Church Promissory Note With Collateral Sample

Description

How to fill out Promissory Note College To Church?

There's no longer a requirement to squander hours searching for legal documents to fulfill your local state mandates.

US Legal Forms has gathered all of them in one spot and streamlined their accessibility.

Our site offers over 85k templates for any business and personal legal situations categorized by state and intended use.

Using the Search field above, locate another sample if the current one does not suit your needs. Click Buy Now next to the template title once you identify the correct one. Choose the most appropriate subscription plan and either register for an account or Log In. Ensure payment for your subscription via credit card or PayPal to proceed. Pick the file format for your Church Promissory Note With Collateral Sample and download it to your device. Print your document to complete it by hand or upload the sample if you would rather do it in an online editor. Creating official documents in compliance with federal and state laws is quick and easy with our collection. Try US Legal Forms today to keep your paperwork organized!

- All forms are correctly drafted and authenticated for legitimacy, ensuring you receive a current Church Promissory Note With Collateral Sample.

- If you are acquainted with our service and already possess an account, ensure your subscription is active before accessing any templates.

- Log In to your account, select the document, and hit Download.

- You can also revisit all saved documents whenever necessary by opening the My documents section in your profile.

- If you've never utilized our service before, the process will involve a few additional steps to finalize.

- Here's how new users can access the Church Promissory Note With Collateral Sample from our collection.

- Review the page content thoroughly to confirm it contains the sample you require.

- To assist with this, use the form description and preview options, if available.

Form popularity

FAQ

A banknote is frequently referred to as a promissory note, as it is made by a bank and payable to bearer on demand. Mortgage notes are another prominent example. If the promissory note is unconditional and readily saleable, it is called a negotiable instrument.

