Unincorporated Organization

Description

How to fill out Articles Of Association Of Unincorporated Charitable Association?

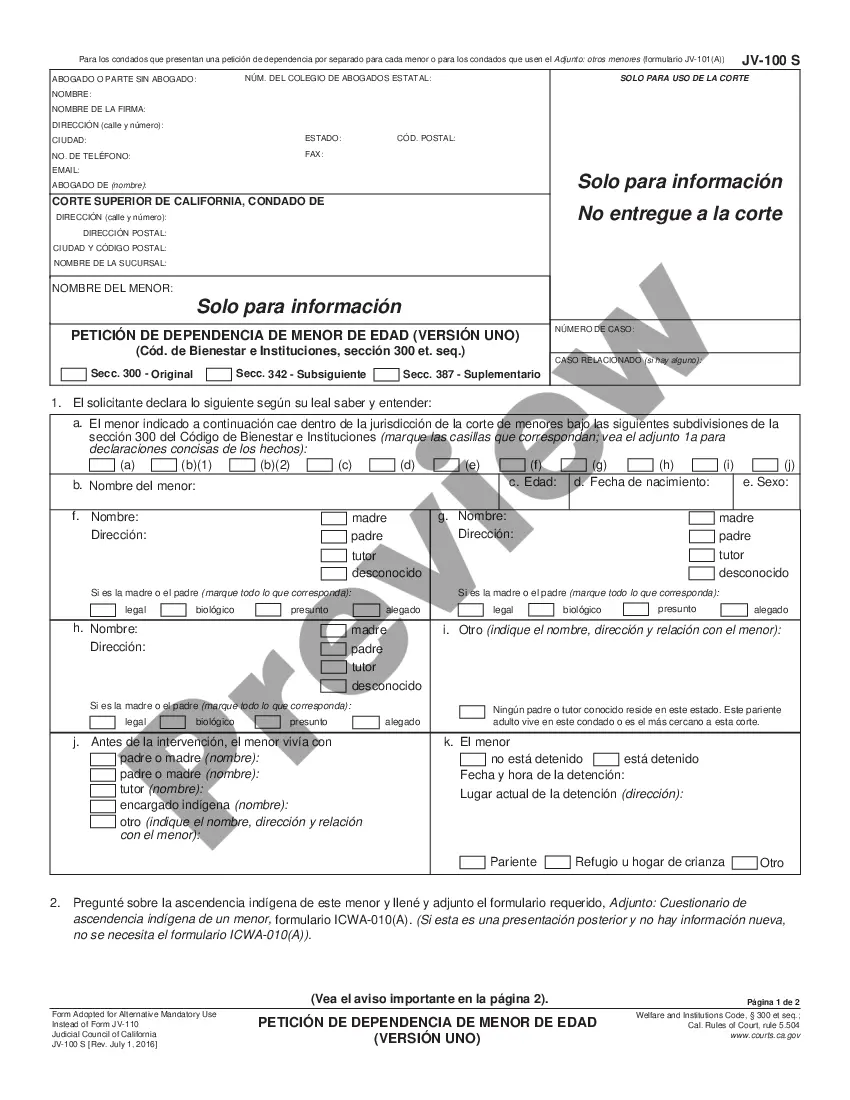

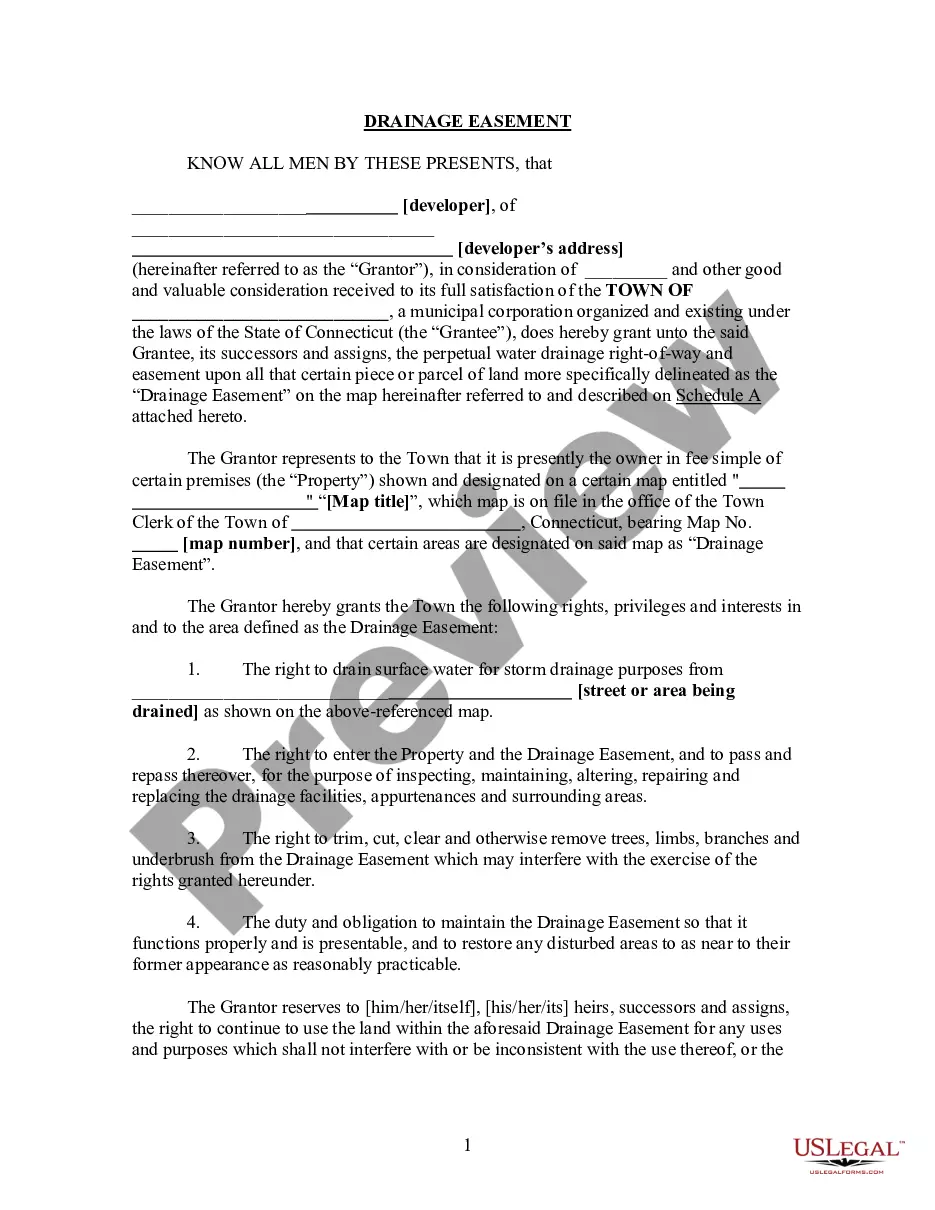

- Begin by logging into your US Legal Forms account. If you're new, create an account before proceeding.

- Review the legal document previews and descriptions to confirm they've been tailored for your situation and jurisdiction.

- If the needed document isn't correct, utilize the Search function to find alternatives that align better with your requirements.

- Select your desired document by clicking the Buy Now button and choose a subscription plan that suits you. Registration may be required.

- Complete your purchase securely using credit card details or your PayPal account.

- Once your payment is confirmed, download the form and save it for future use. You can also access it later in the My Forms section.

By following these straightforward steps, you'll gain access to a wealth of essential legal resources tailored for unincorporated organizations. US Legal Forms empowers you to manage your documentation smoothly and effectively.

Start today by exploring the extensive library of legal documents that US Legal Forms offers, and ensure you're equipped with the right forms for your needs!

Form popularity

FAQ

When an organization is described as unincorporated, it indicates that it has not taken the formal steps to establish itself as a legal entity. This means it does not have distinct legal rights and protections, making the owners personally liable for any financial obligations. Understanding this status is crucial for anyone considering starting a business.

Whether an incorporated or unincorporated organization is better depends on your business goals and needs. Unincorporated organizations offer simplicity and less regulatory burden, while incorporated entities provide liability protection and enhanced credibility. Evaluating these factors helps you decide the best structure for your specific situation.

One of the main disadvantages of operating as an unincorporated organization is the personal liability faced by owners. They are responsible for all debts and legal actions, which puts their personal assets at risk. Moreover, unincorporated businesses often struggle to attract investors or secure financing compared to incorporated organizations that can offer shares.

