Accident Release Order Form Canada

Description

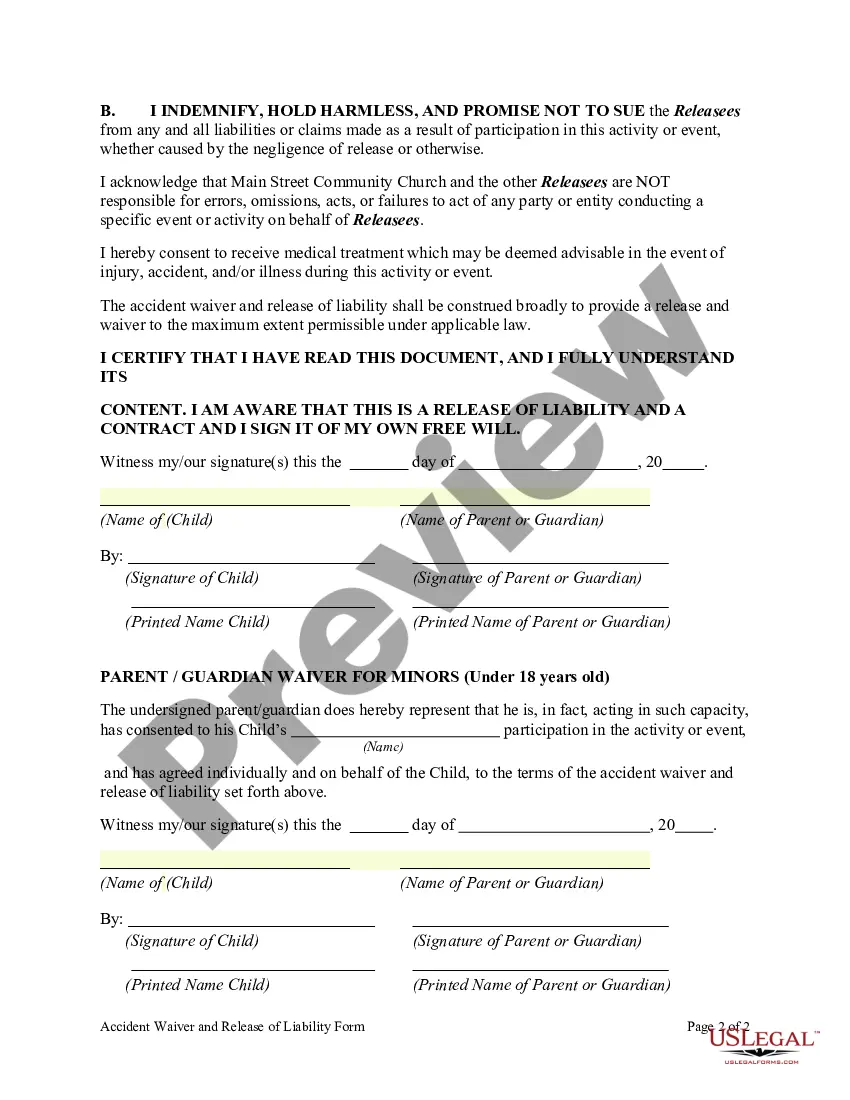

How to fill out Accident Waiver And Release Of Liability Form?

