Accident Release Liability Application With Insurance

Description

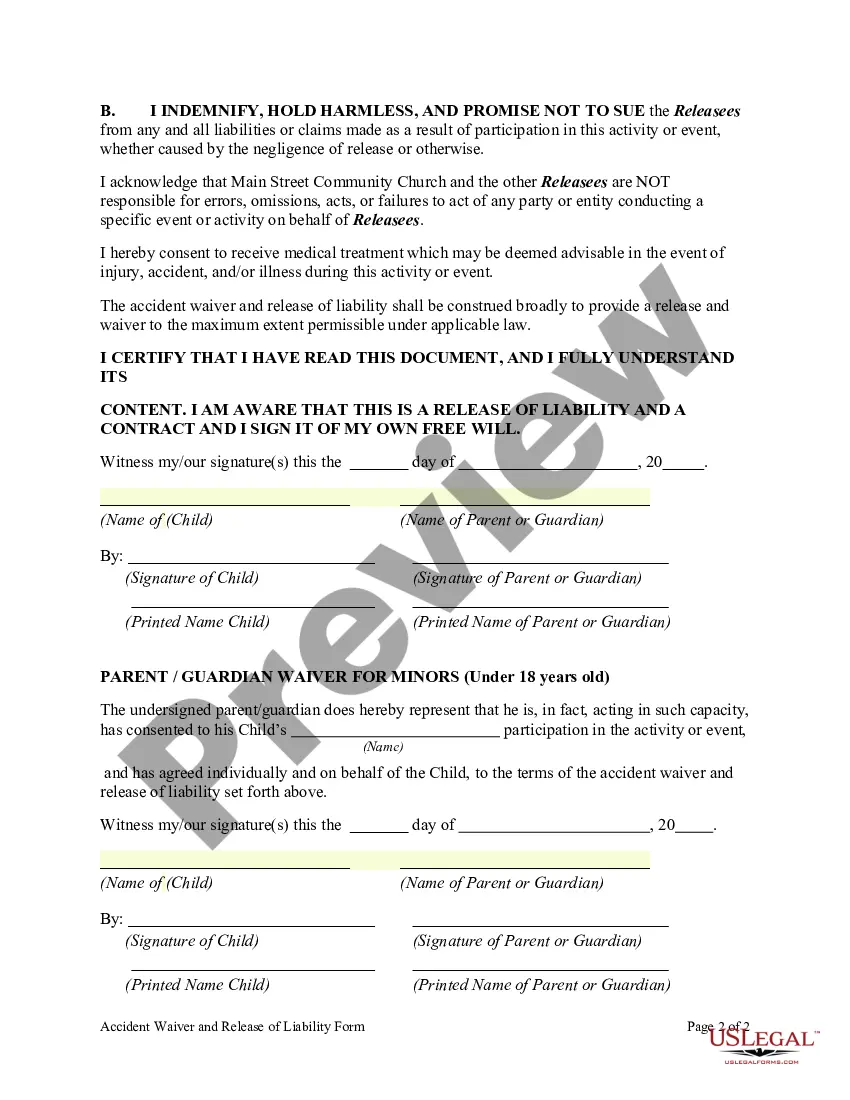

How to fill out Accident Waiver And Release Of Liability Form?

Managing legal paperwork and processes can be a lengthy addition to your day.

Accident Release Liability Application With Insurance and similar forms often require you to locate them and comprehend the most effective way to fill them out correctly.

Consequently, if you are dealing with financial, legal, or personal issues, possessing a comprehensive and efficient online repository of forms readily available will greatly assist.

US Legal Forms is the premier online resource for legal templates, featuring over 85,000 state-specific forms and various tools to help you complete your documents swiftly.

Is this your first time using US Legal Forms? Sign up and create your account in just a few minutes, and you’ll gain access to the form repository and Accident Release Liability Application With Insurance. Then, follow the steps below to complete your form: Make sure you have the correct form using the Preview feature and reviewing the form details. Choose Buy Now when ready, and select the subscription plan that fits your needs. Click Download then fill out, eSign, and print the form. US Legal Forms has twenty-five years of experience helping clients manage their legal paperwork. Obtain the form you need today and streamline any process effortlessly.

- Explore the collection of relevant documents accessible to you with just one click.

- US Legal Forms offers state- and county-specific forms available at any time for download.

- Protect your document management tasks by utilizing a high-quality service that enables you to assemble any form within moments without extra or hidden charges.

- Simply Log In to your account, find Accident Release Liability Application With Insurance, and obtain it immediately from the My documents section.

- You can also access previously saved forms.

Form popularity

FAQ

When making an insurance claim, avoid admitting fault or making definitive statements about the incident. Stick to the facts and provide clear information without speculation. This approach is vital when dealing with an Accident release liability application with insurance, as it protects your rights and ensures a fair assessment. Uslegalforms can guide you on best practices for communicating with insurance providers.

To complete an accident report form, begin by documenting the date, time, and location of the incident. Next, include a detailed description of what happened, mentioning any individuals involved and witnesses present. It is crucial to provide accurate information, especially when dealing with an Accident release liability application with insurance. Uslegalforms provides templates that streamline this process, making it easier for you to report accurately.

Filling out a general release of liability form involves providing your personal information and clearly defining the scope of the release. Make sure to include details about the activities or incidents involved, and state that you are releasing any future claims related to those activities. Utilizing an Accident release liability application with insurance will help ensure you cover all necessary aspects. Uslegalforms offers user-friendly templates to simplify this process.

To fill out a release of claims form, start by entering your personal information, including your name and contact details. Next, clearly state the claims you are releasing, ensuring you include the relevant details about the incident. When completing the Accident release liability application with insurance, be specific about the terms and conditions to avoid misunderstandings. Uslegalforms can assist you by providing templates that guide you through the process.

Releasing your car to insurance means that you are transferring ownership or rights of the vehicle to your insurance company, usually following a total loss claim. By doing so, you agree to allow the insurer to take possession of the car, often in exchange for a settlement amount. Understanding this process is vital, and using resources like US Legal Forms can provide guidance on creating an accurate accident release liability application with insurance.

A release of liability for insurance is a legal document that protects an insurance company from future claims related to a specific incident. This document signifies that the insured party agrees to release the insurer from any further liability once compensation is received. It is crucial to ensure that this release is clear and comprehensive, which can be achieved through platforms like US Legal Forms, offering an effective accident release liability application with insurance.

A release of liability for car insurance is a document that relinquishes one party's right to sue another for damages or injuries resulting from an accident. This form is often utilized when settling claims between parties involved in a car accident. By signing this release, the injured party agrees not to pursue further claims, making it essential to have a well-drafted accident release liability application with insurance.

Liability waivers can be effective in protecting businesses from lawsuits, especially if they are properly drafted and signed. Courts generally uphold these waivers when they clearly outline the risks involved and are voluntarily signed by participants. However, the effectiveness can vary by state and specific situation, so consulting legal resources like US Legal Forms can assist you in creating a sound accident release liability application with insurance.

To write a simple release of liability, begin by clearly stating the parties involved in the agreement. Next, outline the specific activities or circumstances for which liability is being released. Include a statement that acknowledges the risks associated with these activities, and finally, have both parties sign and date the document. Using a reliable resource like US Legal Forms can help you create a comprehensive accident release liability application with insurance.