Sample Letter Of Request For Credit Card Limit Increase

Description

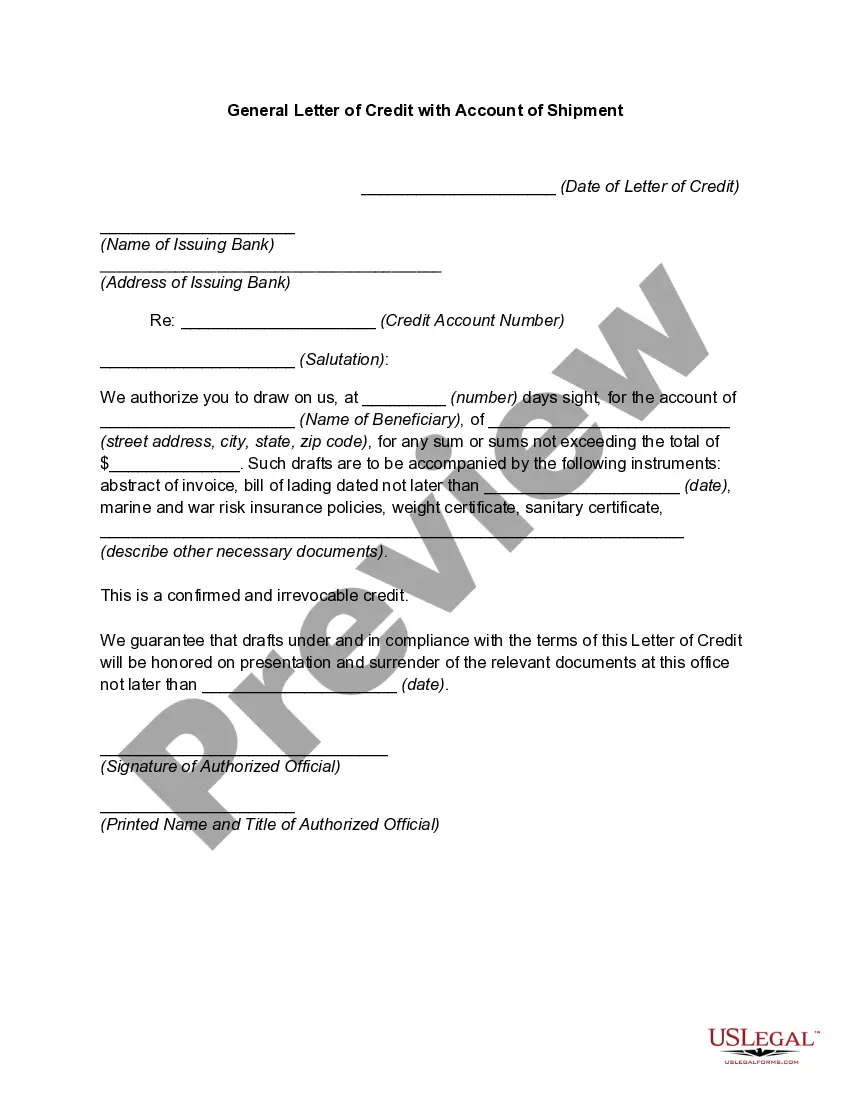

How to fill out Sample Letter Of Credit?

When you are required to present a Sample Letter Of Request For Credit Card Limit Increase in alignment with your local state's laws and regulations, there may be various options available.

There's no requirement to inspect every document to guarantee it meets all legal criteria if you are a US Legal Forms subscriber.

It is a dependable resource that can assist you in obtaining a reusable and current template on any topic.

Utilize the Preview mode and read the form description if provided.

- US Legal Forms boasts the largest online collection with an archive of over 85k ready-to-use documents for both business and personal legal matters.

- All templates are verified to comply with each state's regulations.

- Therefore, when you download the Sample Letter Of Request For Credit Card Limit Increase from our platform, you can be confident that you maintain a valid and current document.

- Acquiring the necessary sample from our site is exceptionally simple.

- If you already possess an account, just Log In to the system, ensure your subscription is active, and save the desired file.

- Later, you can navigate to the My documents section in your profile and retain access to the Sample Letter Of Request For Credit Card Limit Increase whenever you need.

- If this is your first time using our website, please follow the instructions below.

- Browse the suggested page and verify its alignment with your needs.

Form popularity

FAQ

You can request a credit card limit increase by contacting your credit card issuer directly, either over the phone or online. Make sure to explain your reasons for the request, such as increased expenses or improved income. A well-crafted sample letter of request for credit card limit increase can add a professional touch and might improve your chances of approval by underscoring your creditworthiness.

To ask for an increase in your credit limit, start by reviewing your account information and payment history. Next, reach out to your credit card company and formally submit your request. Using a sample letter of request for credit card limit increase can help organize your thoughts and provide a clear rationale for your request, making it easier for the lender to process.

Requesting a credit limit increase can be beneficial if you manage your credit responsibly. A higher limit can improve your credit utilization ratio, positively affecting your credit score. However, ensure you prepare a sample letter of request for credit card limit increase that presents your case clearly, showing that you are a reliable borrower and ready for the responsibility.

To obtain a $50,000 credit card limit, you must first establish a strong credit history. You can achieve this by consistently paying your bills on time and maintaining low credit utilization. Additionally, consider providing a sample letter of request for credit card limit increase that highlights your financial stability and employment details, which can significantly influence the issuer's decision.

To request a credit card limit increase, start by contacting your credit card issuer through their customer service number or online portal. You will need to provide your personal information and the reason for your request. Often, companies have a specific process to follow, which may involve submitting a sample letter of request for credit card limit increase to streamline your request.

To write a letter increasing your credit card limit, address it to your credit card issuer and include essential details about your account. Make a strong case by highlighting your payment history and financial responsibility. Tools like a sample letter of request for credit card limit increase can guide your writing process effectively.

For a bank limit increase application, start with your account details and the specific increase you are seeking. Provide reasons such as improved financial circumstances or a change in income. A sample letter of request for credit card limit increase can illustrate how to make your case clearly.

Requesting a credit limit increase on your credit card involves writing a detailed letter or calling customer service. Mention your current credit limit, desired increase, and justifications like good payment history. A sample letter of request for credit card limit increase can assist in crafting your request.

To ask your credit card company for an increase, draft a concise letter or message that explains your request. Include any improvements in your financial situation and your consistent payment habits. Refer to a sample letter of request for credit card limit increase to guide your communication.

To increase your credit limit through email, start by writing a formal request that includes your account number and desired limit. Clearly outline why you believe you qualify for the increase. Utilizing a sample letter of request for credit card limit increase can provide a helpful framework to follow.