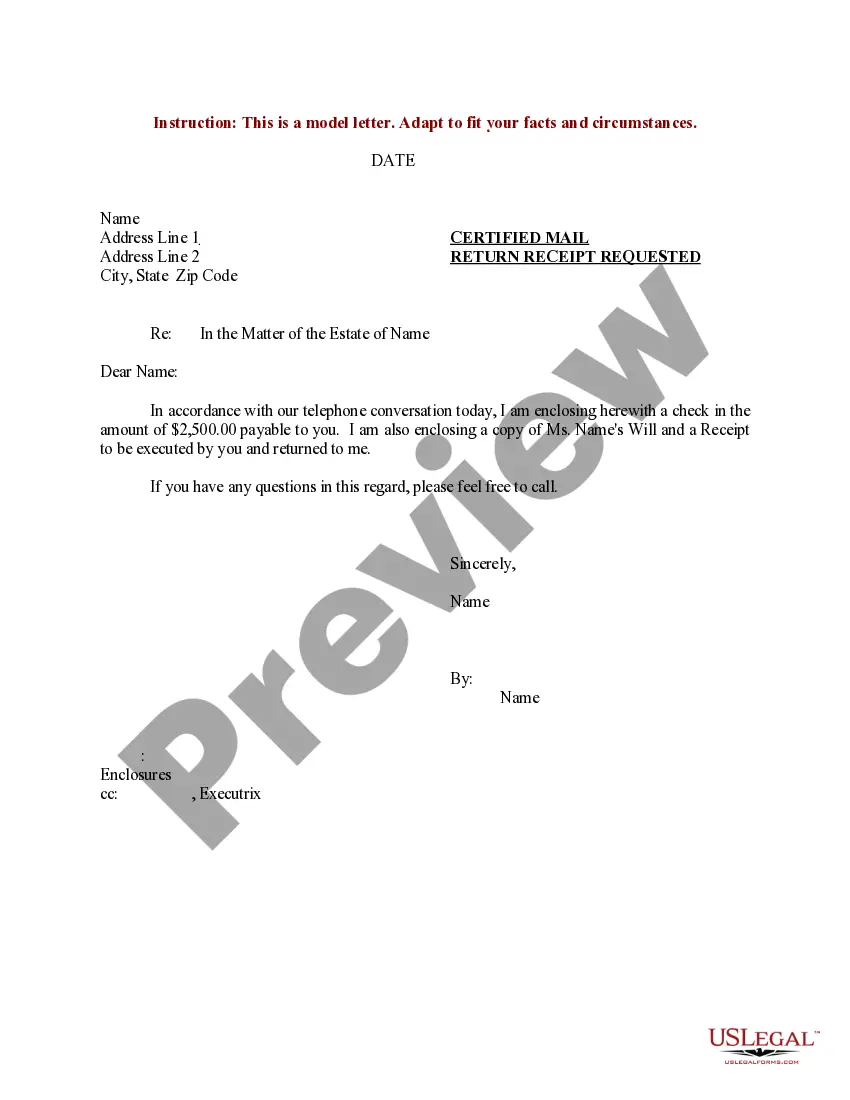

Trust Distribution Letter Template With Cc

Description

How to fill out Sample Letter For Distribution Of Estate Assets?

