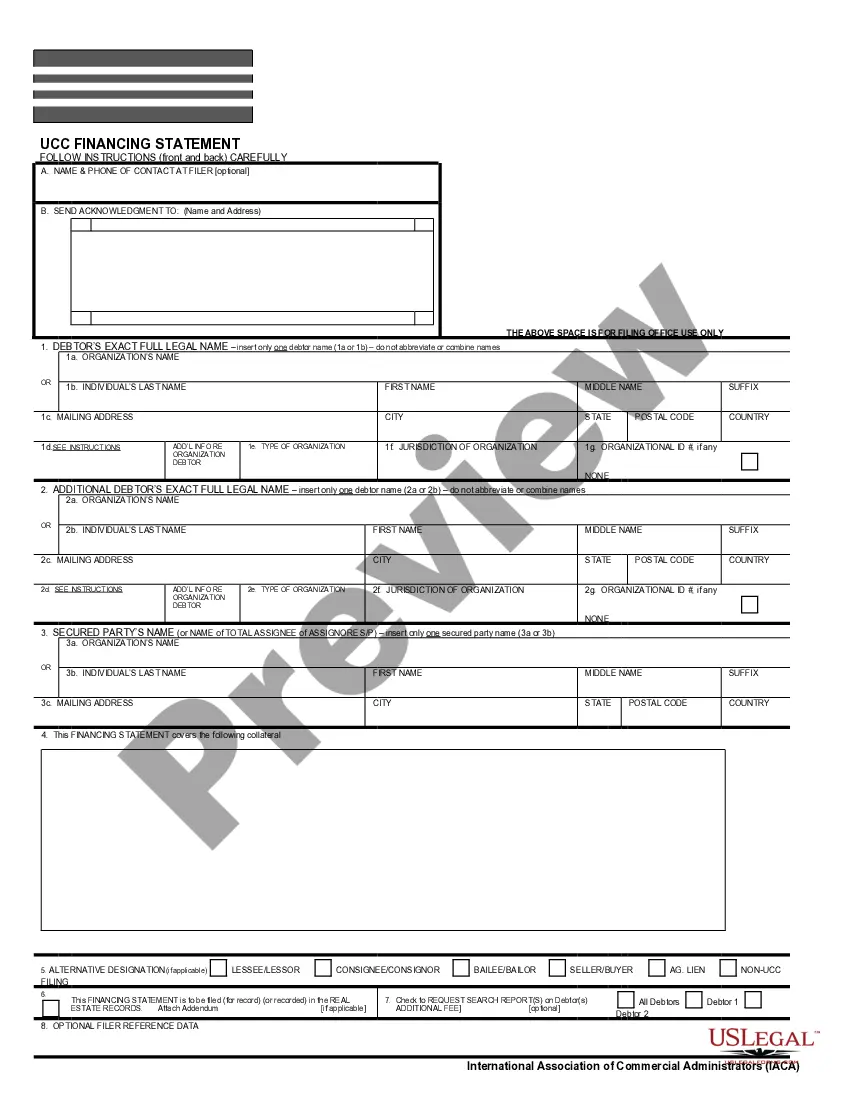

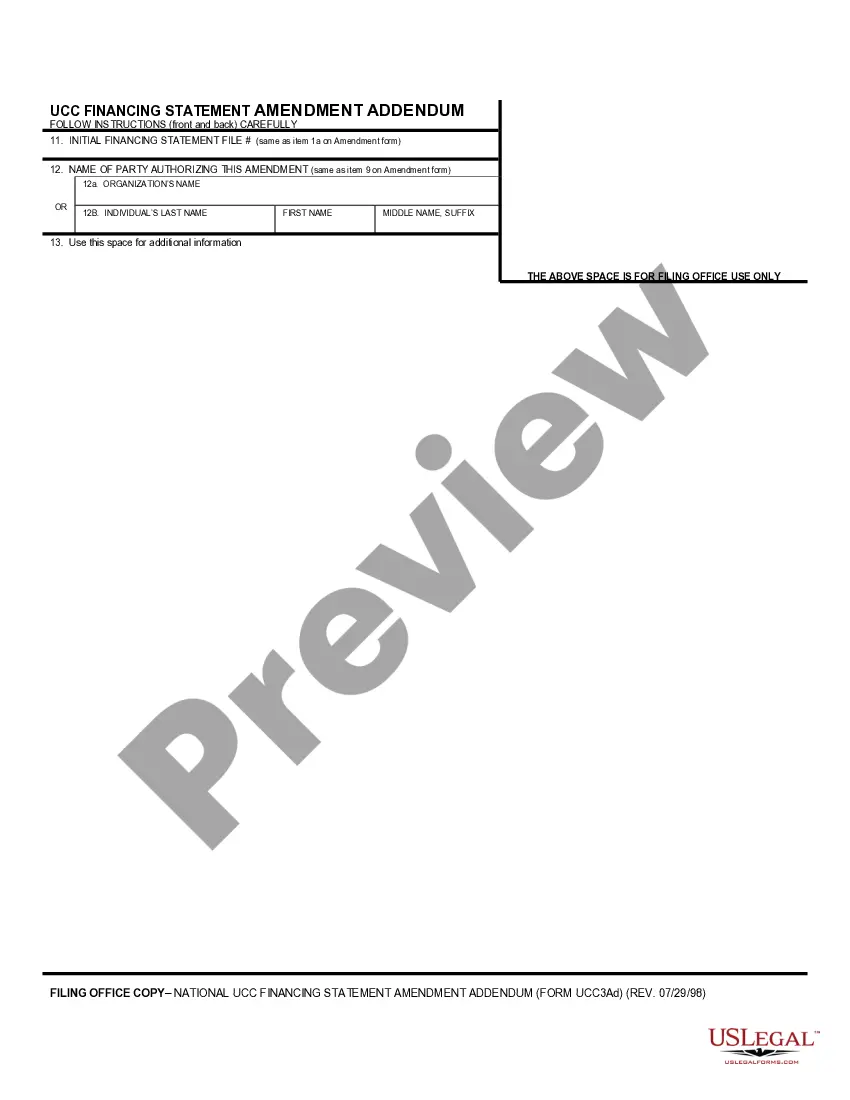

UCC1 Financing Statement Addendum - Alabama - For use after July 1, 2001. This form permits you to add an additional debtor if necessary to cover collateral as specified in the statement.

Alabama UCC1 Financing Statement Addendum

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Alabama UCC1 Financing Statement Addendum?

Leveraging Alabama UCC1 Financing Statement Addendum templates designed by skilled attorneys helps you avert complications when completing forms.

Simply download the document from our site, fill it in, and have a legal expert review it.

This approach will save you considerably more time and effort than seeking a legal expert to draft a document entirely from square one tailored to your specifications.

Use the Preview feature and examine the description (if provided) to determine if you require this specific template, and if so, click Buy Now. Search for another template using the Search field if needed. Select a subscription that meets your requirements. Begin using your credit card or PayPal. Pick a file format and download your document. Once you have completed all the above steps, you’ll be able to finalize, print, and sign the Alabama UCC1 Financing Statement Addendum sample. Remember to thoroughly check all inserted information for accuracy before submitting or sending it out. Streamline your document creation with US Legal Forms!

- If you possess a US Legal Forms subscription, just sign in to your account and navigate back to the sample page.

- Locate the Download button adjacent to the template you are reviewing.

- After downloading a template, all your saved samples can be found under the My documents section.

- If you do not have a subscription, it's not a major issue.

- Just adhere to the instructions below to register for your online account, acquire, and complete your Alabama UCC1 Financing Statement Addendum template.

- Verify that you are downloading the correct state-specific form.

Form popularity

FAQ

To file your UCC-1 statement in Alabama, you need to submit it to the Secretary of State's office. This office is responsible for maintaining public records of UCC filings. You can file the Alabama UCC1 Financing Statement Addendum online or through mail, depending on your preference. Using UsLegalForms can simplify this process, guiding you through the necessary steps and ensuring proper submission.

Yes, a UCC financing statement typically requires the signature of the secured party, which confirms their intention to secure an interest in the specified collateral. This signature acts as a declaration of the secured party's rights and serves as an important element in establishing priority in case of disputes. For clarity and ease, consider using services from US Legal Forms to manage the signing process accurately when filing your Alabama UCC1 Financing Statement Addendum.

