Section 1244 Stock With Dividends

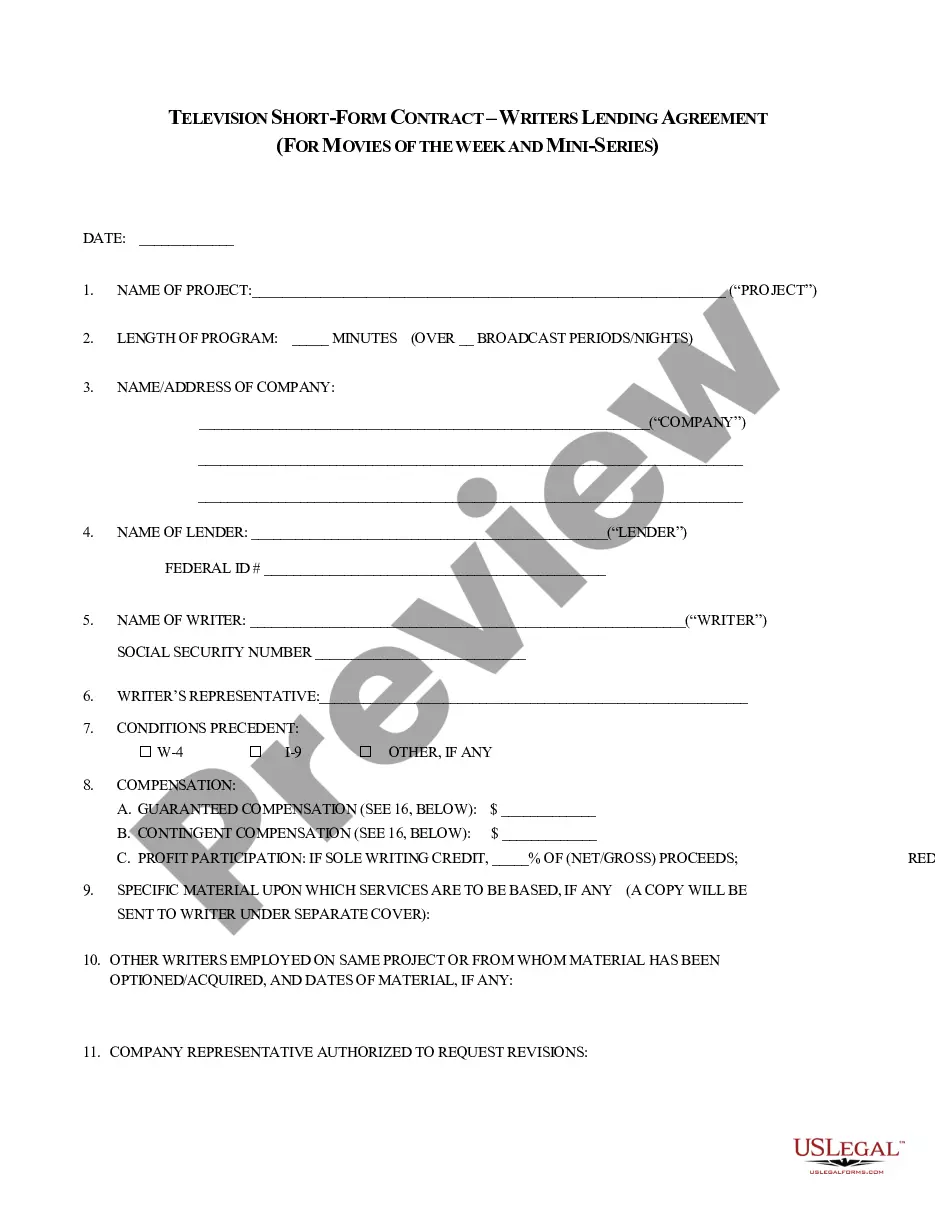

Description

How to fill out Agreement To Incorporate As An S Corp And As Small Business Corporation With Qualification For Section 1244 Stock?

It’s well-known that you cannot transform into a legal authority instantly, nor can you swiftly acquire the knowledge to prepare Section 1244 Stock With Dividends without possessing a distinct skill set.

Drafting legal paperwork is an extensive undertaking that necessitates specific training and expertise. So why not entrust the preparation of the Section 1244 Stock With Dividends to the experts.

With US Legal Forms, one of the most extensive legal document collections, you can find everything from court papers to templates for internal corporate correspondence. We recognize how vital it is to comply with and follow federal and state regulations.

Create a free account and select a subscription plan to buy the form.

Click Buy now. Once the transaction is completed, you can obtain the Section 1244 Stock With Dividends, fill it out, print it, and send or mail it to the appropriate individuals or entities.

- That’s why, on our platform, all templates are location-specific and current.

- Start off with our website and acquire the form you require in just a few minutes.

- Find the document you need by utilizing the search bar at the top of the page.

- Preview it (if this option is available) and read the accompanying description to see if Section 1244 Stock With Dividends is what you seek.

- If you require a different template, begin your search anew.

Form popularity

FAQ

Section 1244 stock is a type of equity investment in a small business. It allows investors to claim an ordinary loss on the investment rather than a capital loss if the investment goes bad. The maximum loss that can get claimed is $50,000 per year, or $100,000 for married couples filing jointly.

However, § 1244 allows shareholders of a small business corporation who sold stock at a loss to avoid the limitations on deductions and deduct the entire loss from their sale as an ordinary loss immediately in the year of realization.

1244 stock are deductible as ordinary losses up to a maximum of $50,000 per taxable year ($100,000 for married taxpayers filing a joint return), Any excess loss for the year is a capital loss. Gains on the sale of Sec. 1244 stock are capital gains.

Section 1244 stock refers to the tax treatment of qualified restricted shares. Section 1244 stock allows firms to report certain capital losses as ordinary losses for tax purposes. This lets new or smaller companies take advantage of lower effective tax rates and increased deductions.

To claim the business loss from Section 1244 stock, you will need to file Form 4797 with your tax return. You will also need to attach a computation of the loss from the sale or exchange of section 1244 stock.