Under A Royalty Agreement With Another Entity

Description

How to fill out Royalty Agreement And License Of Rights Under Patent?

- If you're an existing user, log in to your account and download the required form template by clicking the Download button. Confirm that your subscription is active and renew it if necessary.

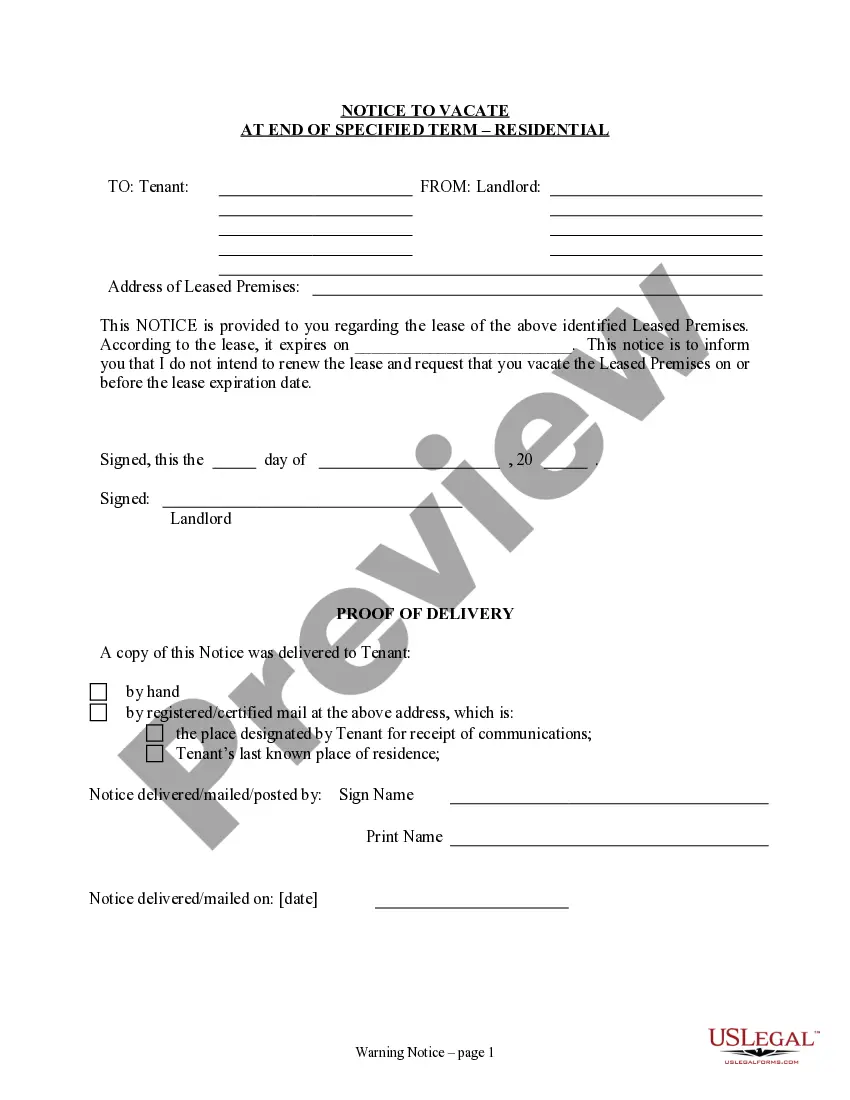

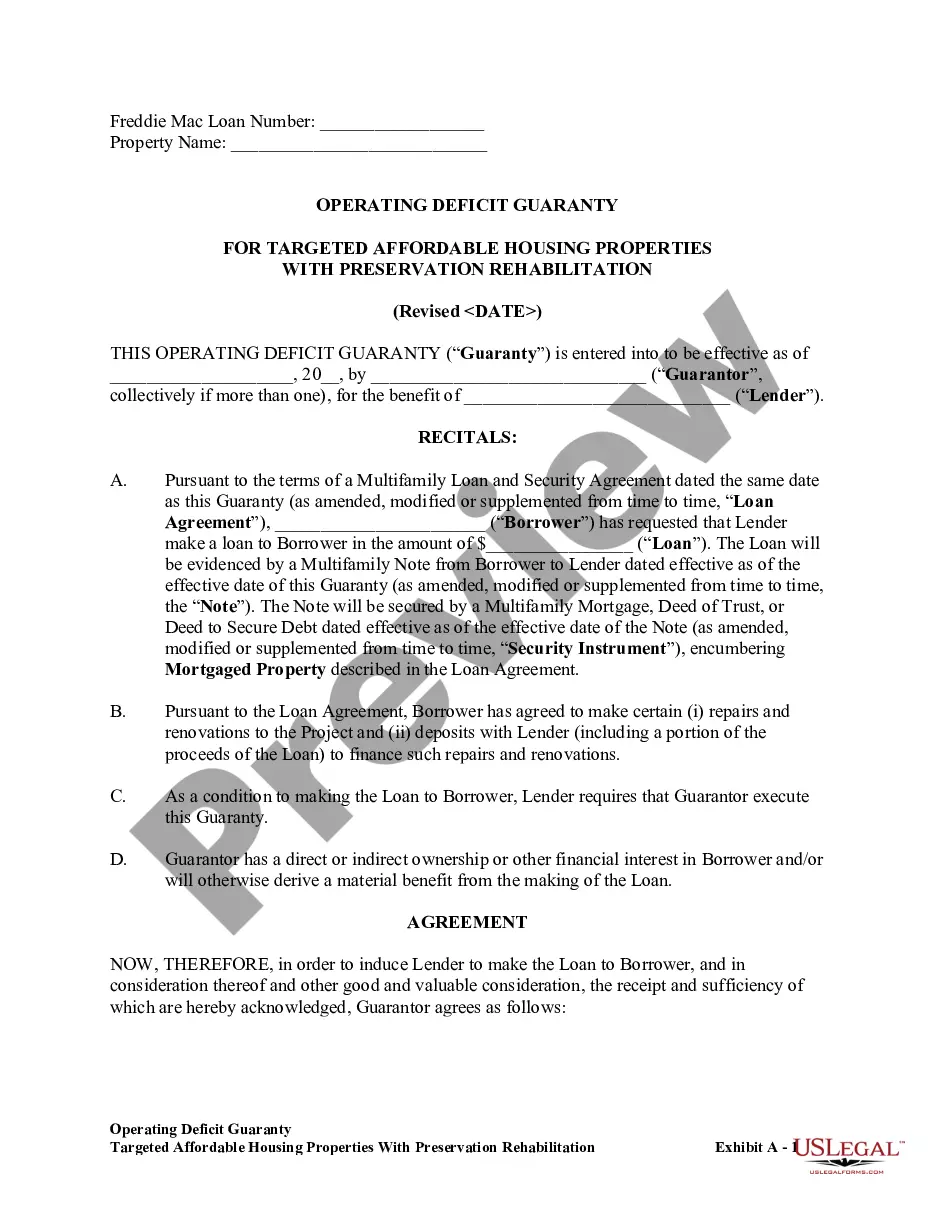

- For first-time users, start by checking the Preview mode and reading the form description to ensure it meets your specific needs and adheres to local regulations.

- If the chosen template doesn’t match, utilize the Search tab to find an alternative that does.

- Once you've selected the correct document, click on the Buy Now button, then select your preferred subscription plan. Registration is required to access the full library.

- Complete your purchase by entering your credit card information or utilizing your PayPal account to finalize your subscription.

- Download the form directly to your device for completion and later access it in the My Forms section of your profile.

US Legal Forms empowers both individuals and attorneys, ensuring quick execution of necessary legal documents with an extensive library of over 85,000 fillable and editable forms. Their robust collection sets them apart from competitors in terms of value.

Don’t hesitate to experience the convenience this platform offers. Start your journey with US Legal Forms today and safeguard your legal needs efficiently.

Form popularity

FAQ

Yes, royalties can be transferred, but the process often depends on the terms set in the original agreement. Under a royalty agreement with another entity, rights holders may have the option to assign or license their royalties to another party. This transfer typically involves formal documentation to ensure clarity and protect the rights of all involved.

Royalty agreements establish the terms under which one party compensates another for the use of their intellectual property. Under a royalty agreement with another entity, these contracts detail the percentage of sales, payment schedules, and specific rights granted. By clearly defining expectations, royalty agreements protect the interests of all parties involved and lay the foundation for successful collaboration.

Sharing royalties refers to the division of earnings generated from intellectual property, such as music, books, or patents. Under a royalty agreement with another entity, rights holders usually negotiate how profits are allocated among artists, producers, or publishers. This collaborative approach ensures that all parties benefit from the commercial success of the work while respecting their contributions.