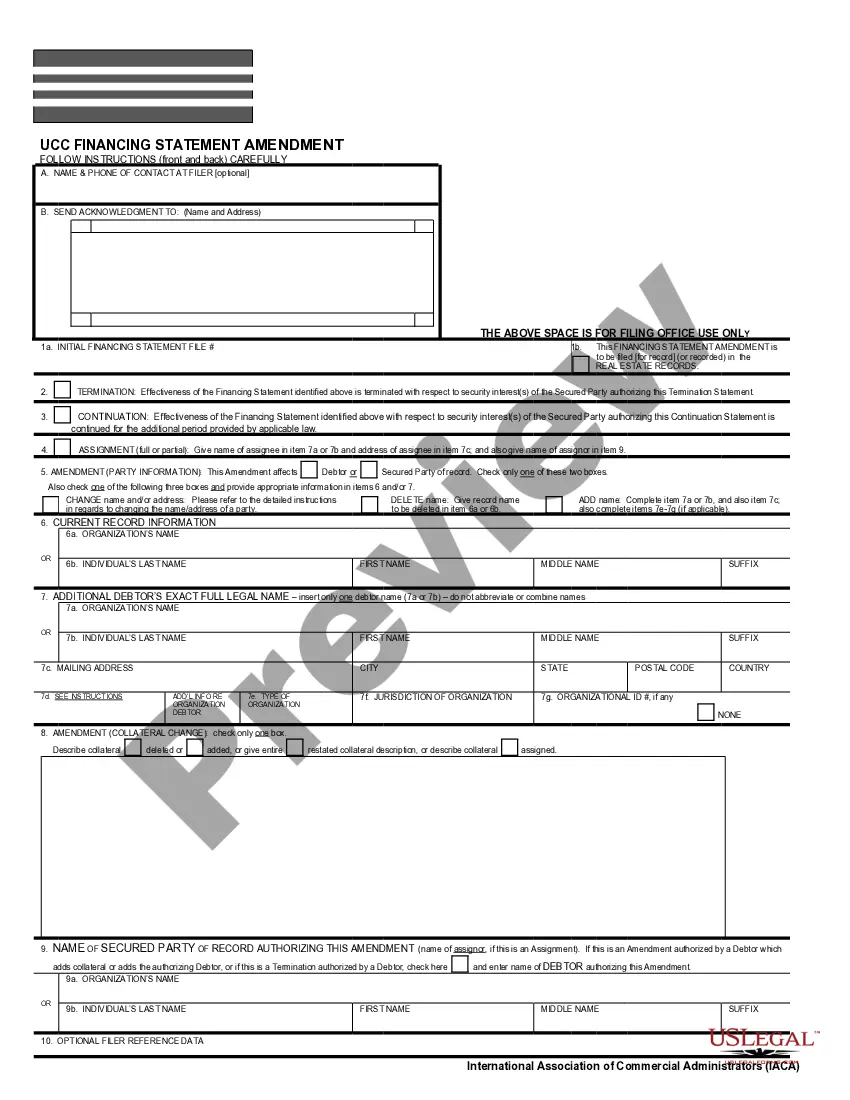

A UCC financing statement amendment is a legal document that updates or modifies an existing UCC-1 statement. This can involve adding or removing collateral, changing the debtor's information, or altering the secured party's details. Such amendments are essential for maintaining accurate records and ensuring continuous protection of your secured interests. When dealing with the Alabama UCC1 Financing Statement Addendum, ensuring timely updates is critical for legal compliance.

UCC requirements focus on the documentation and procedures necessary for creating a secured interest in collateral. Key elements include identifying the debtor and secured party, accurately describing the collateral, and filing the statement with the appropriate governmental entity. Understanding these requirements is vital for properly securing debts under the Alabama UCC1 Financing Statement Addendum. Accessing tools from US Legal Forms can help you navigate these requirements effortlessly.

1 financing statement requires specific information to be valid. You must provide the debtor's legal name, your name as the secured party, and a description of the collateral. Additionally, the form must be filed in the correct jurisdiction, which in Alabama is typically with the Secretary of State. Utilizing platforms like US Legal Forms can simplify this process and ensure compliance with the Alabama UCC1 Financing Statement Addendum requirements.

The rules for UCC-1 financing statements set guidelines for securing a debtor's obligations through a public filing. In Alabama, the UCC-1 form must be filed with the Secretary of State's office to protect the creditor's interest. It is essential to accurately describe the collateral and include the debtor's correct name to avoid issues. By following these regulations, you ensure that your Alabama UCC1 Financing Statement Addendum serves its purpose.

A UCC filing, such as the Alabama UCC1 Financing Statement Addendum, can be seen as beneficial for both lenders and borrowers. For lenders, it secures their interest in a borrower's collateral, minimizing risk. For borrowers, it can facilitate easier access to credit by providing proof of collateral. However, it’s essential to understand that a UCC filing may impact your creditworthiness. If you need help navigating these implications, uslegalforms can provide valuable insights and support.

The purpose of a UCC filing, including the Alabama UCC1 Financing Statement Addendum, is to publicly record a secured party's interest in personal property offered as collateral for loans. This process protects lenders by giving them a legal claim to the collateral if the borrower defaults. Moreover, it helps clarify ownership rights between buyers and sellers in transactions. For assistance in understanding UCC filings, consider using uslegalforms for comprehensive guidance.

The Alabama UCC1 Financing Statement Addendum serves as a supplemental document that provides additional details relating to a specific UCC filing. It clarifies information about the collateral or modifies existing data in the original filing. This addendum is crucial for lenders and creditors as it ensures there is no ambiguity about the secured interest. Utilizing resources from uslegalforms can help you understand when and how to use an addendum properly.

To fill out the Alabama UCC1 Financing Statement Addendum, you need to provide specific details such as the name and address of the debtor, the secured party information, and a description of the collateral. It's essential to ensure all information is accurate to avoid any issues during filing. Using a platform like uslegalforms can simplify this process, guiding you through each section effectively. Once completed, submit the form according to your state’s requirements.