In an unincorporated organization, the owner is typically the individual or individuals who operate the business. This could be a sole proprietor running the business independently or multiple partners sharing ownership in a partnership. Since there is no legal separation between the owners and the business, the owners retain full control and responsibility.

An unincorporated organization is a business that is not registered as a legal entity separate from its owners. This means that the business operates as an extension of the owners and does not enjoy the same legal protections or structure as incorporated entities. As a result, owners of unincorporated organizations are personally liable for debts and obligations incurred by the business.

An unincorporated organization offers flexibility and simplicity in structure, making it easier for members to collaborate without complex paperwork. These organizations typically have fewer regulatory requirements, providing groups an opportunity to focus on their mission. Moreover, since unincorporated associations are often tax-exempt, they can direct more resources toward activities that benefit their members.

Certain individuals and entities do not need an EIN, including sole proprietors without employees or those who do not meet federal tax filing requirements. Additionally, small unincorporated organizations that do not have a bank account may also opt out of acquiring one. However, acquiring an EIN offers benefits, such as facilitating tax reporting and establishing a formal presence.

Yes, you can obtain an EIN for your unincorporated organization by applying through the IRS. The process is straightforward and can be completed online, ensuring your organization can operate efficiently in financial and tax matters. An EIN not only helps in tax identification but also enhances credibility when dealing with banks and other financial institutions.

Generally, unincorporated organizations are not required to file federal tax returns, provided they meet specific criteria. However, the IRS treats them as pass-through entities, meaning any income is reported on the individual members' tax returns. It's essential to consult with a tax professional to ensure compliance with both federal and state tax laws related to your unincorporated organization.

Associations often need an Employer Identification Number (EIN), especially if they have employees. This requirement applies to unincorporated organizations that engage in various activities like opening a bank account or filing certain tax forms. Even if your unincorporated organization has no employees, obtaining an EIN can simplify financial management and provide credibility.