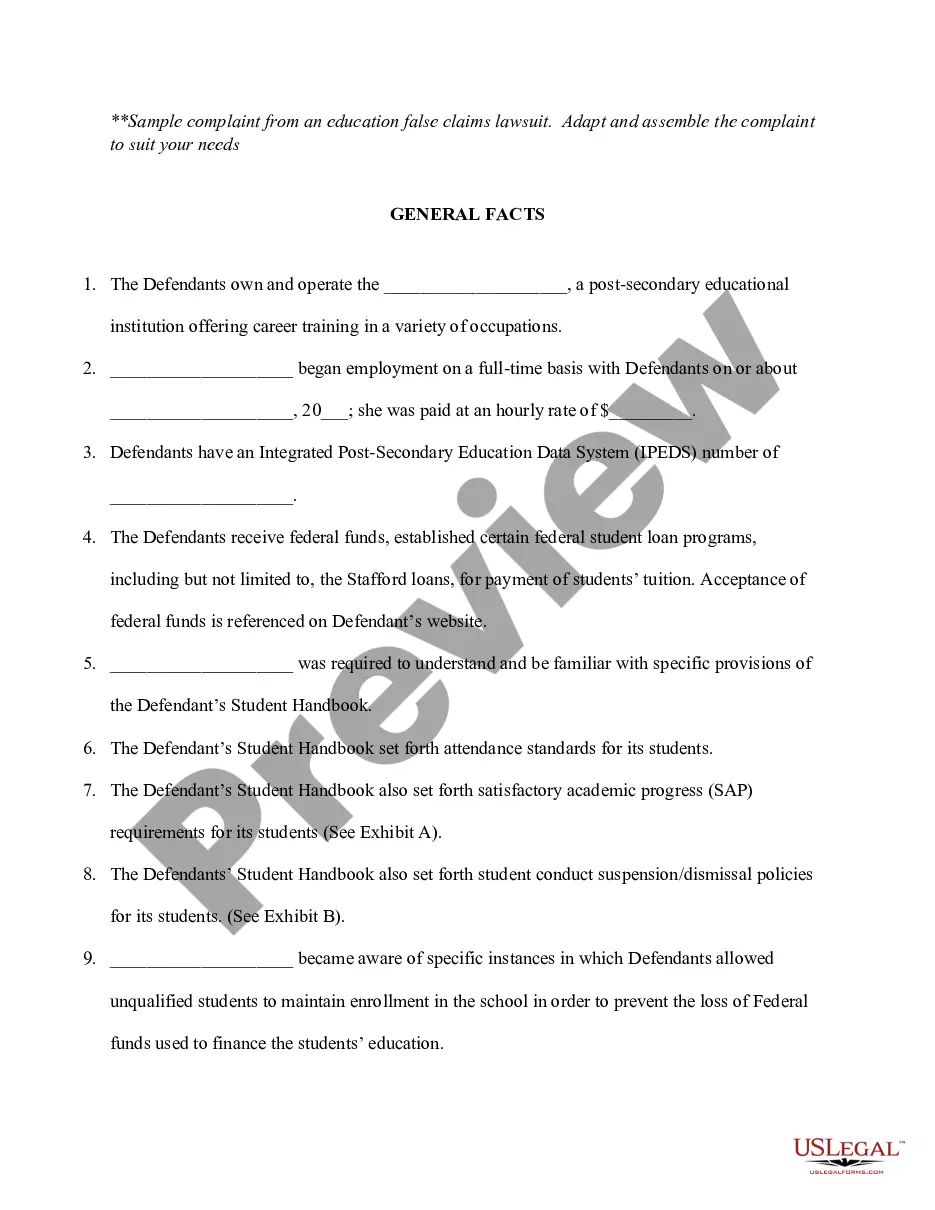

Legal document management might be overpowering, even for skilled professionals. When you are searching for a Trust Distribution Letter Template With Cc and do not get the a chance to spend searching for the right and up-to-date version, the operations may be nerve-racking. A strong online form library can be a gamechanger for anyone who wants to manage these situations successfully. US Legal Forms is a market leader in web legal forms, with more than 85,000 state-specific legal forms available anytime.

With US Legal Forms, you can:

- Gain access to state- or county-specific legal and business forms. US Legal Forms handles any needs you may have, from individual to organization documents, all-in-one spot.

- Use advanced resources to accomplish and manage your Trust Distribution Letter Template With Cc

- Gain access to a resource base of articles, instructions and handbooks and materials connected to your situation and needs

Save effort and time searching for the documents you need, and make use of US Legal Forms’ advanced search and Review feature to find Trust Distribution Letter Template With Cc and acquire it. If you have a subscription, log in in your US Legal Forms profile, search for the form, and acquire it. Take a look at My Forms tab to find out the documents you previously saved and also to manage your folders as you can see fit.

