Unincorporated Associations Sample Withholding

Description

How to fill out Articles Of Association Of Unincorporated Charitable Association?

Managing legal documents can be exasperating, even for the most proficient professionals.

When you are searching for a sample of Unincorporated Associations Withholding and don't have the opportunity to invest time finding the correct and current version, the process can be anxiety-inducing.

US Legal Forms caters to all requirements you may have, ranging from personal to business documents, all consolidated in one location.

Employ advanced tools to complete and manage your Unincorporated Associations Withholding sample.

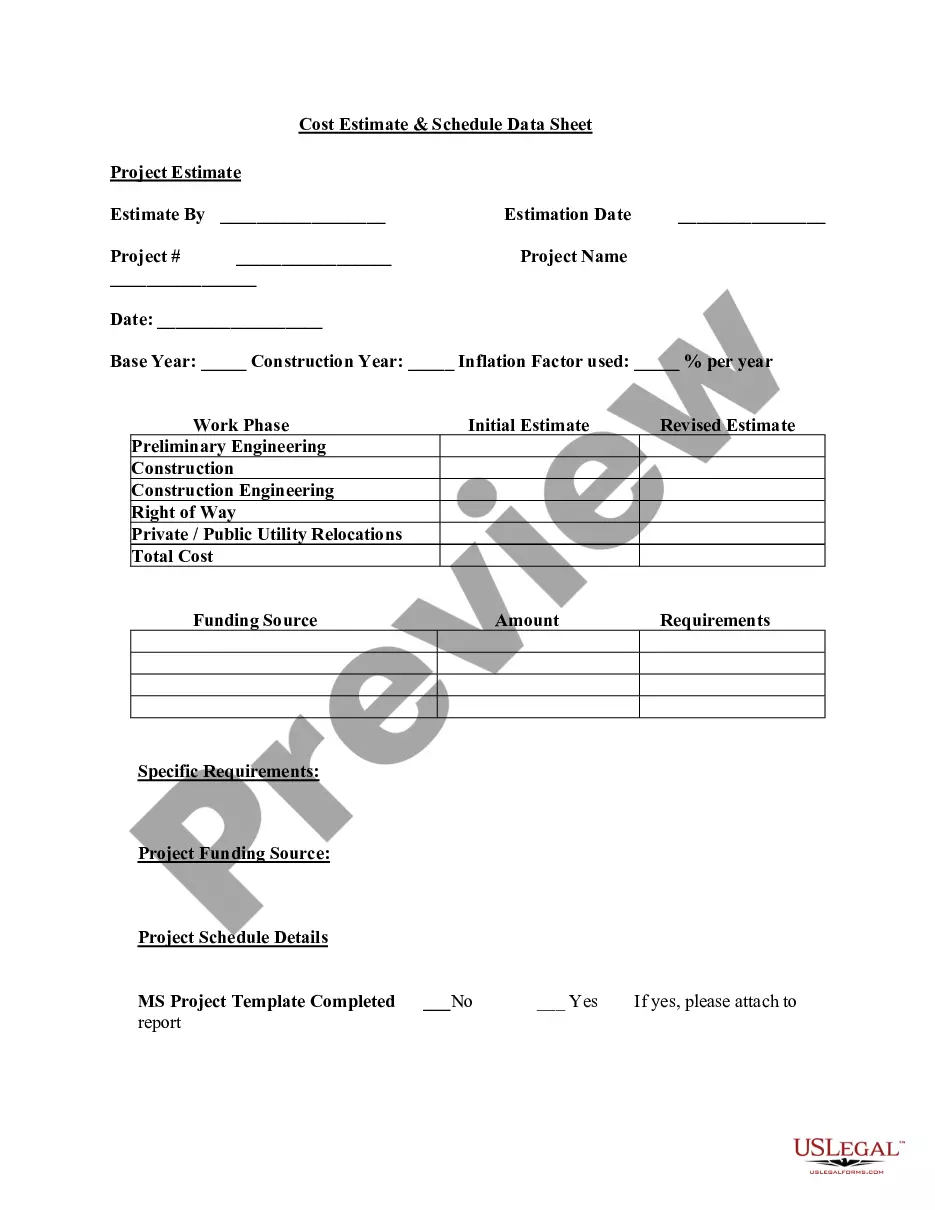

Below are the steps to follow after locating the form you desire: Confirm that this is the correct document by previewing it and reviewing its description.

