Close Corporation Agreement For A Form Of Ownership

Description

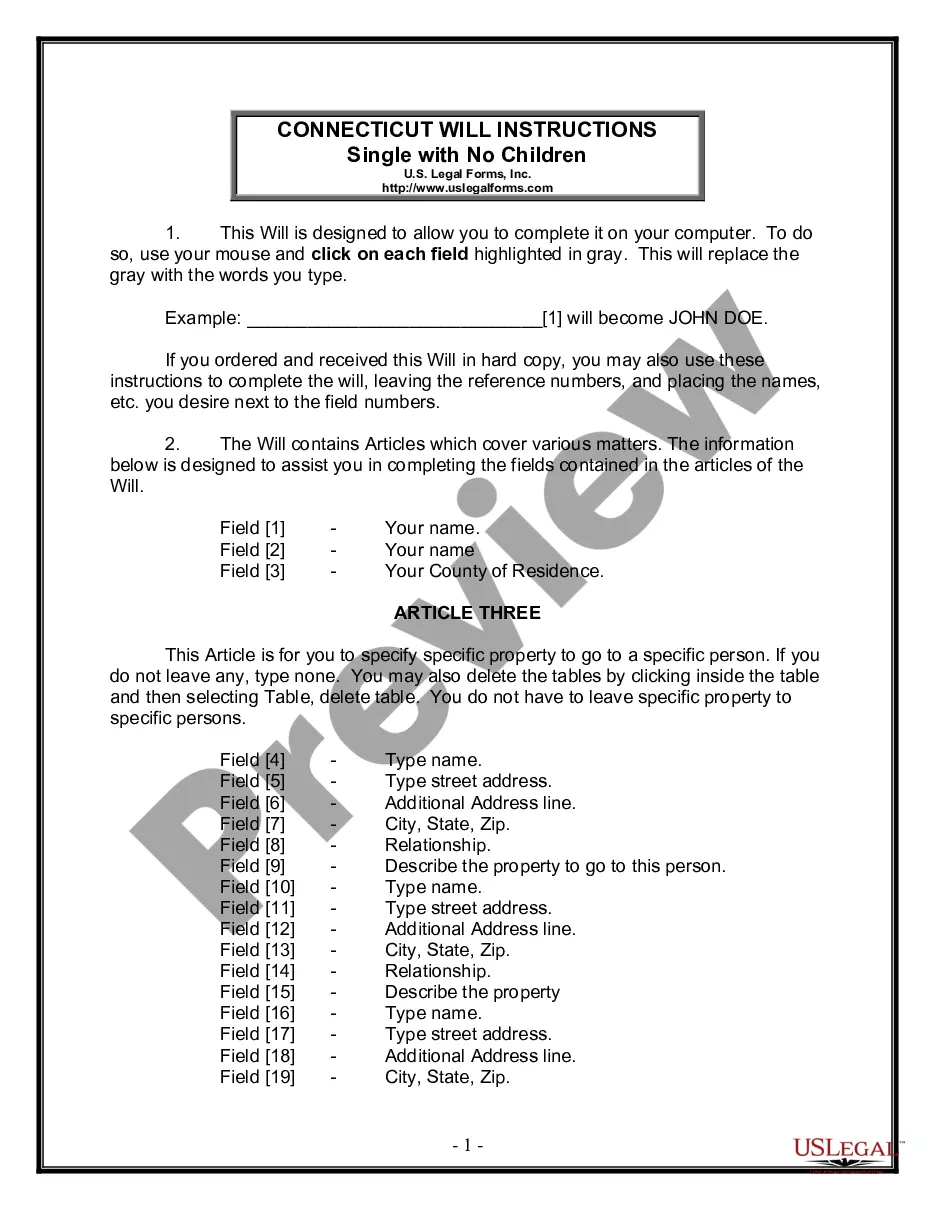

How to fill out Agreement To Incorporate Close Corporation?

How to obtain professional legal documents that comply with your state's regulations and draft the Close Corporation Agreement For A Form Of Ownership without the need to hire an attorney.

Numerous services online provide templates for various legal situations and formal requirements.

However, it can take time to ascertain which of the accessible samples meet both your usage needs and legal criteria.

If you do not possess an account with US Legal Forms, please follow the instructions below.

- US Legal Forms is a reliable platform that assists you in finding official documents created according to the latest state law updates and economizing on legal fees.

- US Legal Forms is not a typical online directory; it features over 85,000 verified templates for different business and personal scenarios.

- All documents are categorized by area and state to streamline your search process and reduce frustration.

- Additionally, it integrates with advanced solutions for PDF editing and electronic signatures, allowing users with a Premium subscription to quickly complete their paperwork online.

