Letter Cpa Form For Llc

Description

How to fill out Sample Letter For Congratulations On Passing The CPA Exam?

Managing legal documents can be exasperating, even for seasoned professionals.

When searching for a Letter Cpa Form For Llc and struggling to find the time to search for the correct and current version, the processes might be stressful.

US Legal Forms addresses all potential requirements you may have, ranging from personal to business paperwork, all in a single location.

Make use of advanced tools to complete and manage your Letter Cpa Form For Llc.

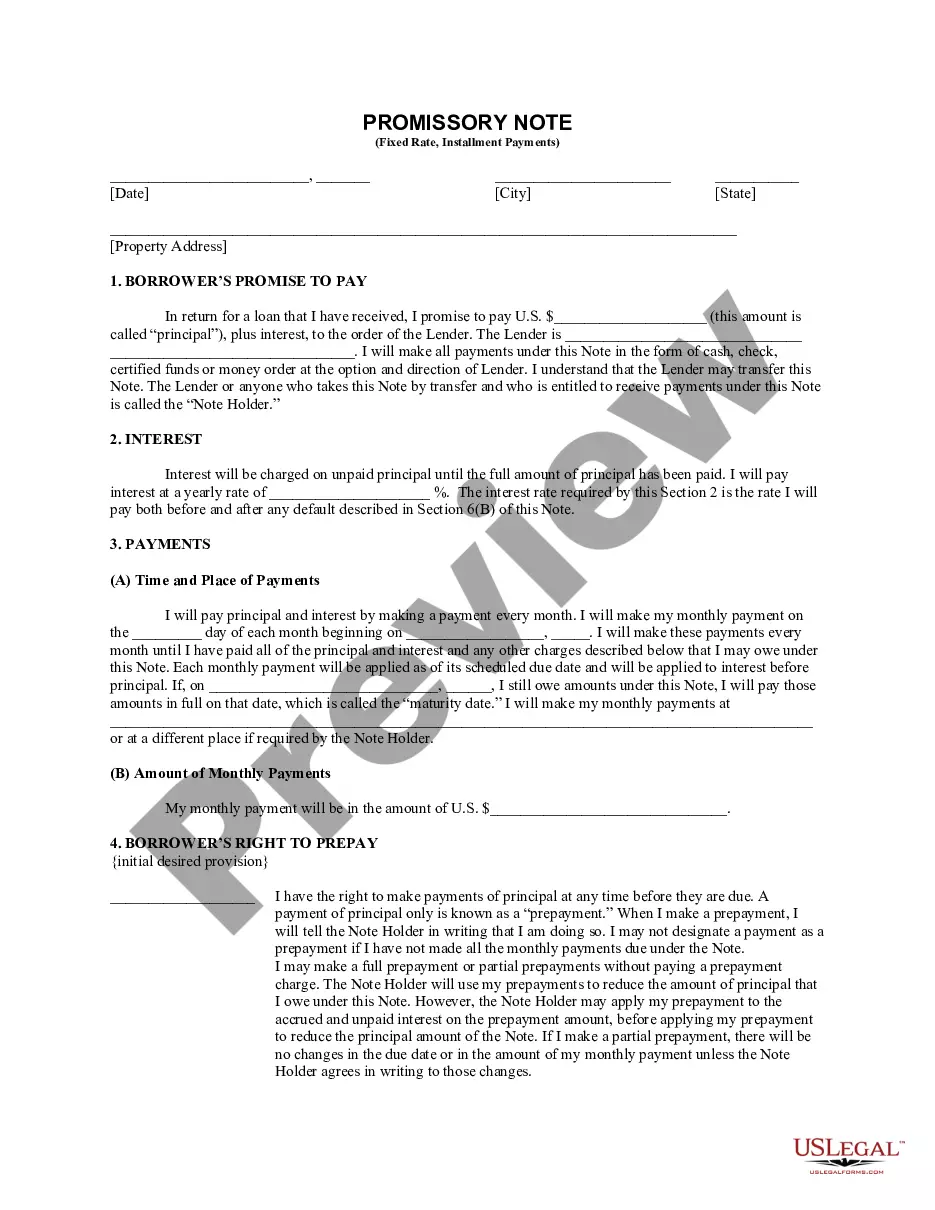

Here are the steps to follow after obtaining the form you desire: Verify that this is the correct form by previewing it and reviewing its description.

- Access a library of articles, tutorials, handbooks, and resources relevant to your situation and requirements.

- Save time and effort by searching for the documents you need, and leverage US Legal Forms’ enhanced search and Preview tool to find and download your Letter Cpa Form For Llc.

- For members, Log In to your US Legal Forms account, locate your desired form, and download it.

- Visit the My documents section to review the documents you’ve previously saved, as well as to manage your folders according to your preference.

- If it's your initial experience with US Legal Forms, create a free account to obtain unlimited access to the full advantages of the library.

- Utilize a comprehensive online form repository that can revolutionize the way you handle these scenarios effectively.

- US Legal Forms is an industry frontrunner in online legal forms, offering over 85,000 state-specific legal forms accessible to you 24/7.

- With US Legal Forms, you can easily access state- or county-specific legal and business forms.

Form popularity

FAQ

To create a CPA letter, begin by consulting with a licensed CPA who understands your needs. They will guide you through the process, helping you compile relevant financial data and ensuring the letter meets all necessary criteria. Utilizing a resource like USLegalForms can simplify obtaining the letter CPA form for LLC, making the process efficient and straightforward.

Creating a CPA letter involves several key steps. First, gather the necessary financial documents and information your CPA will need. Next, collaborate with your CPA to draft the letter, ensuring it accurately reflects your LLC’s financial standing. Finally, make sure the letter adheres to any specific requirements outlined in the letter CPA form for LLC.

While having an LLC provides some liability protection, hiring a CPA can be beneficial. A CPA can help you navigate tax obligations and ensure compliance, especially regarding the letter CPA form for LLC. Additionally, a CPA can provide valuable financial advice tailored to your business needs.

To get a CPA letter, start by identifying a certified public accountant with a strong reputation. Request a consultation to discuss your specific needs for the Letter CPA form for LLC and share necessary documents. Once your CPA understands your situation, they will draft the letter efficiently and ensure it meets all legal standards.

While not all LLCs are required to hire a CPA, having one can significantly benefit your business. A CPA can help you accurately prepare your taxes, understand financial statements, and complete the Letter CPA form for LLC. This financial expertise can also aid in securing loans, navigating audits, and ensuring compliance with regulations.

To obtain a CPA letter, start by contacting a certified public accountant who specializes in business services. Discuss your needs regarding the Letter CPA form for LLC, and provide any necessary documentation such as financial statements. Your CPA will then prepare the letter, ensuring it meets all compliance requirements.

A CPA letter can be provided by a certified public accountant who has the necessary expertise and credentials. These professionals are licensed by the state and are qualified to prepare financial statements and letters for various purposes, including the Letter CPA form for LLC. To ensure you receive a valid document, choose a CPA with experience in your specific industry.