- Access a wide array of articles, guides, handbooks, and resources related to your situation and needs.

- Conserve time and energy searching for the documents you require, and utilize US Legal Forms’ enhanced search and Review feature to locate Unincorporated Associations Withholding and obtain it.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and acquire it.

- Check the My documents section to view the documents you have previously downloaded and manage your folders as necessary.

- If this is your first experience with US Legal Forms, create a free account and enjoy unlimited access to all the advantages of the library.

- Utilize a comprehensive online form repository to revolutionize the way you tackle these scenarios.

- US Legal Forms stands as a frontrunner in digital legal documentation, offering over 85,000 state-specific legal documents accessible to you at any moment.

- Access legal and organizational forms that are specific to your state or municipality.

Form popularity

FAQ

Filling out a certificate of exemption involves providing essential information about your organization and its purpose. Start by listing the name and address of your unincorporated association, along with its tax identification number. Include any specific details related to unincorporated associations sample withholding that may apply. If you need a structured format, USLegalForms provides templates and examples that simplify this task, ensuring you complete the certificate correctly.

Filling out your tax withholding form requires careful attention to your financial situation. Begin by entering your personal details on the IRS Form W-4, noting any dependents and additional income. Make sure to reference any relevant information about unincorporated associations sample withholding to ensure accuracy. For assistance, USLegalForms offers user-friendly tools and samples to help you navigate the process with confidence.

To fill out a withholding exemption, start by gathering your personal information, including your Social Security number and filing status. Next, use the IRS Form W-4 as your guide, ensuring you indicate the appropriate number of allowances that apply to your situation. If you belong to an unincorporated association, you may have specific considerations based on its structure. For more detailed guidance, consider using USLegalForms to access templates and resources tailored to unincorporated associations sample withholding.

Unincorporated associations offer several advantages, such as lower operational costs and simpler formation processes compared to incorporated entities. These associations provide flexibility in management and decision-making, making them ideal for small groups or community organizations. Additionally, utilizing resources from uslegalforms can help streamline the formation process and address any unincorporated associations sample withholding concerns you may have.

The 33% rule for nonprofits refers to the guideline that limits the amount of lobbying activities a nonprofit organization can engage in, typically capping it at one-third of its total expenditures. This rule is designed to ensure that nonprofits primarily focus on their charitable missions. Understanding this rule can help unincorporated associations sample withholding navigate their operational boundaries while remaining compliant with IRS regulations.

One significant disadvantage of an unincorporated association is that it does not offer personal liability protection to its members. This means that members may be personally responsible for debts or legal actions against the association. Additionally, unincorporated associations may face challenges in securing funding and formal recognition, making it essential to weigh these factors carefully.

Yes, an unincorporated association can qualify for tax-exempt status under certain conditions. To achieve this, the organization must operate exclusively for non-profit purposes and meet the criteria set by the IRS. Consider using uslegalforms to navigate the application process effectively and ensure that your unincorporated associations sample withholding remains compliant.

Association dues generally are not subject to withholding tax, as they are typically considered contributions rather than income. This means that unincorporated associations sample withholding could be minimal or non-existent. However, it is crucial to evaluate your specific situation and consult with a tax professional to ensure compliance with all tax regulations and reporting requirements.

An unincorporated association may require an Employer Identification Number (EIN) if it has employees or if it plans to open a bank account. The EIN helps the association manage tax responsibilities and is essential for reporting purposes. Understanding the role of an EIN in relation to unincorporated associations sample withholding is crucial for proper financial management. US Legal Forms can assist you in applying for an EIN easily.

Yes, an unincorporated association may need to file a tax return, depending on its income and structure. If the association generates income, it typically must report it, even if it operates as a pass-through entity. Keeping track of unincorporated associations sample withholding is vital to ensure compliance with tax laws. Using platforms like US Legal Forms can help clarify your filing requirements.