Report Accident With State Farm

Description

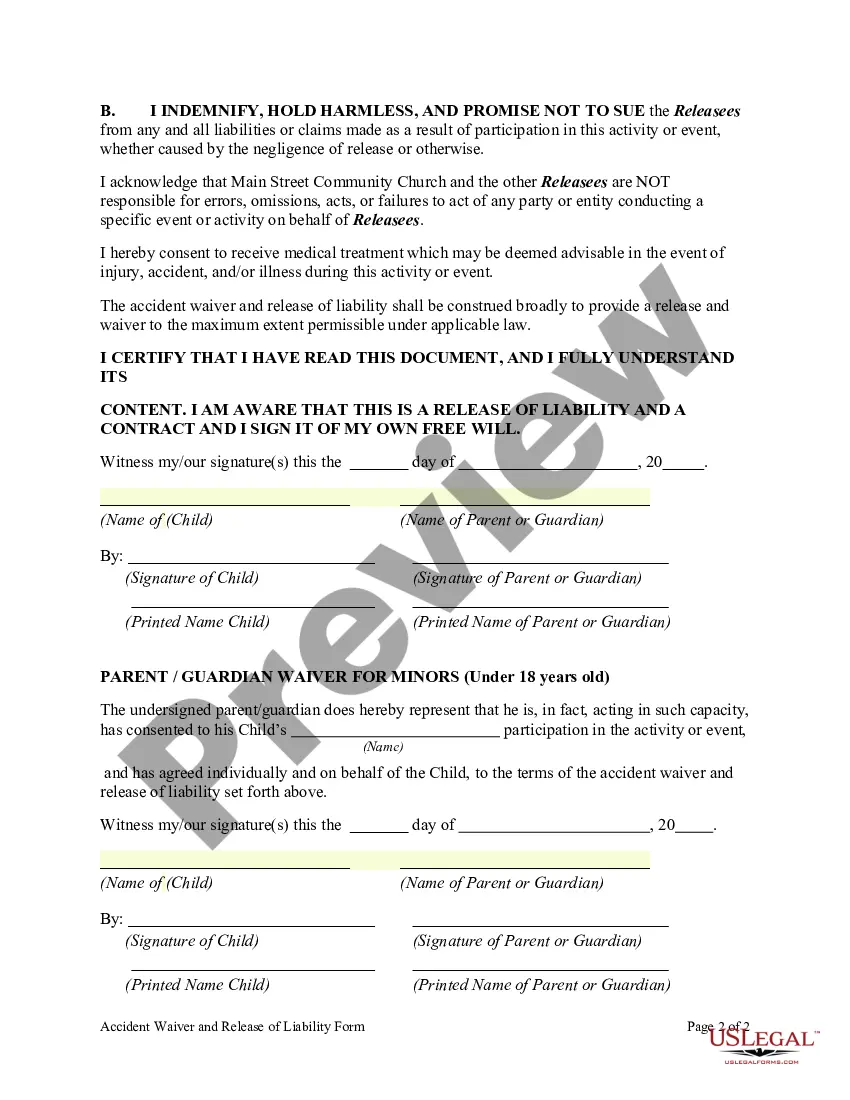

How to fill out Accident Waiver And Release Of Liability Form?

The Accident Report With State Farm that you see on this page is a reusable legal document created by expert attorneys in compliance with federal and state laws.

For over 25 years, US Legal Forms has supplied individuals, enterprises, and lawyers with upwards of 85,000 authenticated, state-specific documents for any professional and personal circumstance.

Register with US Legal Forms to have reliable legal templates for all of life’s situations at your fingertips.

- Explore the document you require and review it.

- Browse the file you searched and preview it or examine the form description to confirm it meets your needs. If it doesn’t, use the search feature to locate the appropriate one. Click Buy Now once you have located the template you need.

- Enroll and Log In to your account.

- Select the payment plan that works for you and create an account. Use PayPal or a credit card for a swift transaction. If you already possess an account, Log In and verify your subscription to proceed.

- Obtain the editable template.

- Select the format you prefer for your Accident Report With State Farm (PDF, DOCX, RTF) and save the document on your device.

- Fill out and sign the document.

- Print the template to fill it out manually. Alternatively, use an online versatile PDF editor to swiftly and accurately complete and sign your form with a valid signature.

- Download your documents again.

- Reuse the same document whenever necessary. Access the My documents tab in your profile to redownload any previously retrieved documents.

Form popularity

FAQ

If the accident is not your fault, you can still claim insurance by reporting the incident with State Farm. Provide all evidence and details, emphasizing that you were not at fault. State Farm can assist you in filing against the other party’s insurance for damages incurred. Their expertise will guide you through the steps to ensure you receive the compensation you deserve.

Choosing whether to file a claim with your insurance or the other party’s insurance can depend on various factors, including the extent of damages and fault. If you report the accident with State Farm, they can guide you on the benefits of processing through them or the other party's insurer. Often, your insurer will manage the process more efficiently. However, consult with your agent to see which option serves your interests better in your particular situation.

To file an accident report with State Farm, you can either call their claims department or use their online portal. Begin by providing your personal details, policy number, and a summary of the incident. Be specific about what happened, and don’t forget to share any information you have gathered at the scene. This thorough approach will support your claim and help expedite the review process.

After an accident that is not your fault, collect all necessary information from the scene, including photos and witness contacts. Next, you should report the accident with State Farm to start the claims process. Document everything, and avoid admitting fault, as it could complicate your claim. Staying organized and providing clear details to your insurer will help in managing the aftermath effectively.

You can report an accident with State Farm within a specific time frame, typically within a few years. However, it's best to report the accident as soon as possible to ensure a smoother claims process. Delaying may complicate your claim, so reach out promptly. State Farm recommends notifying them within 24 hours for optimal assistance.

Several factors can lead to State Farm denying a claim after you report an accident. Common reasons include lack of coverage for the type of accident, discrepancies in the information provided, or missing deadlines set by your policy. It is important to carefully review your policy terms and keep all documentation organized to minimize the chances of denial.

To ensure a smooth claim process, you should report an accident with State Farm as soon as possible. Ideally, notify them within 24 hours, but you typically have a window of several days to report. Delaying the report may complicate your claim or reduce your coverage. Always refer to your policy details to understand the specific timelines.

Yes, State Farm offers first-time accident forgiveness for qualifying new customers. This benefit helps protect your driving record from the effects of your first accident, potentially lowering your rates. By discussing this option with your agent, you can understand how this feature applies to your policy. Always review the specific terms to see if you qualify.

Reporting timelines can vary, but generally, reporting an accident with State Farm later than a few days could pose challenges. Many policies specify a reasonable timeframe, and exceeding that could lead to claim denial. Every situation is different, so it's best to act as soon as possible. For any concerns, contacting State Farm directly can clarify your standing.

It's advisable to report an accident with State Farm as soon as you can, preferably within 24 to 48 hours. Prompt reporting helps document the details while they are fresh and allows for quicker resolution. This timing can also prevent complications in your claim process. Be proactive to help ensure a smoother claims journey.