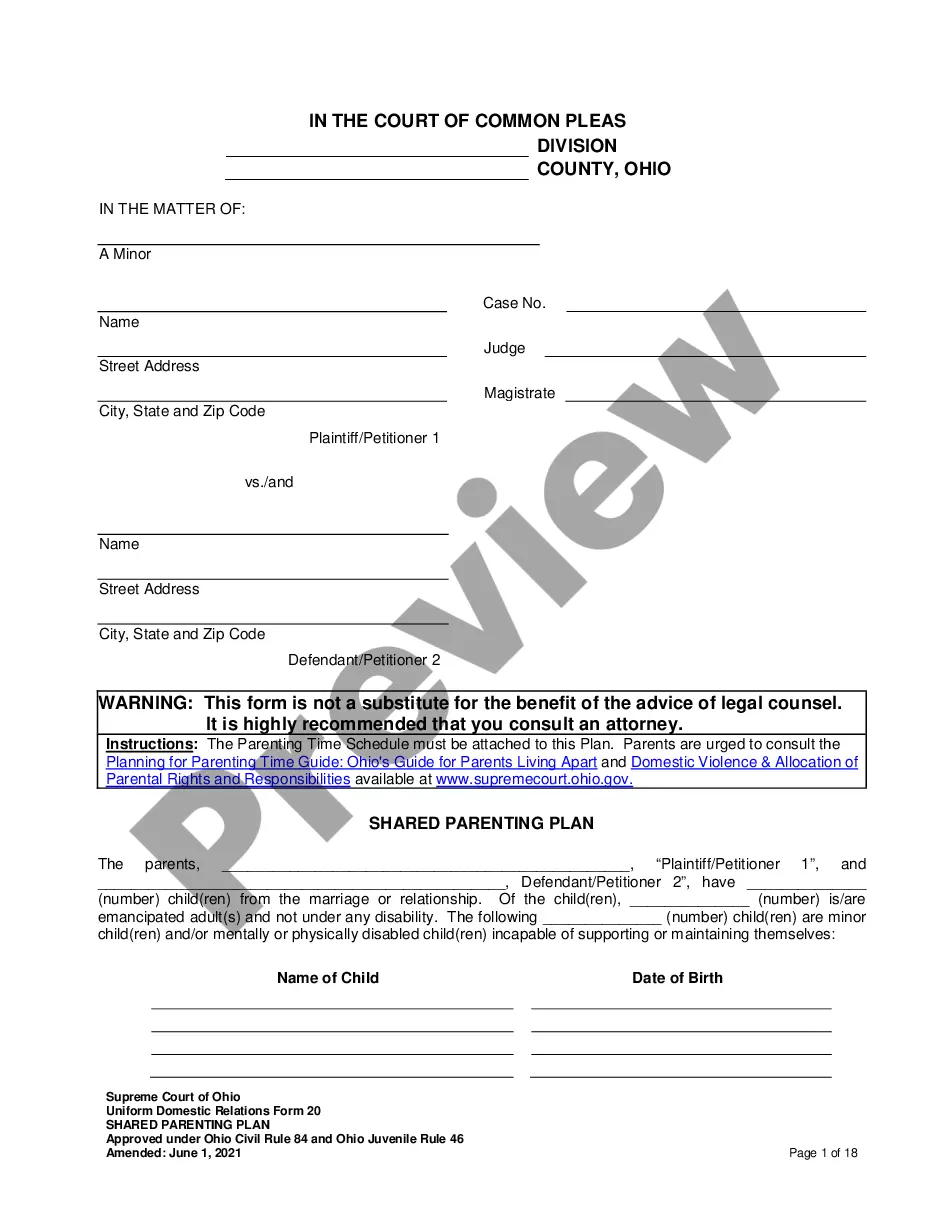

If it is your first time with US Legal Forms, register a free account and have limitless access to all advantages of the platform. Here are the steps to consider after getting the form you need:

