Agreement Terminate Form For Lending Money

Description

How to fill out Agreement To Terminate Cohabitation?

There’s no longer a requirement to devote hours searching for legal documents to meet your local state standards.

US Legal Forms has compiled all of them in one location and enhanced their accessibility.

Our website offers over 85,000 templates for various business and personal legal situations categorized by state and purpose.

Preparing legal documents under federal and state laws is swift and straightforward with our platform. Explore US Legal Forms now to maintain your documentation organized!

- All forms are expertly composed and verified for accuracy, so you can be confident in acquiring a current Agreement Terminate Form For Lending Money.

- If you are acquainted with our platform and possess an account, ensure your subscription is active before acquiring any templates.

- Click Log In to your account, select the document, and press Download.

- You may also revisit all saved documents whenever necessary by accessing the My documents tab in your profile.

- If you have not utilized our platform before, the process will require a few more steps to finalize.

- Here’s how new users can obtain the Agreement Terminate Form For Lending Money from our library.

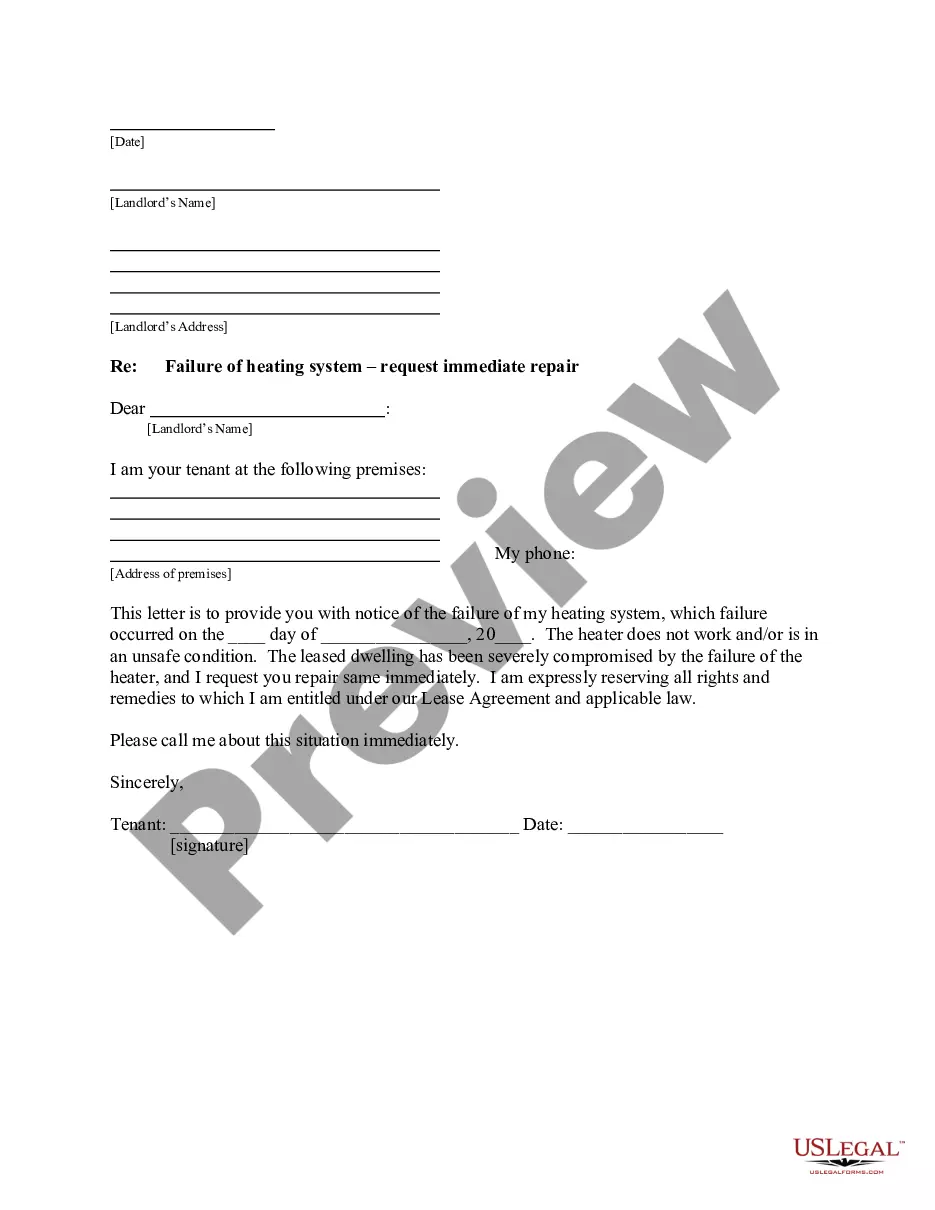

- Examine the page content thoroughly to confirm it has the example you need.

- Use the form description and preview options if available.

Form popularity

FAQ

You must notify your lender in writing that you are cancelling the loan contract and exercising your right to rescind. You may use the form provided to you by your lender or a letter. You can't rescind just by calling or visiting the lender.

State the purpose for the loan. #Set forth the amount and terms of the loan. Your agreement should clearly state the amount of money you're lending your friend, the interest rate, and the total amount your friend will pay you back.

Loan Termination Date means the date on which all Obligations, other than contingent liabilities and obligations which are unasserted at such date, have been paid and satisfied in full and all Commitments have been terminated.

For loans by a commercial lender, the lender will provide the agreement. But for loans between friends or relatives, you will need to create your own loan agreement.

Call the lender and explain that you would like to cancel the loan contract, disown the item it financed (car or house) and be relieved of any future obligations. Give your reasons and see if the lender is willing to work with you.