Unincorporated Associations Document Without Comments

Description

How to fill out Articles Of Association Of Unincorporated Charitable Association?

Finding a go-to place to access the most current and relevant legal templates is half the struggle of handling bureaucracy. Discovering the right legal documents demands accuracy and attention to detail, which is why it is vital to take samples of Unincorporated Associations Document Without Comments only from trustworthy sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to be concerned about. You may access and see all the details regarding the document’s use and relevance for the circumstances and in your state or county.

Consider the following steps to finish your Unincorporated Associations Document Without Comments:

- Use the catalog navigation or search field to locate your template.

- Open the form’s information to check if it suits the requirements of your state and region.

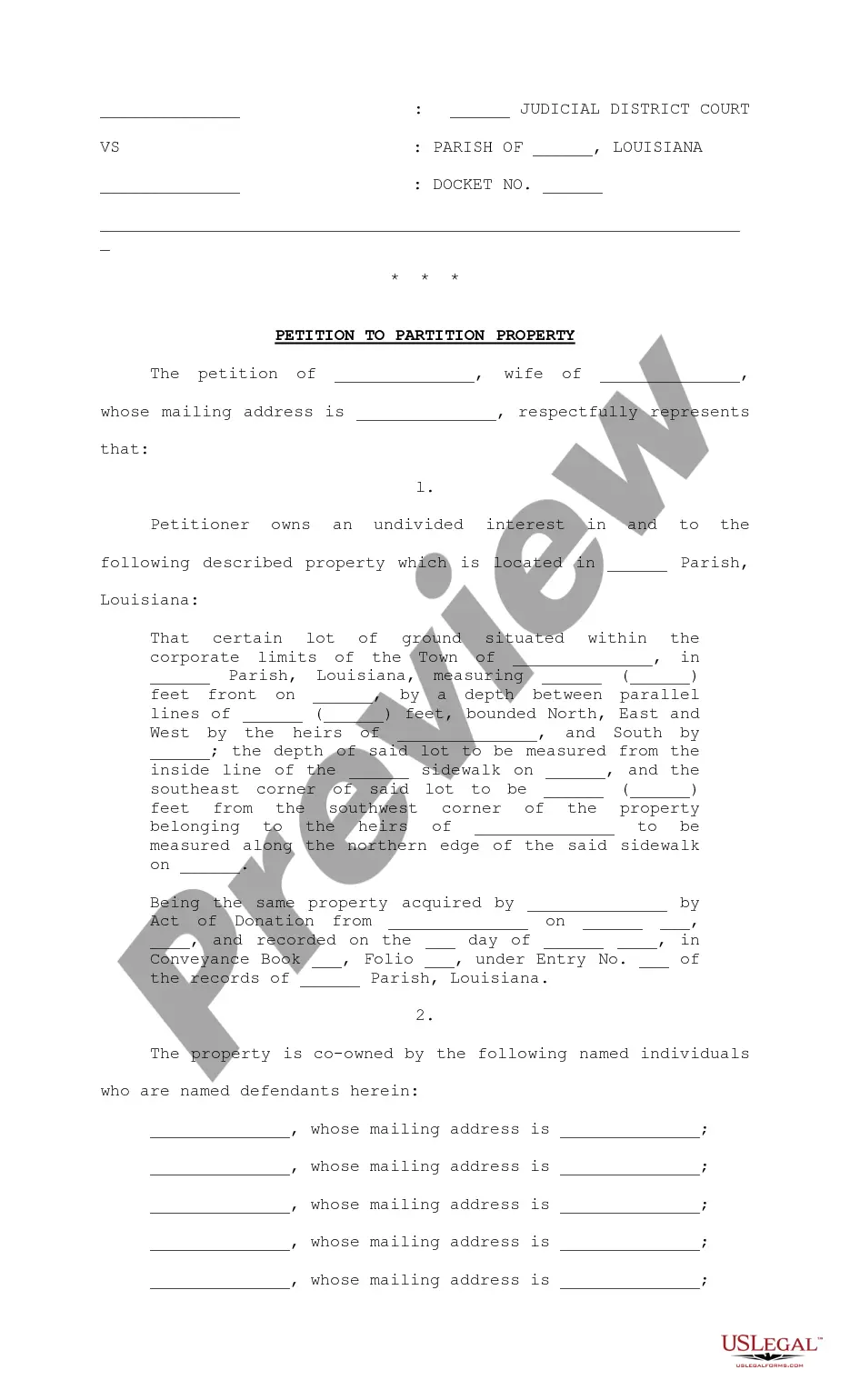

- Open the form preview, if there is one, to ensure the form is definitely the one you are searching for.

- Get back to the search and look for the correct template if the Unincorporated Associations Document Without Comments does not suit your requirements.

- When you are positive regarding the form’s relevance, download it.

- If you are a registered user, click Log in to authenticate and access your picked forms in My Forms.

- If you do not have a profile yet, click Buy now to get the template.

- Pick the pricing plan that fits your needs.

- Go on to the registration to finalize your purchase.

- Finalize your purchase by picking a payment method (credit card or PayPal).

- Pick the file format for downloading Unincorporated Associations Document Without Comments.

- When you have the form on your gadget, you can alter it using the editor or print it and finish it manually.

Get rid of the headache that accompanies your legal documentation. Explore the extensive US Legal Forms library where you can find legal templates, check their relevance to your circumstances, and download them on the spot.

Form popularity

FAQ

The nonprofit corporation, however, is different from an unincorporated nonprofit association because, as its name suggests, it is a corporation formed with the primary goal of benefiting the public, as opposed to being just an association of people.

Therefore, an unincorporated association cannot enter into contracts in its own name, or own land, or employ people, or sue or be sued. The members of the unincorporated association do these things on behalf of the association.

Unincorporated Associations Deposit accounts held in the name of an unincorporated association (such as a neighborhood association or a scout troop) engaged in an independent activity are insured as the association's deposits, separately from the personal deposits of the officers or members.

An unincorporated association may be a for- profit or nonprofit group, such as a partnership, social club, charitable group, mutual aid society, homeowners association, labor union, political group, or religious society.

A nonprofit organization may be created as a corporation, a trust, or an unincorporated association. Any of these entities may qualify for exemption. Note, however, that a partnership generally may not qualify.