Accident Release Application For Office

Description

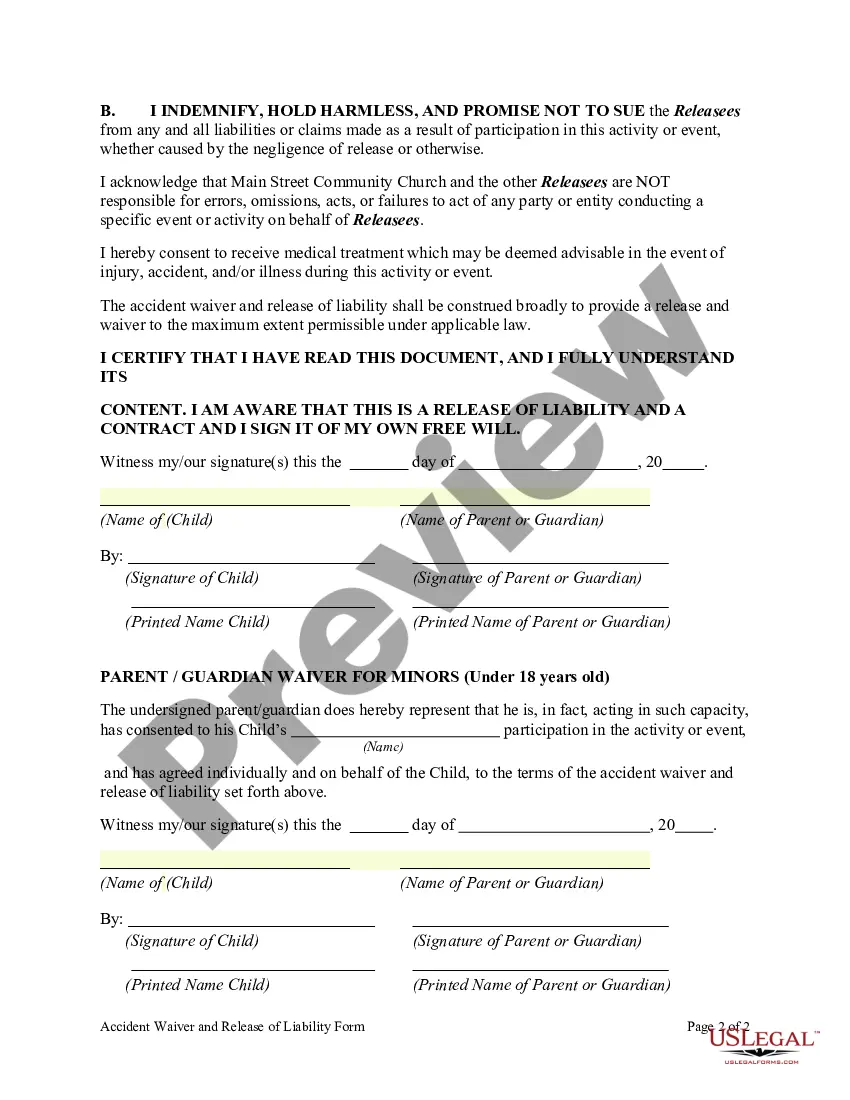

How to fill out Accident Waiver And Release Of Liability Form?

Creating legal documents from the ground up can occasionally be overwhelming.

Some situations may require extensive research and significant financial investment.

If you seek a simpler and more affordable method of generating Accident Release Application For Office or other forms without excessive hurdles, US Legal Forms is readily available.

Our online database of over 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal matters.

Before proceeding to download the Accident Release Application For Office, please consider the following suggestions: Review the document preview and descriptions to confirm that you've located the form you need. Ensure that the template you select complies with the rules and regulations of your state and county. Choose the appropriate subscription plan to obtain the Accident Release Application For Office. Download the form, then fill it in, sign it, and print a copy. US Legal Forms has a flawless reputation and over 25 years of experience. Join us today and make document completion a straightforward and efficient process!

- With just a few clicks, you can quickly acquire state- and county-compliant templates meticulously crafted by our legal experts.

- Utilize our platform whenever you need dependable services that allow you to easily find and download the Accident Release Application For Office.

- If you're already familiar with our offerings and have created an account in the past, simply Log In to your account, select the form, and download it instantly or re-download it later in the My documents section.

- Not registered yet? No problem. Setting up an account is quick and allows you to explore the library.

Form popularity

FAQ

Form 720-V, Electronic Filing Payment Voucher, is used by an entity filing an electronic Kentucky tax return (Form 720, 720S, 725 or 765) to pay the balance of tax due.

The Form K-5 is used to report withholding statement information from Forms W-2, W-2G, and 1099. Once the form is completed, it may be filed electronically by clicking the Submit Electronically button or it may be downloaded, printed, and mailed to DOR at the address on the form.

Statute of Limitations The statute of limitations for product liability actions is one year after the cause of action accrues. KRS §413.140(1)(a).

If you have a valid Federal tax extension (IRS Form 4868), you will automatically receive a Kentucky tax extension. In this case, you don't need to use Kentucky Form 40A102. unless you owe Make sure to attach a copy of your approved Federal extension to your Kentucky tax return when you file.

P.O. Box 856905, Louisville, KY 40285-6905. Kentucky Department of Revenue, Frankfort, KY 40620-0020.

Form 740 is the Kentucky income tax return for use by all taxpayers.

?Calculating KY Limited Liability Entity Tax (LLET) Kentucky imposes a tax on every business that is protected from liability by the laws of the state. This includes corporations, LLCs, S-Corporations, limited partnerships, and other types of businesses.

Form 720EXT grants an automatic 6-month extension of time to file Form 720. Kentucky State General Business S Corporation tax extension Form 720EXT is due within 4 months and 15 days following the end of the corporation reporting period.