11 Usc Definitions

Description

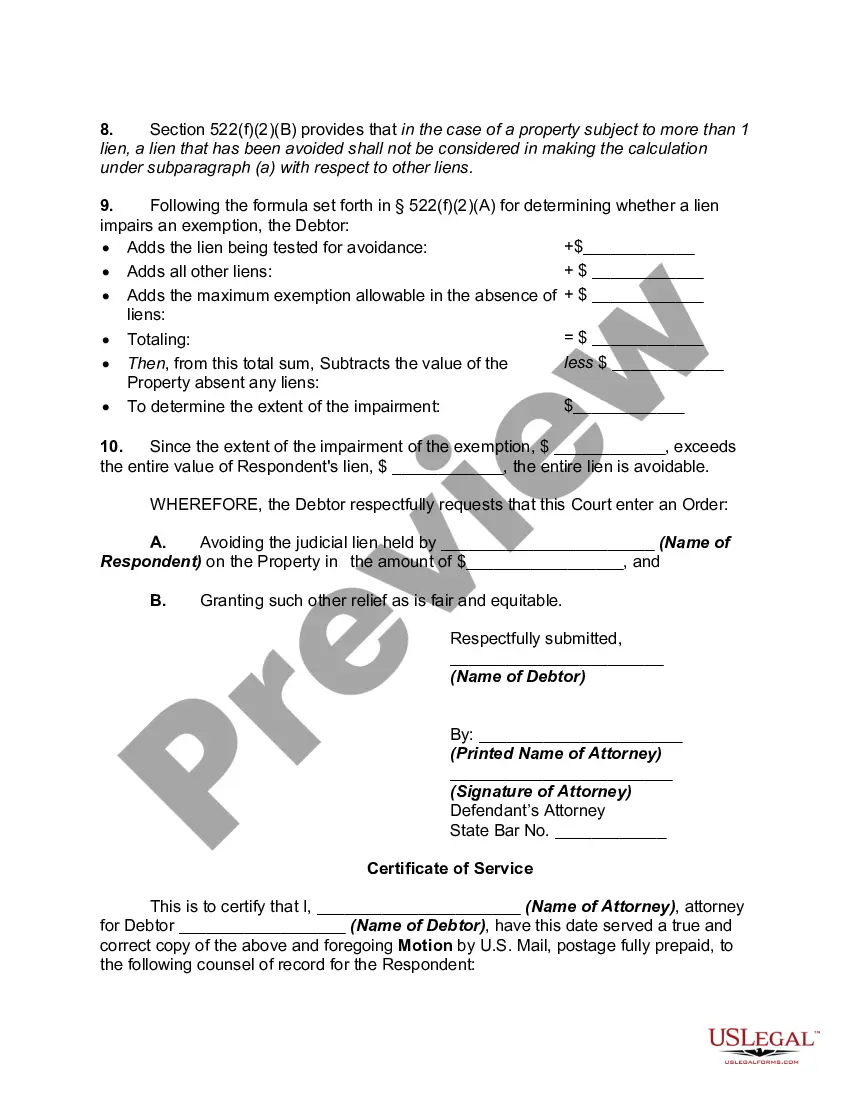

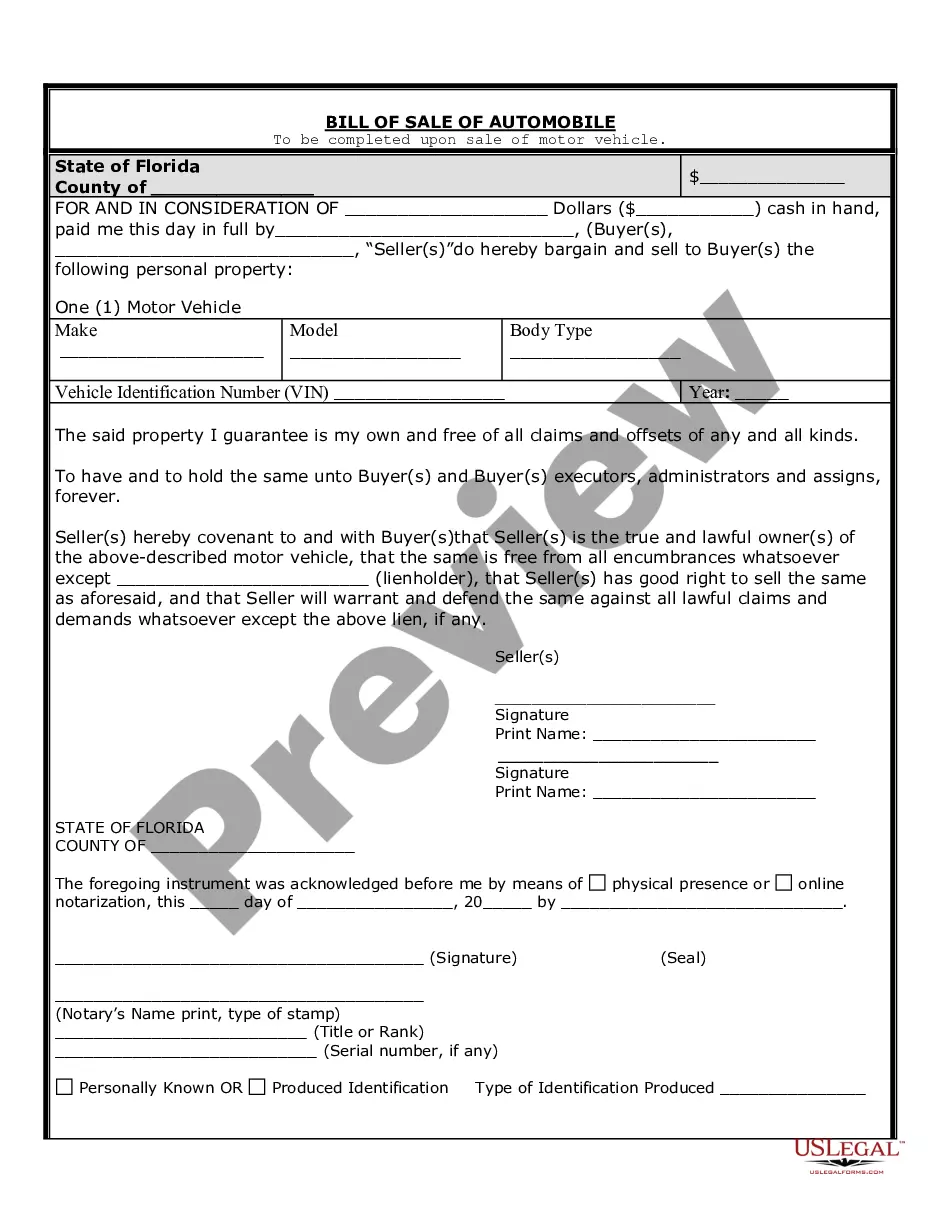

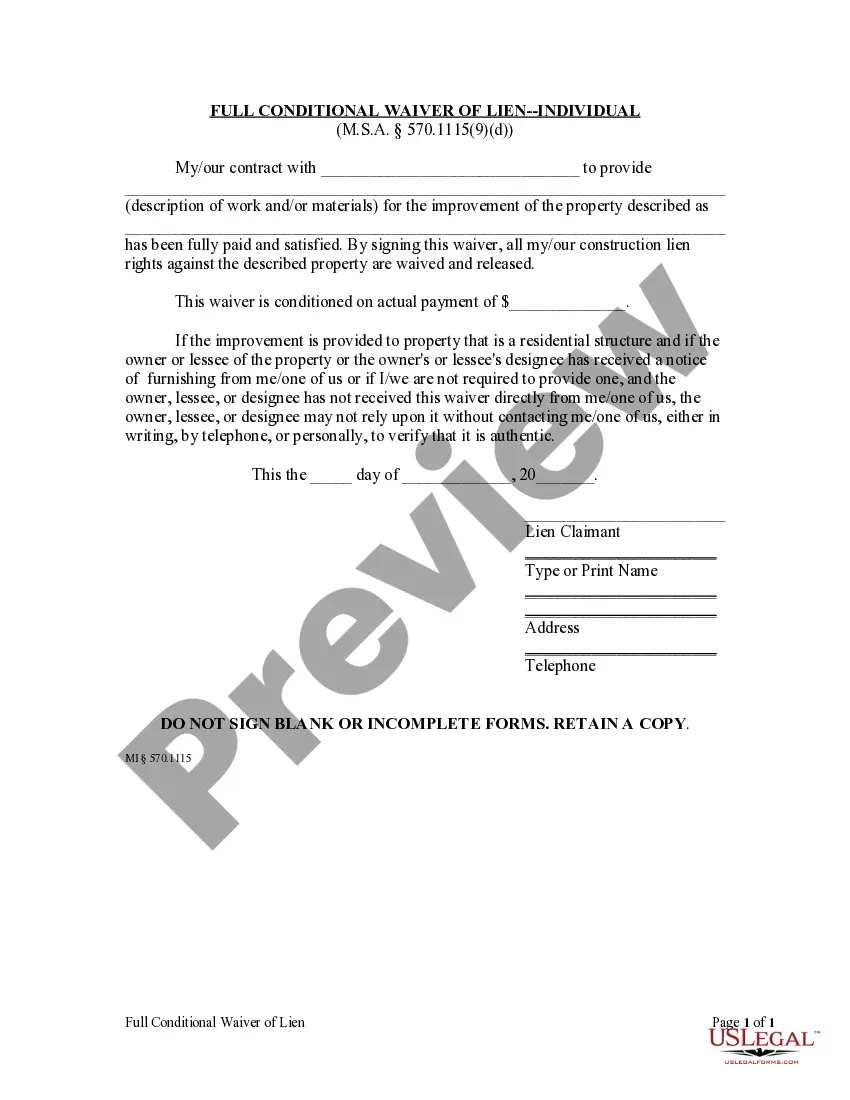

How to fill out Motion To Avoid Creditor's Lien?

Accessing legal document samples that meet the federal and regional regulations is a matter of necessity, and the internet offers a lot of options to pick from. But what’s the point in wasting time looking for the correctly drafted 11 Usc Definitions sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the biggest online legal catalog with over 85,000 fillable templates drafted by attorneys for any professional and life case. They are simple to browse with all documents arranged by state and purpose of use. Our specialists keep up with legislative changes, so you can always be confident your paperwork is up to date and compliant when acquiring a 11 Usc Definitions from our website.

