Unincorporated Association Template Formation

Description

How to fill out Articles Of Association Of Unincorporated Charitable Association?

Whether for professional reasons or personal issues, everyone must confront legal matters at some point in their lives.

Completing legal documents requires meticulous attention, starting with selecting the correct form template.

With an extensive US Legal Forms catalog available, you won’t need to waste time searching for the suitable sample online. Utilize the library’s user-friendly navigation to find the correct template for any circumstance.

- For example, if you select an incorrect version of an Unincorporated Association Template Formation, it will be declined upon submission.

- Thus, it is crucial to find a reliable source of legal documents like US Legal Forms.

- If you wish to acquire an Unincorporated Association Template Formation template, adhere to these straightforward steps.

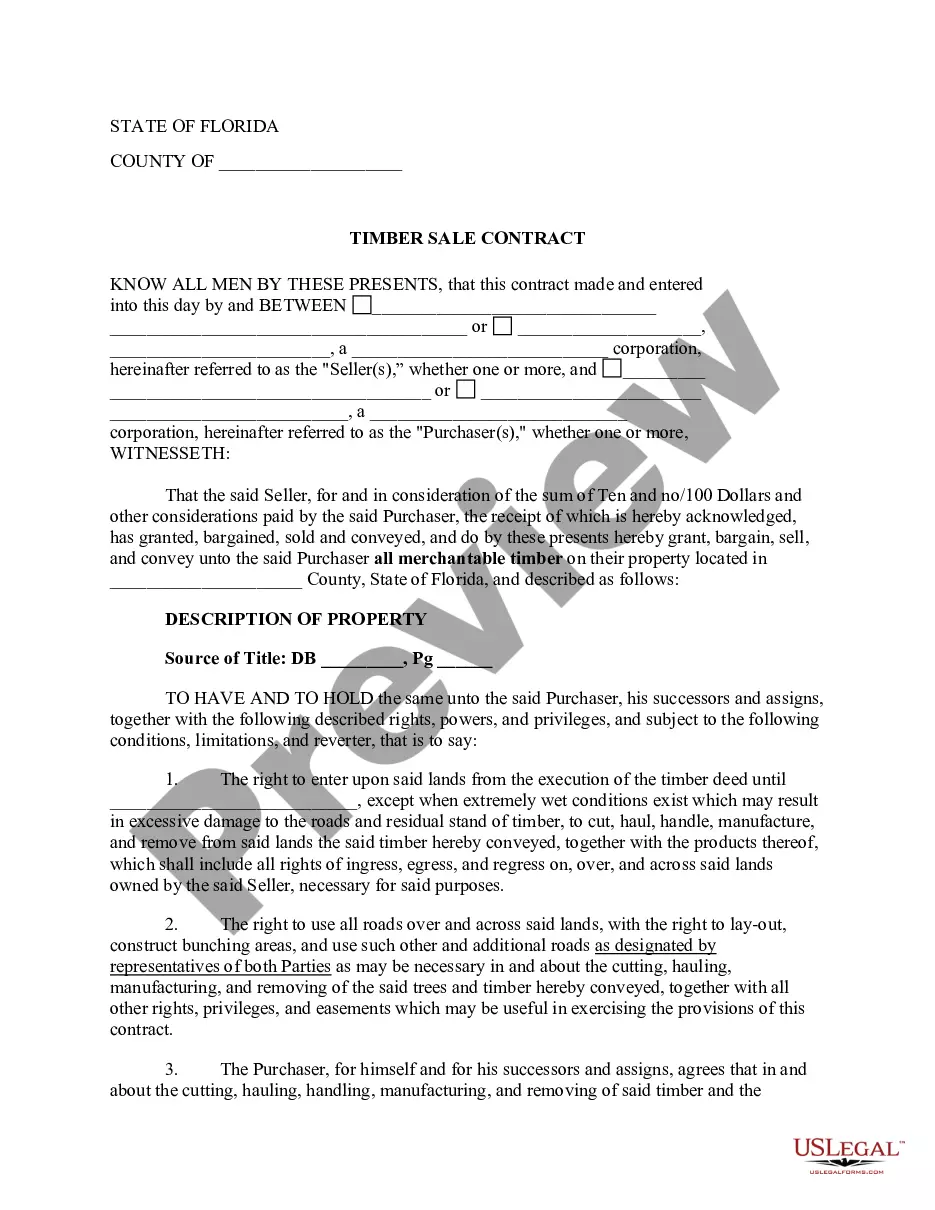

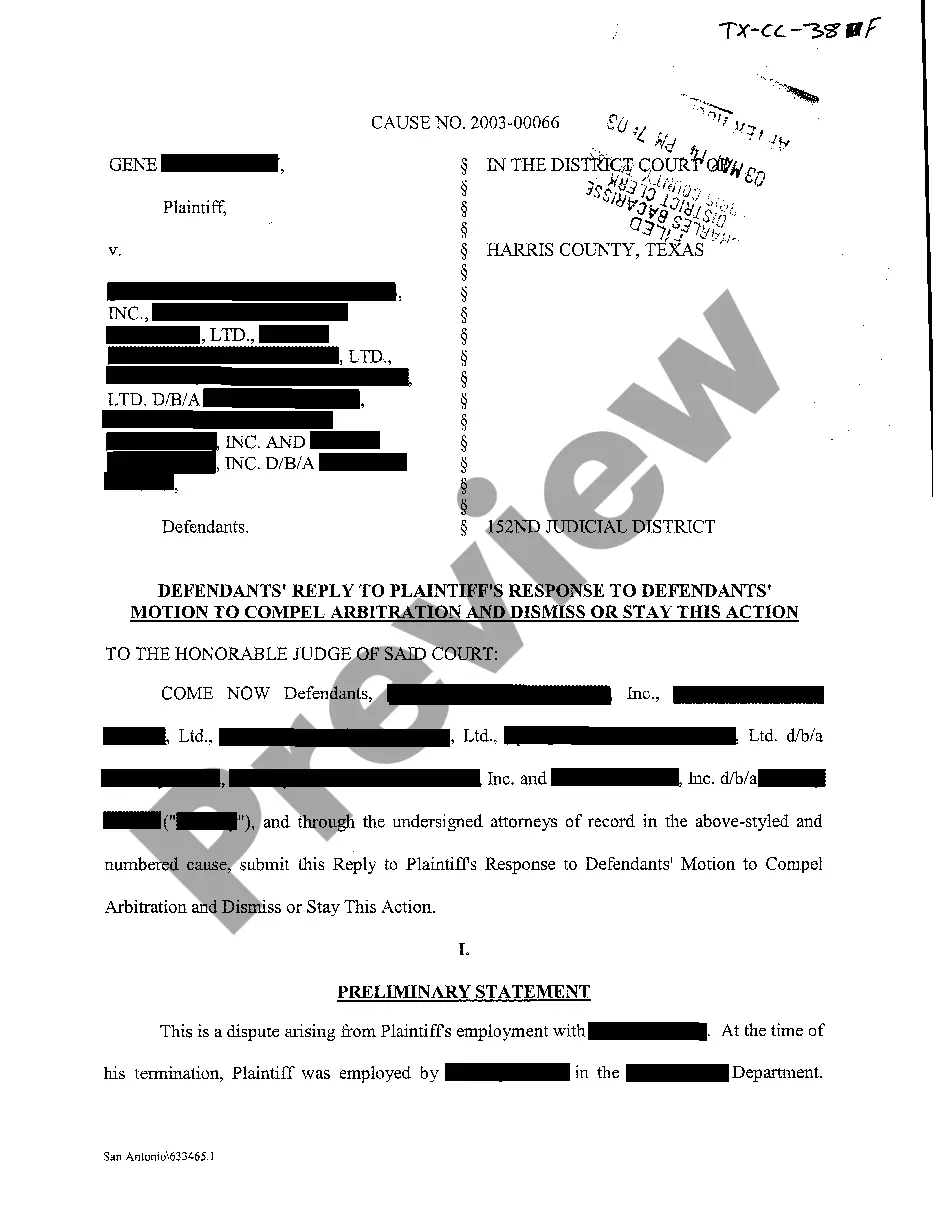

- Obtain the sample you require through the search bar or catalog browsing.

- Review the form’s details to confirm it aligns with your case, jurisdiction, and county.

- Click on the form’s preview to inspect it.

- If it is the incorrect document, revert to the search feature to find the Unincorporated Association Template Formation sample you need.

- Download the file once it fulfills your requirements.

- If you possess a US Legal Forms profile, simply click Log in to access previously saved documents in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the profile registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the document format you desire and download the Unincorporated Association Template Formation.

- Once downloaded, you can fill out the form using editing software or print it and finish it manually.

Form popularity

FAQ

An unincorporated association is defined as an association of two or more persons formed for some religious, educational, charitable, social or other non-commercial purpose. Accounts of a sole proprietorship or a DBA are not insured under this account category.

Texas law defines an ?unincorporated nonprofit association? as an unincorporated organization, other than one created by a trust, consisting of three or more members joined by mutual consent for a common, nonprofit purpose.

Privacy ? an unincorporated association does not have to file accounts and other information with Companies House or with the Registrar of Friendly Societies. 3. In relation to the day to day running of the club, brewers, banks and other suppliers are happy to deal with the officers.

An unincorporated association may be a for- profit or nonprofit group, such as a partnership, social club, charitable group, mutual aid society, homeowners association, labor union, political group, or religious society.

The one most commonly used is the 1099-MISC. The IRS requires individuals, churches, and organizations (profit or nonprofit) to use this form to report specific kinds of taxable income paid to individuals and unincorporated entities.