Unincorporated Association Form Formation

Description

How to fill out Articles Of Association Of Unincorporated Charitable Association?

Acquiring legal document samples that adhere to federal and state regulations is crucial, and the internet provides numerous choices to select from.

However, what's the benefit of spending time hunting for the suitable Unincorporated Association Form Formation sample online when the US Legal Forms online library already has such templates compiled in one location.

US Legal Forms is the largest digital legal catalog featuring over 85,000 fillable templates created by attorneys for any business and personal situation. They are easy to navigate with all documents categorized by state and intended use. Our experts stay updated on legislative modifications, so you can always trust that your form is current and compliant when obtaining a Unincorporated Association Form Formation from our site.

Click Buy Now when you've located the correct form and select a subscription plan. Create an account or Log In and process payment with PayPal or a credit card. Choose the best format for your Unincorporated Association Form Formation and download it. All templates you find through US Legal Forms are reusable. To re-download and complete previously acquired forms, access the My documents tab in your profile. Enjoy the most comprehensive and user-friendly legal paperwork service!

- Obtaining a Unincorporated Association Form Formation is straightforward and fast for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document sample you need in your desired format.

- If you are new to our site, follow the steps below.

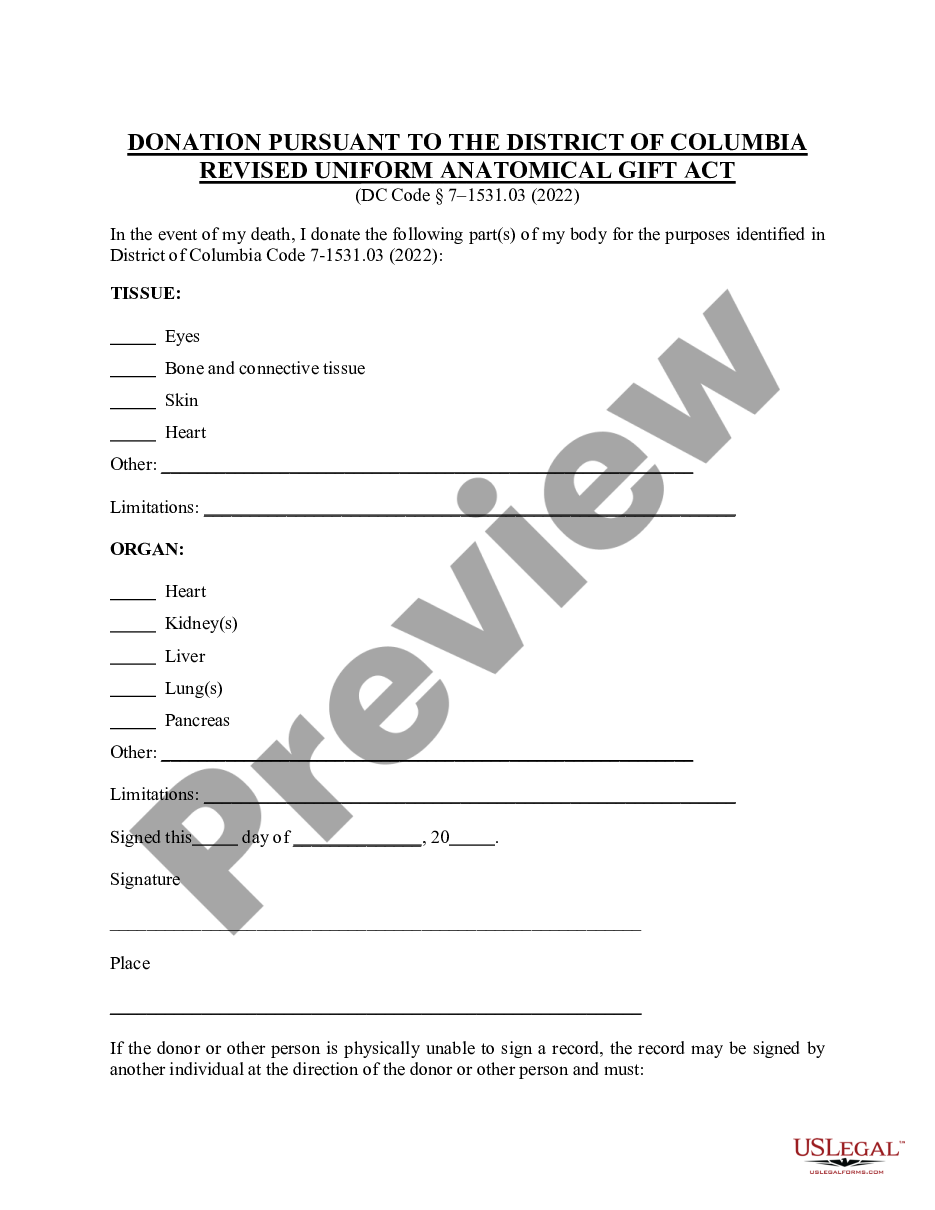

- Review the template using the Preview feature or through the text outline to confirm it satisfies your requirements.

- Search for another sample using the search tool at the top of the page if necessary.

Form popularity

FAQ

Unincorporated Associations Deposit accounts held in the name of an unincorporated association (such as a neighborhood association or a scout troop) engaged in an independent activity are insured as the association's deposits, separately from the personal deposits of the officers or members.

The one most commonly used is the 1099-MISC. The IRS requires individuals, churches, and organizations (profit or nonprofit) to use this form to report specific kinds of taxable income paid to individuals and unincorporated entities.

Definitions. Section 18035. (a) Unincorporated association means an unincorporated group of two or more persons joined by mutual consent for a common lawful purpose, whether organized for profit or not.

Privacy ? an unincorporated association does not have to file accounts and other information with Companies House or with the Registrar of Friendly Societies. 3. In relation to the day to day running of the club, brewers, banks and other suppliers are happy to deal with the officers.

Similarly, an unincorporated association cannot own property (even its own funds): the members must appoint someone, usually a treasurer or committee, who will hold the property as a trustee.