Spouse Surviving State Without Permission

Description

How to fill out Waiver Of Right To Election By Spouse?

Accessing legal documents that comply with federal and state regulations is essential, and the internet provides numerous choices.

However, why spend time searching for the appropriate Spouse Surviving State Without Permission example online when the US Legal Forms digital library has gathered such documents in one location.

US Legal Forms is the largest online legal resource with over 85,000 fillable documents created by lawyers for any business and personal scenario. They are simple to navigate with all files organized by state and intended use. Our specialists stay updated with legal modifications, so you can always trust that your form is current and compliant when obtaining a Spouse Surviving State Without Permission from our site.

Press Buy Now once you’ve located the appropriate form and select a subscription plan. Create an account or Log In and complete your payment with PayPal or a credit card. Choose the format for your Spouse Surviving State Without Permission and download it. All files you find through US Legal Forms are reusable. To re-download and complete forms you have previously acquired, access the My documents tab in your account. Enjoy the most comprehensive and user-friendly legal documents service!

- Acquiring a Spouse Surviving State Without Permission is swift and straightforward for both existing and new users.

- If you have an account with an active subscription, Log In and download the document you need in the correct format.

- If you are new to our platform, follow these steps.

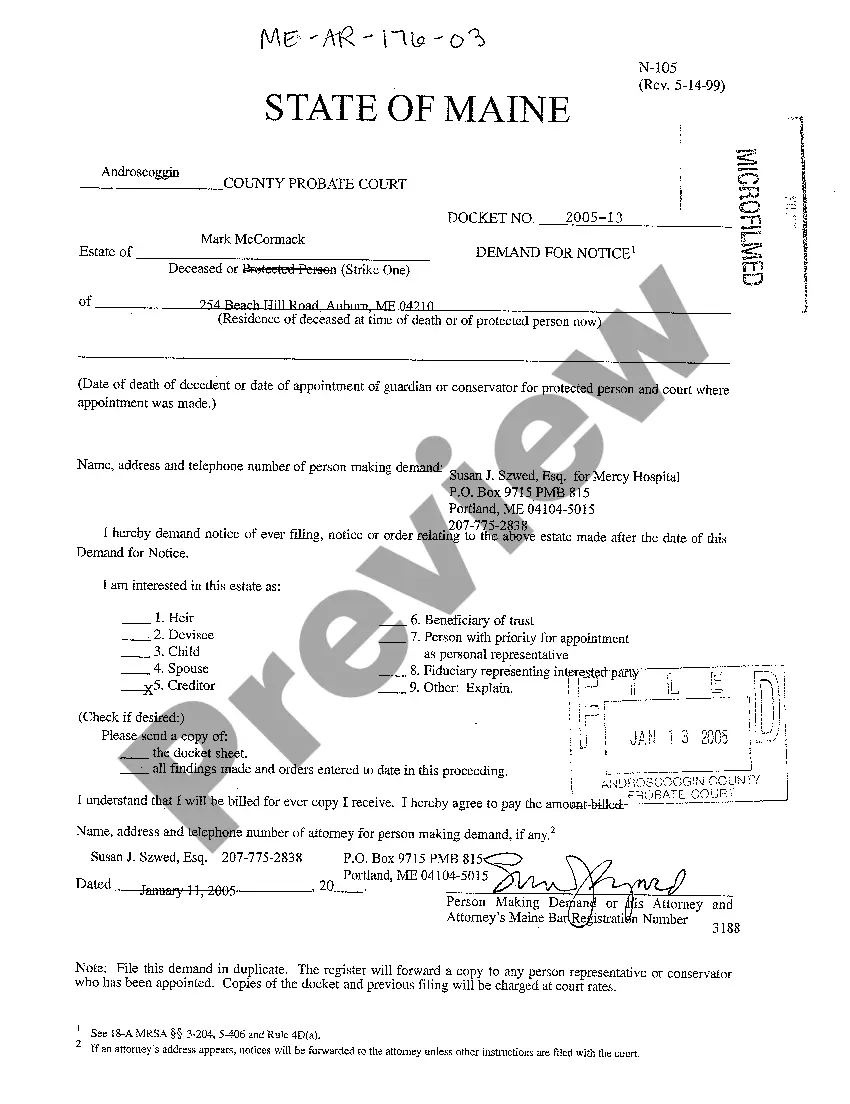

- Review the template using the Preview option or through the text description to confirm it satisfies your needs.

- Search for another example using the search tool at the top of the page if required.

Form popularity

FAQ

In our example, if the husband had a will then the house would pass to whomever is to receive his assets pursuant to that will. That may very well be his wife, even if her name is not on the title. If he dies without a will, state laws will determine who is entitled to the home.

Right of Survivorship Deeds If the title of a certain piece of property has it designated as community property with right of survivorship, the surviving spouse will inherit the property upon the death of their partner without the property having to pass through the probate process.

The IRS considers the surviving spouse married for the full year their spouse died if they don't remarry during that year. The surviving spouse is eligible to use filing status "married filing jointly" or "married filing separately." The same tax deadlines apply for final returns.

In California, a community property state, the surviving spouse is entitled to at least one-half of any property or wealth accumulated during the marriage (i.e. community property), absent a pre-nuptial or post-nuptial agreement that states otherwise.

Unless someone co-signed the loan or is a co-borrower with you, nobody is required to take on the mortgage. However, if the person who inherits the home decides they want to keep it and take over responsibility for the mortgage, there are laws in place that allow them to do so.