Motion To Avoid Lien Form For Mortgage Loan

Description

How to fill out Motion To Avoid Creditor's Lien?

Dealing with legal documents and procedures can be a lengthy addition to your entire day. Motion To Avoid Lien Form For Mortgage Loan and similar forms frequently necessitate you to look for them and comprehend how to fill them out correctly.

As a result, whether you are managing financial, legal, or personal issues, having a comprehensive and user-friendly online library of forms readily available will significantly help.

US Legal Forms is the premier online platform for legal templates, boasting over 85,000 state-specific documents and numerous resources that will enable you to complete your paperwork with ease.

Explore the collection of relevant documents accessible to you with just one click.

Then, follow the instructions below to complete your form: Ensure you have found the correct form using the Preview feature and reviewing the form details. Select Buy Now when ready, and choose the subscription plan that suits you best. Click Download and then fill out, sign, and print the form. US Legal Forms has 25 years of experience helping users manage their legal documents. Find the form you need today and streamline any process effortlessly.

- US Legal Forms provides state- and county-specific forms available for download at any time.

- Safeguard your document management processes with superior support that allows you to create any form in minutes without extra or concealed charges.

- Simply Log In to your account, locate Motion To Avoid Lien Form For Mortgage Loan, and download it immediately from the My documents section.

- You can also access previously downloaded forms.

- Is this your first time using US Legal Forms? Register and establish your account in a few minutes, and you will gain access to the form library and Motion To Avoid Lien Form For Mortgage Loan.

Form popularity

FAQ

What Is a Motion to Avoid a Judicial Lien in Bankruptcy? A Motion to Avoid Judicial Lien is a motion your bankruptcy attorney can file in bankruptcy court to remove an involuntary judgment lien from your house or other property after you have completed bankruptcy.

? Lien avoidance protects an individual debtor's. right to exempt property. ? A debtor can avoid judicial liens and non- possessory, non-purchase money security. interests in household goods (?NPMSIs?) to the extent that the lien or NPMSI ?impairs? the debtor's exemption in the property.

Yes, a lien may be placed on property that is jointly owned. However, the effects of that lien depend on the type of ownership that the property is under. Before discussing the terms of joint ownership, it's important that you understand exactly what liens are and what they may mean for you and your investment.

Filing for bankruptcy can eliminate your second mortgage debt. If an appraiser determines the value of your home is less than your first mortgage, or is upside down, Chapter 13 lien stripping may be possible. The bankruptcy court essentially converts your second mortgage into an unsecured debt.

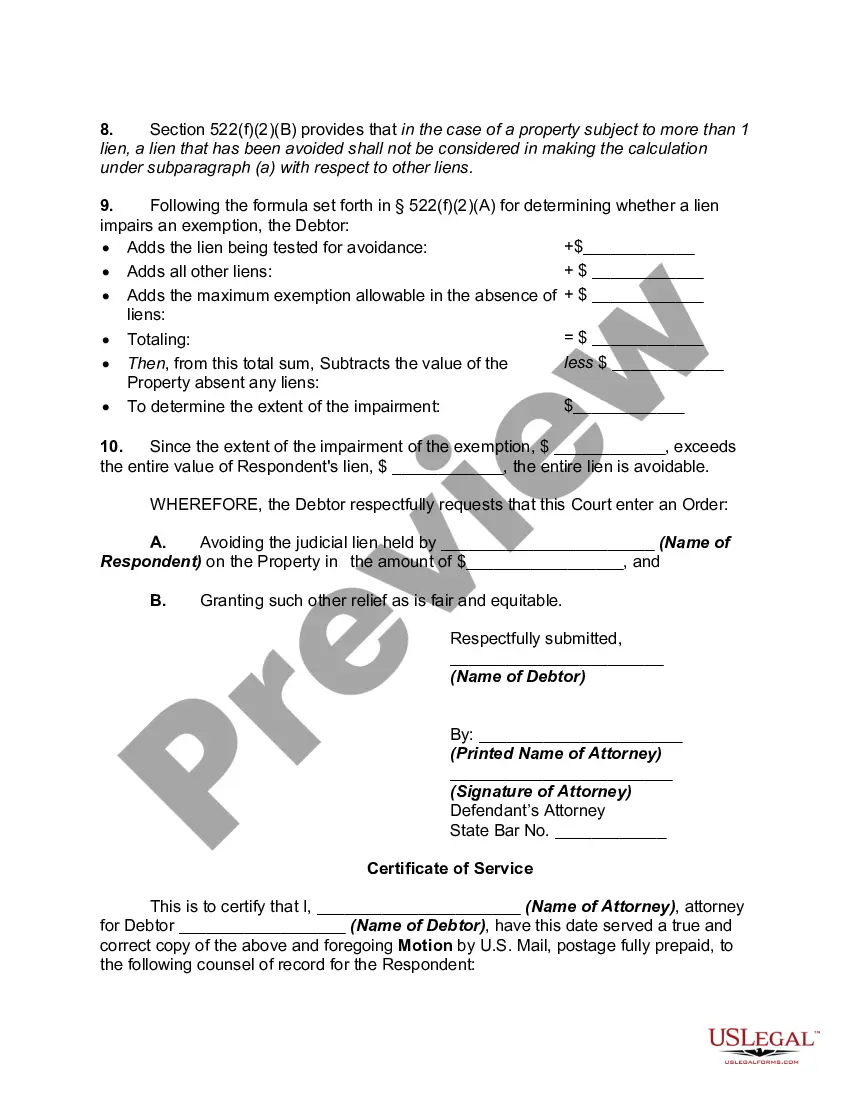

In order to avoid a lien under § 522(f), the debtor must show: (1) that he has an interest in the homestead property; (2) he is entitled to a homestead exemption; (3) the asserted lien impairs that exemption; and (4) the lien is a judicial lien.