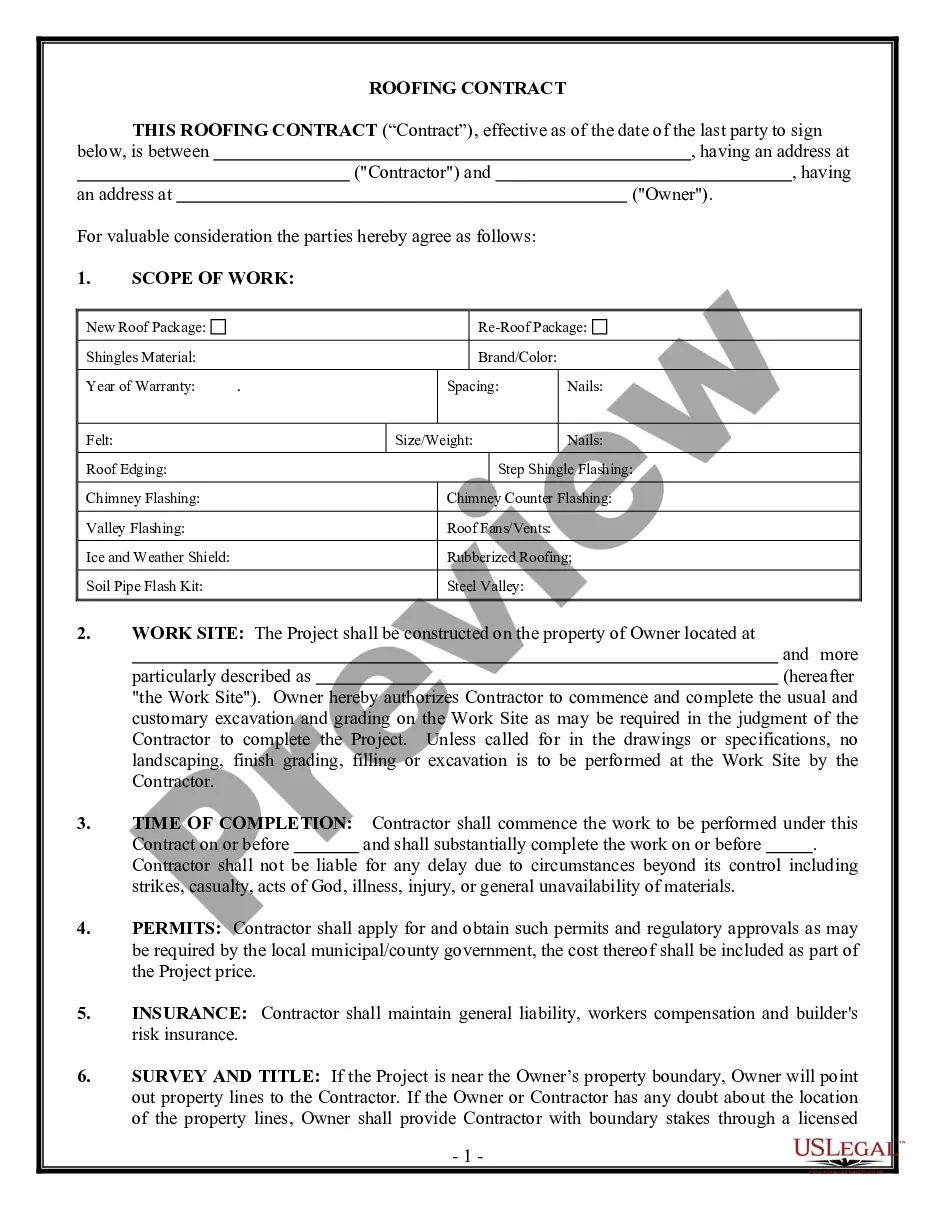

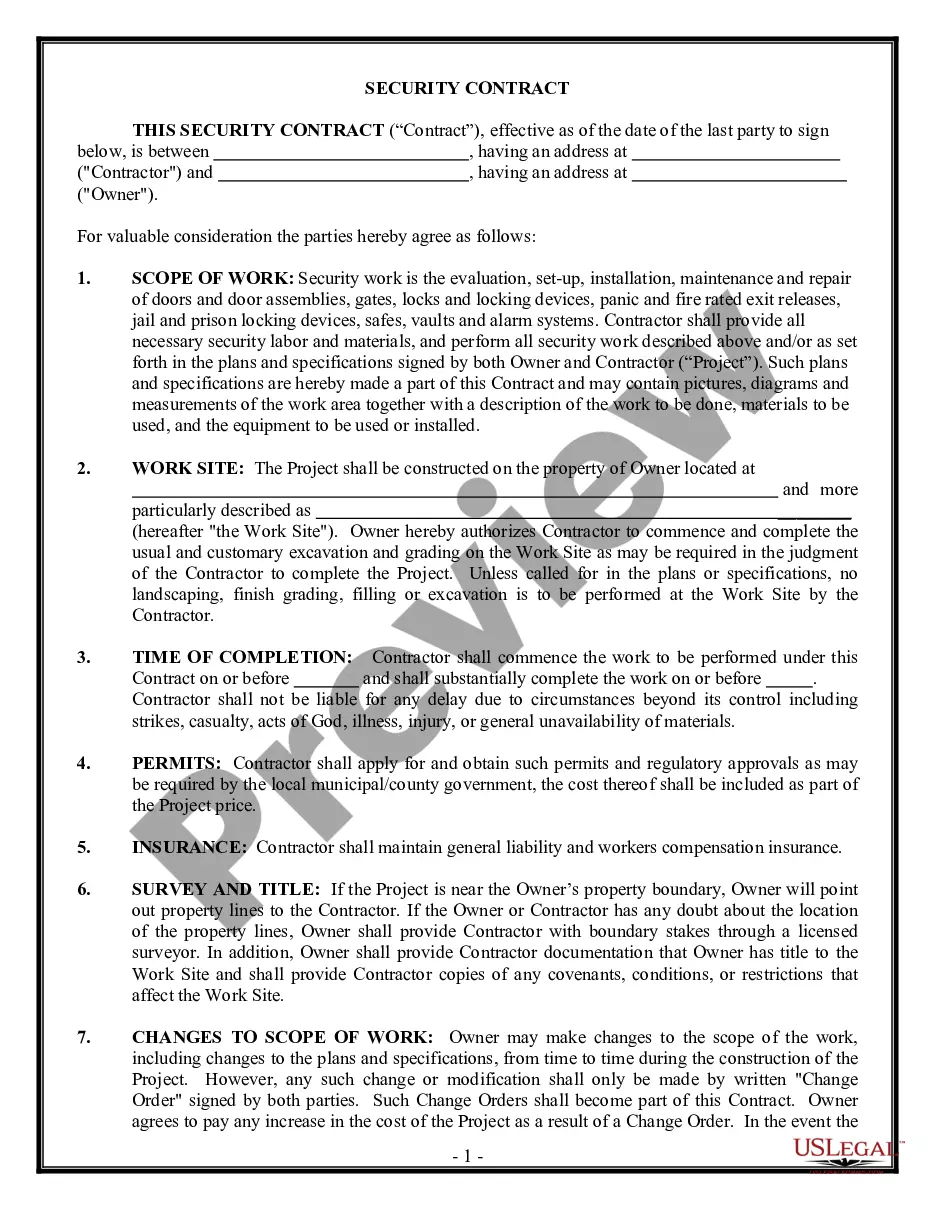

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Detailed Information The note has all the required information including the name of the drawer and payee, date of maturity, terms of repayment, issue date, name of the drawee, name, and signature of the drawer, principal amount, and the rate of interest, etc.

The promissory note journal entry is recorded by debiting the account that receives value, commonly the cash account, and crediting the notes payable account.