Attempt Unclaimed Property For Tax Purposes

Description

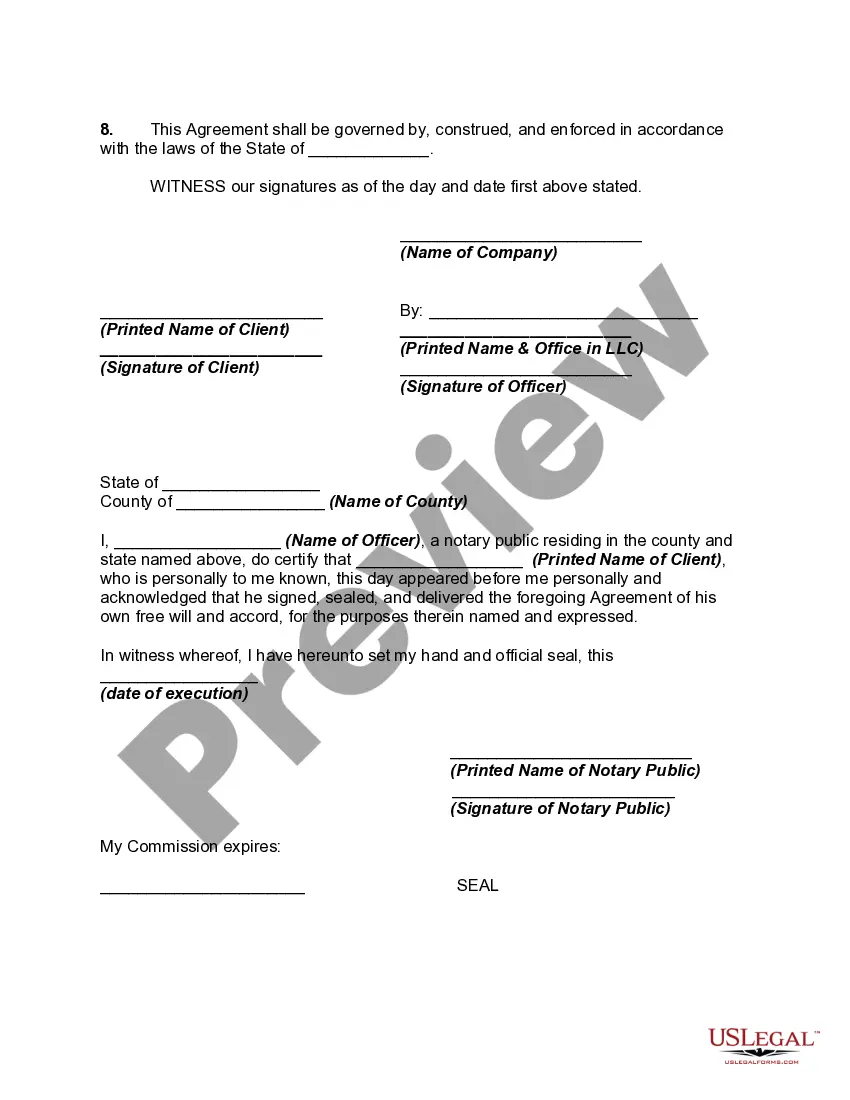

How to fill out Agreement To Attempt To Locate Unclaimed Property Of Client?

- Log in to your existing account on the US Legal Forms website. Ensure your subscription is active; renew if necessary.

- Review the form preview and description carefully to confirm it fits your needs and adheres to local regulations.

- If the current form does not meet your requirements, utilize the search functionality to find an alternative.

- Select the necessary document and hit the Buy Now button to proceed with your purchase.

- Provide your payment information or use your PayPal account to finalize the subscription.

- Download the form onto your device for easy access and completion. You can find it anytime under 'My Forms' in your account.

By following these steps, you can ensure that your legal documentation for unclaimed property is correct and efficiently managed.

US Legal Forms empowers you to navigate legal processes seamlessly. Start exploring their collection today and make legal compliance easier!

Form popularity

FAQ

When you attempt unclaimed property for tax purposes, you may wonder about the tax implications. In most cases, claiming unclaimed property is considered taxable income. Therefore, it’s essential to track these funds closely, ensuring you comply with tax laws and accurately report them. Using US Legal Forms can simplify your experience by providing the essential tools and information needed for a smooth process.

Yes, when you attempt unclaimed property for tax purposes, it's important to understand the IRS regulations. Generally, if you receive unclaimed funds, the IRS expects you to report these amounts as income. This means keeping accurate records of any unclaimed funds you obtain to properly declare them on your tax return. We recommend using resources like US Legal Forms to guide you through the reporting process.

To determine if property was left to you, start by checking probate records in the relevant county. You can also contact relatives or the estate executor for details. Platforms like USLegalForms can assist you in navigating these inquiries more easily, helping you effectively attempt unclaimed property for tax purposes.

If unclaimed property remains unclaimed, it typically escheats to the state after a specified period. The state then holds the property in trust for rightful owners, which means it may still be possible to claim it later. Therefore, it is wise to routinely attempt unclaimed property for tax purposes, ensuring you do not miss out on potentially beneficial assets.

The most common types of unclaimed property include forgotten bank accounts, uncashed checks, and unclaimed insurance benefits. Many individuals are also unaware of securities or dividend payments waiting for claim. When you attempt unclaimed property for tax purposes, you might discover surprising assets that can enhance your financial standing.

To claim unclaimed property in California, you need valid identification, such as a driver's license or government-issued ID. You should also gather any relevant documents that prove your ownership, like bank statements or property titles. By following these steps, you can successfully attempt unclaimed property for tax purposes with confidence.

To obtain a list of unclaimed property, start by visiting your state's unclaimed property website. You can search for properties using your name or business name. Additionally, online resources like USLegalForms can help streamline this process. By utilizing these tools, you can efficiently attempt unclaimed property for tax purposes.

When you file a claim for unclaimed property, the state agency reviews your submission for accuracy and legitimacy. You may need to provide identification and proof of ownership before the claim is approved. Once verified, the agency will process your claim and release the funds to you. To streamline this process, consider using US Legal Forms, which offers resources to help you effectively navigate your claim.

Generally, unclaimed property does not count as taxable income when you reclaim it. However, if you earned interest or income from the property, that amount may be subject to taxation by the IRS. Therefore, when you attempt unclaimed property for tax purposes, consult a tax professional to understand any implications. Proper planning can help you ensure compliance with tax obligations.

In Minnesota, unclaimed property consists of assets that remain unclaimed by their owners for a specific period, typically three to five years, depending on the type of property. To attempt unclaimed property for tax purposes, you should file a claim with the Minnesota Department of Commerce. They provide guidelines on how to reclaim these assets and emphasize the importance of diligent record-keeping. Engaging with the US Legal Forms platform can help simplify the entire process.