Business State Liability For Llc

Description

How to fill out Checklist - Small Business Legal Compliance Inventory?

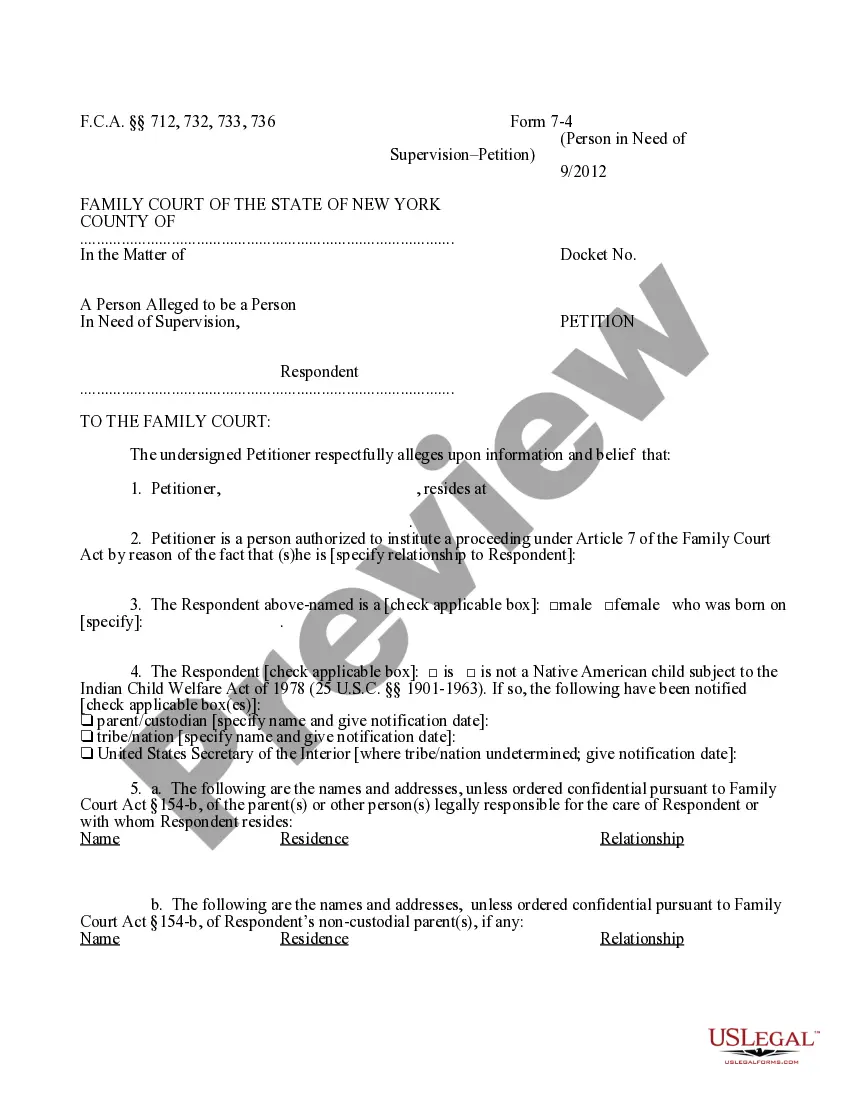

The Business State Liability For Llc you see on this page is a reusable formal template drafted by professional lawyers in compliance with federal and state regulations. For more than 25 years, US Legal Forms has provided individuals, companies, and attorneys with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the fastest, most straightforward and most reliable way to obtain the documents you need, as the service guarantees bank-level data security and anti-malware protection.

Getting this Business State Liability For Llc will take you just a few simple steps:

- Browse for the document you need and review it. Look through the sample you searched and preview it or check the form description to ensure it suits your requirements. If it does not, utilize the search bar to get the right one. Click Buy Now once you have found the template you need.

- Sign up and log in. Choose the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to proceed.

- Get the fillable template. Pick the format you want for your Business State Liability For Llc (PDF, DOCX, RTF) and save the sample on your device.

- Complete and sign the paperwork. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a legally-binding] {electronic signature.

- Download your papers one more time. Use the same document once again anytime needed. Open the My Forms tab in your profile to redownload any earlier downloaded forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s scenarios at your disposal.

Form popularity

FAQ

All corporations and limited liability companies doing business in Pennsylvania are required to pay corporate net income tax. Businesses that elect federal subchapter S status are considered Pennsylvania S corporations and are subject to the 9.99 percent corporate net income tax only to the extent of built-in-gains.

No, since your California LLC doesn't need to pay the $800 franchise tax for its 1st year, you don't need to file Form 3522. Form 3522 will need to be filed in the 2nd year.

Disregarded entities are the simplest tax classification with straightforward tax reporting. Your LLC is not taxed or required to file a tax return. Instead, the business profits and losses pass to you as the sole owner to be reported on your personal income tax return.

Pennsylvania State Income Tax Single member LLCs, only have to pay the state's personal income tax, which is 3.07%. If your LLC is filing as a C-corp, you pay Pennsylvania's 9.99% corporate net income tax rate and the state's corporate loans tax, which is 4 mill on each dollar.

Just go to California's Franchise Tax Board website, and under 'Business,' select 'Use Web Pay Business. ' Select 'LLC' as entity type and enter your CA LLC entity ID. Pay the annual fee for the full calendar year (1/1 to 12/31) using your business bank account.