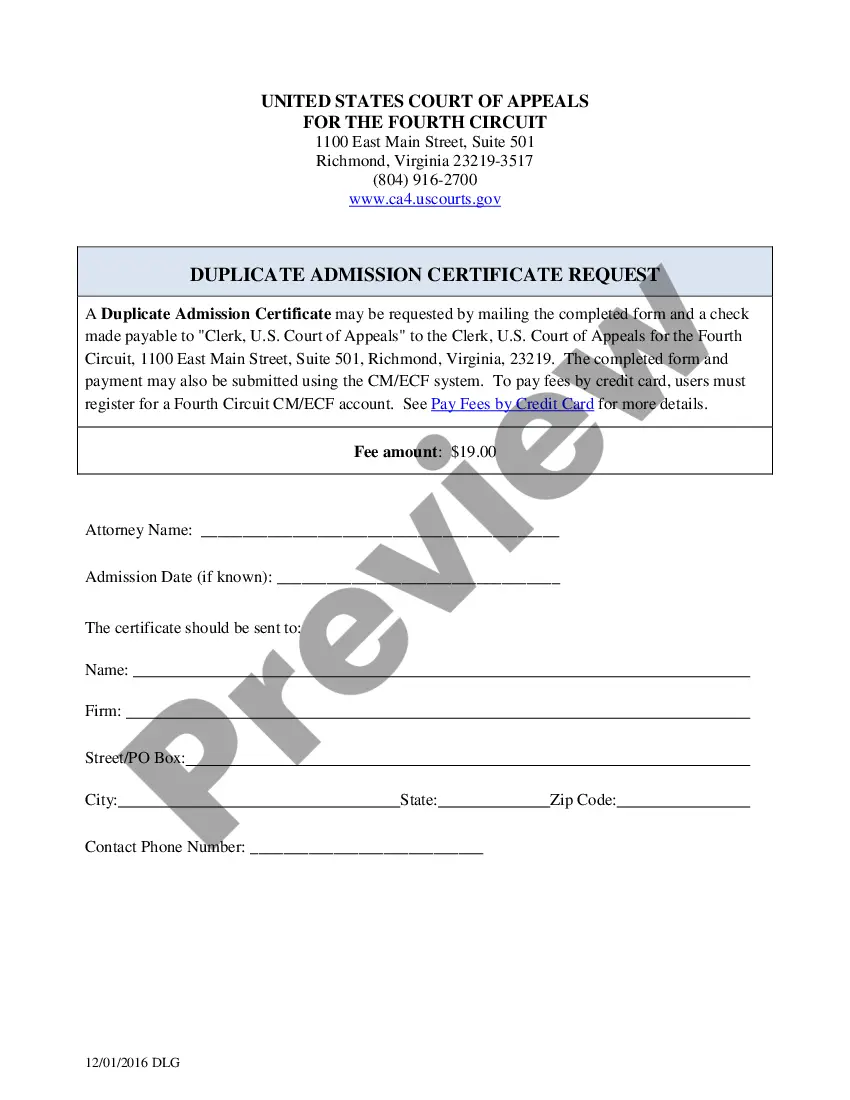

- Confirm it is the correct form by previewing it and looking at its information.

- Ensure that the sample is accepted in your state or county.

- Select Buy Now when you are all set.

- Choose a subscription plan.

- Find the file format you need, and Download, complete, eSign, print and send out your document.

Benefit from the US Legal Forms online library, backed with 25 years of expertise and reliability. Transform your daily document management in to a easy and easy-to-use process right now.