Determining if 10% royalties are good depends on various factors, including the industry and specific agreement terms. Under a royalty agreement with another entity, a 10% share can be beneficial if the total sales volume is high. However, it's important to evaluate other industry standards and negotiate terms that reflect the value of your contributions. Using platforms like US Legal Forms can assist you in crafting fair royalty agreements that protect your interests.

A 10% royalty generally refers to the payment an entity receives based on revenue generated from another party's use of its assets. Under a royalty agreement with another entity, this percentage signifies that for each dollar made, the entity receives ten cents. This arrangement allows creators to earn income while retaining ownership of their work. It is a common practice in industries like publishing, music, and software.

Drafting a royalty agreement requires careful consideration of various elements, including the scope of use, payment terms, and duration of the agreement. Under a royalty agreement with another entity, it’s crucial to clarify the rights of both parties involved to avoid disputes. Begin by outlining definitions, responsibilities, and the calculation method for royalties. To simplify the process, think about using platforms like US Legal Forms for templates and guidance tailored to your specific needs.

A royalty in an agreement represents a payment made by one party to another for the use of their intellectual property, such as patents or trademarks. Under a royalty agreement with another entity, royalties can be fixed amounts or calculated as a percentage of sales generated from the licensed product or service. This payment structure incentivizes creators to share their innovations while ensuring they receive fair compensation. Utilizing an organized approach to manage royalties helps in maintaining clarity and compliance.

When evaluating expense allocation methods under a royalty agreement with another entity, it is essential to understand various theoretical bases, such as direct costs or proportional allocation. However, any method lacking a logical connection to revenue generation may not be a valid basis for allocation. Identifying the right approach ensures transparency and fairness in royalty distribution. For assistance, you may consider platforms like US Legal Forms to navigate these complexities.

To do a royalty deal, start by negotiating terms such as the royalty rate and payment schedule with the other entity. It’s important to draft a formal agreement that reflects these terms clearly. Uslegalforms can help you create a legally binding document that protects both parties involved in the agreement.

The formula for calculating royalty often involves multiplying the total sales revenue by the agreed-upon royalty rate. For example, if you have $100,000 in sales and a royalty rate of 7%, the royalty payment would be $7,000. This calculation is essential for maintaining transparency under a royalty agreement with another entity.