- Acquiring the necessary documentation requires minimal time and effort.

- If you already have an account, Log In and verify your subscription status is active.

- Download the Close Corporation Agreement For A Form Of Ownership using the corresponding button next to the file name.

Form popularity

FAQ

It is a legal entity with its own legal personality and perpetual succession and must register as a taxpayer in its own right. A CC has no share capital and therefore no shareholders. The owners of a CC are the members of the CC.

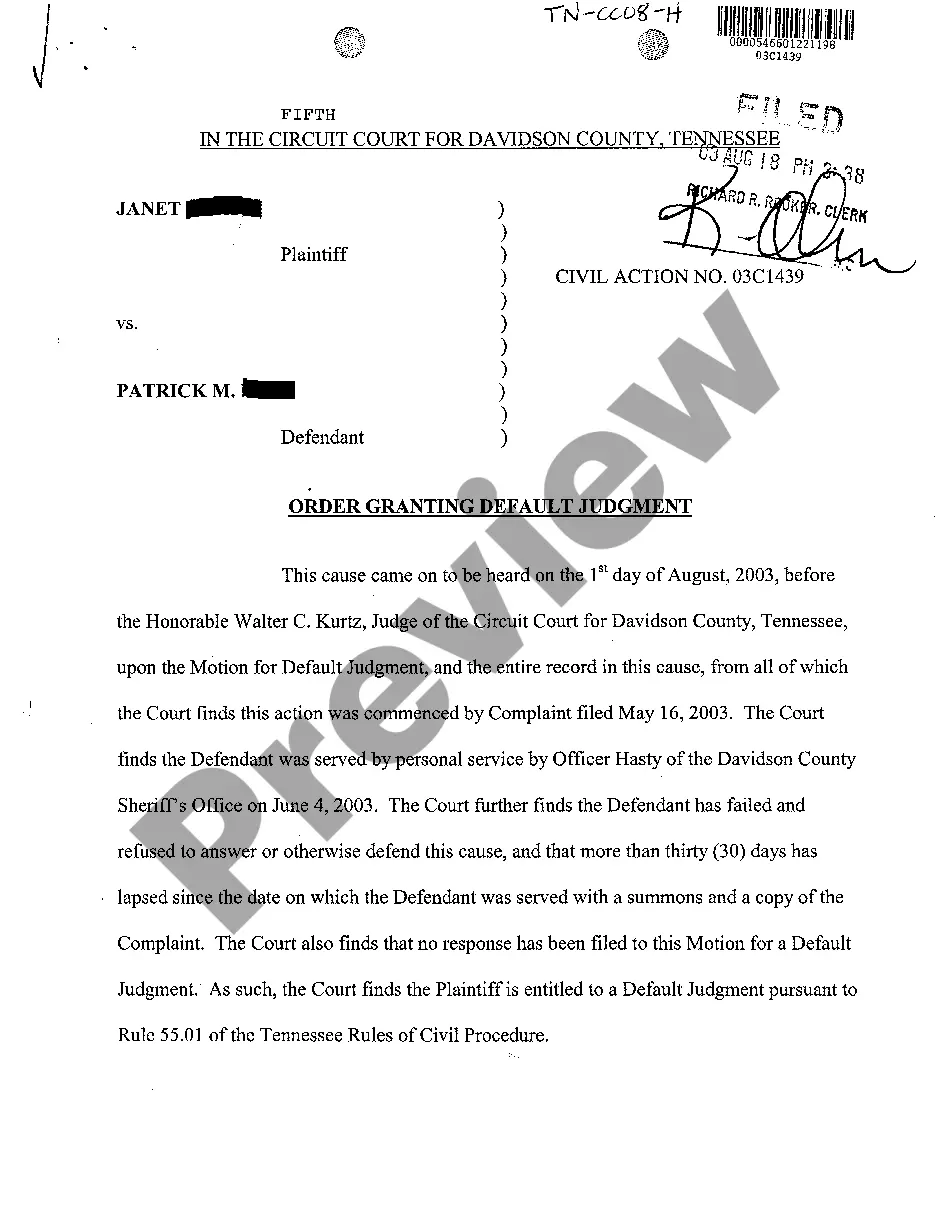

ORC § 1701.591 entitled Close Corporation Agreement provides a mechanism for shareholders of a close corporation to agree in advance on issues related to the internal management and business operations of their corporation and the relations between and among themselves as shareholders.

A close corporation is a corporation which does not exceed a statutorily defined number of shareholders and is not a public corporation. This number depends on the state's business laws, but the number is usually 35 shareholders.

Visit your state's website. Enter the corporation's name into the state's complimentary business registration database, also searchable by registration number. View registration information for the corporation. State records show the name and address of the business owner as well as the name of the registered agent.