Form popularity

FAQ

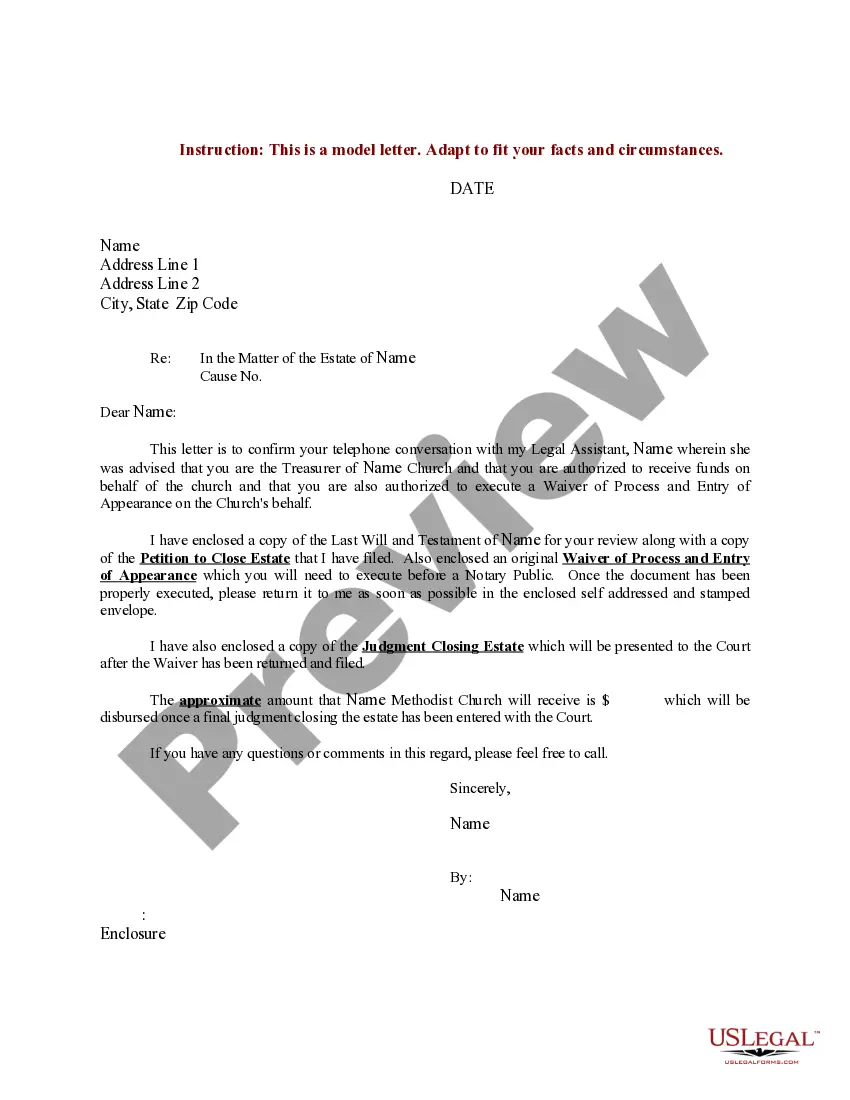

The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

Are Assets Owned by an Irrevocable Trust Subject to Estate Tax? Assets transferred by a grantor to an irrevocable trusts are generally not part of the grantor's taxable estate for the purposes of the estate tax. This means that the assets will pass to the beneficiaries without being subject to estate tax.

For example, if the trust owns real estate, the trustee could make a distribution in cash by selling the property and dividing the proceeds among the settlor's two children, or the trustee could make a distribution in kind by simply deeding the property equally to both children so that each owns an undivided 50% ...

When an irrevocable trust disburses funds, the trust takes a taxable deduction for the amount distributed and issues a tax form to the beneficiary. This form, known as a K-1, shows the total disbursement received and includes a breakdown of the amount that is attributed to interest income versus principal balance.

The only transfers that are to be made to a Revocable Living Trust are assets, not liabilities. Debt that has been incurred by the family is not transferred to the Trust; however, the provisions are included in your trust to permit the transfer of certain assets with the debt attached.