Obtaining a 11 Usc Definitions is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the preferred format. If you are new to our website, adhere to the steps below:

- Examine the template utilizing the Preview option or through the text description to ensure it meets your needs.

- Locate another sample utilizing the search tool at the top of the page if needed.

- Click Buy Now when you’ve located the right form and opt for a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your 11 Usc Definitions and download it.

All templates you locate through US Legal Forms are reusable. To re-download and complete earlier purchased forms, open the My Forms tab in your profile. Take advantage of the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

Secured creditors are first in line, as their claims over assets are often secured by collateral and a contract. Some assets may have multiple liens placed upon them; in these cases, the first lien has priority over the second lien.

What Are the Disadvantages of Filing Chapter 11? Chapter 11 bankruptcy is the most complex of all bankruptcy types. It is also usually the most expensive. For a company that is struggling to the point where it is considering filing for bankruptcy, the legal costs alone might be onerous.

Unlike other types of consumer bankruptcy, Chapter 11 bankruptcy does not strictly define what will happen to debts. Certain types of debts (such as student loans, unpaid child support, and unpaid taxes) are not dischargeable, so if these are part of the bankruptcy, the plan must include a way to pay those back.

Under Chapter 11 procedures, Secured Creditors will receive payment before the next class of Creditors?those with unsecured claims. Secured claims can be oversecured, meaning the collateral is worth more than the debt, or undersecured, meaning the debt is worth more than the value of the collateral.

Chapter 1: General Provisions. Chapter 3: Case Administration. Chapter 5: Creditors, the Debtor and the Estate. Chapter 7: Liquidation.