Bankrupting

Description

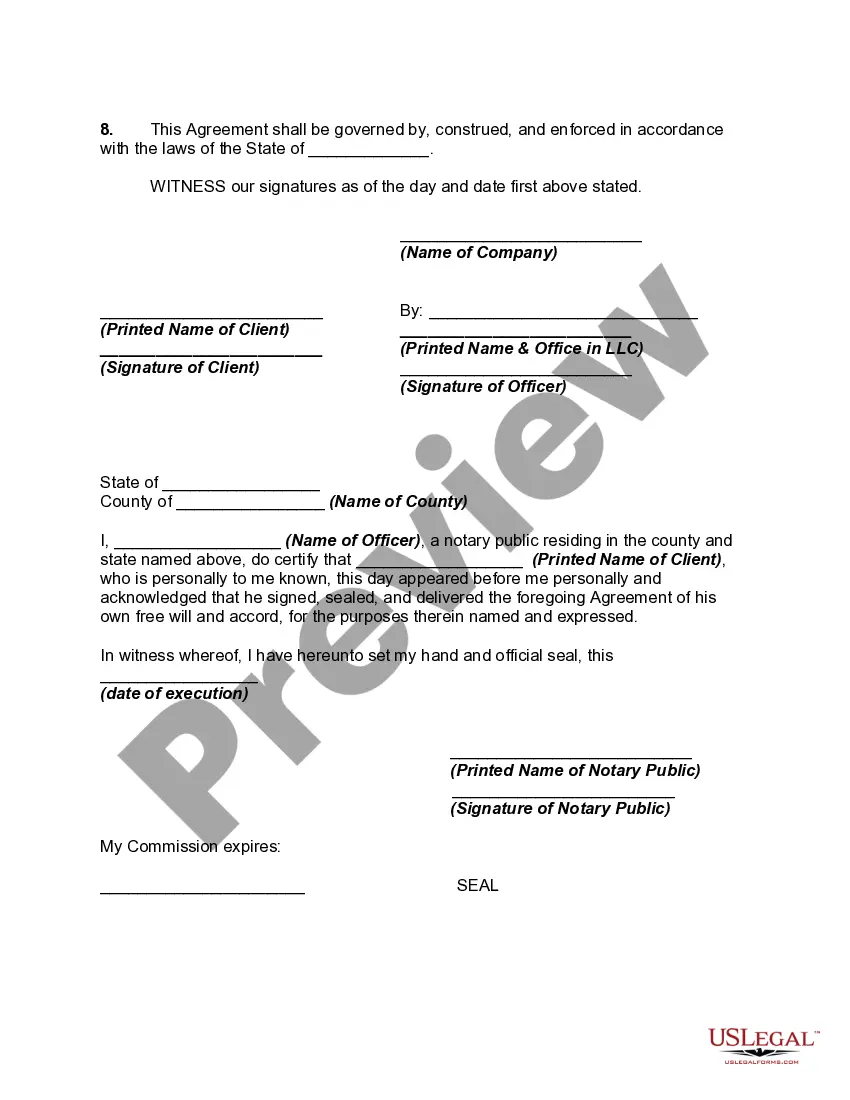

How to fill out Agreement To Attempt To Locate Unclaimed Property Of Client?

- Log into your account at US Legal Forms if you're already a user. Ensure your subscription is active; otherwise, please renew it as per your selected payment plan.

- Examine the Preview mode and review the form description thoroughly. Confirm that you have the correct template that aligns with your local jurisdiction's requirements.

- Utilize the Search tab if you need an alternative form. Finding discrepancies can help you select the perfect document for your needs.

- Purchase the selected document. Click 'Buy Now' and choose your preferred subscription plan. You will need to create an account to access the full library.

- Complete your transaction by entering your payment details, either via credit card or PayPal.

- Download your chosen form. Save it on your device for easy completion and access it later from the 'My Forms' section in your profile.

In conclusion, US Legal Forms alleviates the complexities of legal paperwork, allowing you to focus on what truly matters. By following these steps, you'll quickly obtain the necessary documents without unnecessary hassle.

Explore the wealth of legal forms available today and simplify your legal journey!

Form popularity

FAQ

A commonly used synonym for bankrupting is insolvency. When someone faces bankrupting, they may find themselves in an insolvency situation, where their liabilities surpass their assets. Recognizing the signs of insolvency early can help in taking proactive measures to address the issue. If you seek to understand bankrupting better, resources like USLegalForms can offer valuable information and support.

Bankrupting refers to the financial state where an individual or entity can no longer meet their debt obligations. This situation often leads to formal bankruptcy proceedings, which allow for the restructuring of debts or discharge of liabilities. Being bankrupting can significantly impact a person's financial future, but it can also serve as a chance for a fresh start. By understanding bankrupting, you can navigate financial challenges more effectively.

Several factors can disqualify you from filing bankrupting. For instance, if you have previously filed for bankruptcy within a certain timeframe, you may be ineligible. Moreover, if your debts do not meet specific requirements, or if you have committed bankruptcy fraud, this can also prevent you from qualifying. Understanding these factors is crucial, and using resources like US Legal Forms can help you navigate the complexities of bankruptcy filings effectively.

When looking into bankrupted under Chapter 13, your debts must fall within specific limits to qualify. Currently, unsecured debts must be less than approximately $465,275, and secured debts should not exceed around $1,395,875. This makes Chapter 13 a viable option for many individuals with varying financial situations. Using platforms like US Legal Forms can simplify the process of filing and help ensure you meet all necessary requirements.

For those considering bankrupted under Chapter 7, there's a strict debt limit to keep in mind. Currently, the unsecured debt limit is set at approximately $419,275, while secured debts have a cap of around $1,257,850. These amounts may vary, and they are adjusted regularly. Understanding these boundaries helps individuals effectively assess their eligibility and plan their approach.

While there is no strict minimum amount to file for bankrupting, practical considerations suggest having at least $1,500 in qualifying debt. This amount reflects that you have enough financial strain to merit filing. Falling below this benchmark may lead to a dismissal of your case or a judge's recommendation to pursue other options first. It’s crucial to evaluate these factors to determine your course of action.

To start the process of bankrupted, you typically need to have a significant amount of debt. This can vary, but most individuals seeking relief should have debts exceeding $15,000 to justify the need for bankruptcy. Creditors generally prefer a clear threshold, as this illustrates financial distress. If you find yourself facing overwhelming financial obligations, it's wise to consider your options carefully.

While there is no minimum debt requirement to file for bankruptcy, many individuals consider it when their debts become unmanageable. Generally, having unsecured debts, such as credit cards or medical bills, signals that bankrupting might be a suitable solution. These situations can lead to a fresh start and relief from constant creditor pressure. It's advisable to assess your entire financial picture before making a decision.

The assets you lose in bankruptcy depend on the type of bankruptcy you file. In general, high-value items such as vehicles, investment properties, or second homes may be sold to repay creditors. However, many individuals file for bankruptcy and retain important assets under state exemptions. Consulting with an expert on bankrupting can help you clarify what you can protect.

Declaring bankruptcy can significantly impact your financial future. It can stay on your credit report for several years, making it harder to secure loans or credit in the future. Additionally, you may face limitations on obtaining certain financial products. It’s important to weigh these consequences when considering bankruptcy as an option for your financial relief.