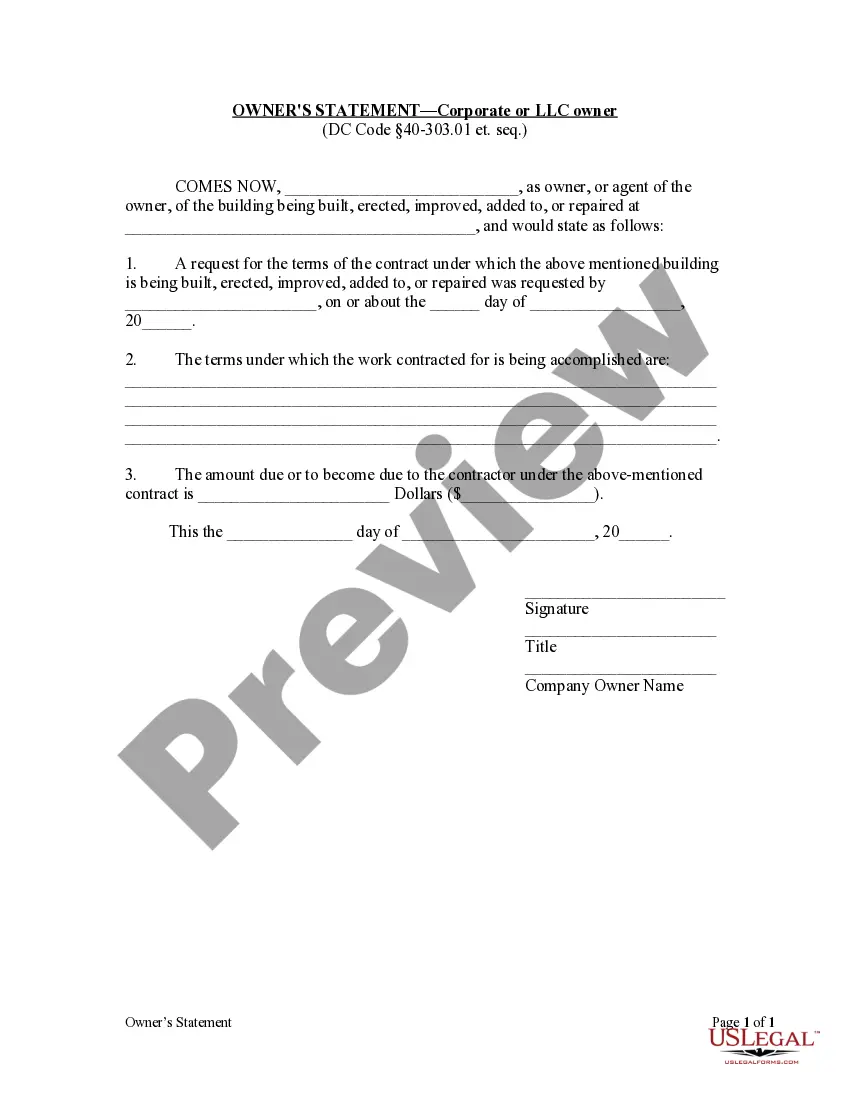

The Accident Release Order Form Canada you see on this page is a multi-usable formal template drafted by professional lawyers in accordance with federal and state laws and regulations. For more than 25 years, US Legal Forms has provided individuals, businesses, and attorneys with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the fastest, simplest and most reliable way to obtain the paperwork you need, as the service guarantees bank-level data security and anti-malware protection.

Acquiring this Accident Release Order Form Canada will take you only a few simple steps:

- Browse for the document you need and review it. Look through the file you searched and preview it or review the form description to ensure it satisfies your requirements. If it does not, utilize the search bar to get the correct one. Click Buy Now when you have located the template you need.

- Subscribe and log in. Choose the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to proceed.

- Acquire the fillable template. Pick the format you want for your Accident Release Order Form Canada (PDF, DOCX, RTF) and save the sample on your device.

- Complete and sign the document. Print out the template to complete it manually. Alternatively, use an online multi-functional PDF editor to rapidly and accurately fill out and sign your form with a legally-binding] {electronic signature.

- Download your paperwork one more time. Utilize the same document once again anytime needed. Open the My Forms tab in your profile to redownload any previously purchased forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

What Is The Auto Insurance Claims Process? Report the auto accident (if applicable to your situation) Contact your insurer. Provide them with details about the incident. Answer questions from your adjuster. Get an estimate for the vehicle damage and repairs. Choose an auto shop and schedule repairs. Close the claim.

In most provinces, such as Ontario, Alberta, Manitoba, Nova Scotia, and British Columbia, a car accident will stay on your driving record for six years from the accident date. In Quebec, an accident can remain on your insurance record for up to three years.

Documents Required for Claiming Car Insurance: Copy of your insurance policy. First Information Report (FIR) filed with the police. Duly filled up and signed Claim Form. Copy of the registration certificate of your car. Copy of your driving license. A detailed estimate of the repairs.

I am writing this email to inform you that on (Date) I have met with a road accident and have been hospitalized since for the same. As per my Doctor's recommendation, I will require 3 weeks of bed rest to heal and join back (Document attached below). I would be obliged if my medical leave application can be approved.

What Is The Auto Insurance Claims Process? Report the auto accident (if applicable to your situation) Contact your insurer. Provide them with details about the incident. Answer questions from your adjuster. Get an estimate for the vehicle damage and repairs. Choose an auto shop and schedule repairs. Close the claim.