Distribution Estate Form For Texas

Description

How to fill out Petition For Partial And Early Distribution Of Estate?

Whether for commercial reasons or personal matters, everyone must handle legal issues at some stage in their life.

Completing legal documents requires meticulous focus, beginning with choosing the correct form template. For example, if you select an incorrect version of a Distribution Estate Form For Texas, it will be rejected upon submission. Thus, it is crucial to obtain a reliable source of legal forms such as US Legal Forms.

With a vast US Legal Forms catalog available, you will never need to waste time searching for the correct template online. Utilize the library’s easy navigation to find the right form for any circumstance.

- Obtain the template you require by utilizing the search bar or browsing the catalog.

- Review the form’s details to verify it aligns with your situation, state, and locality.

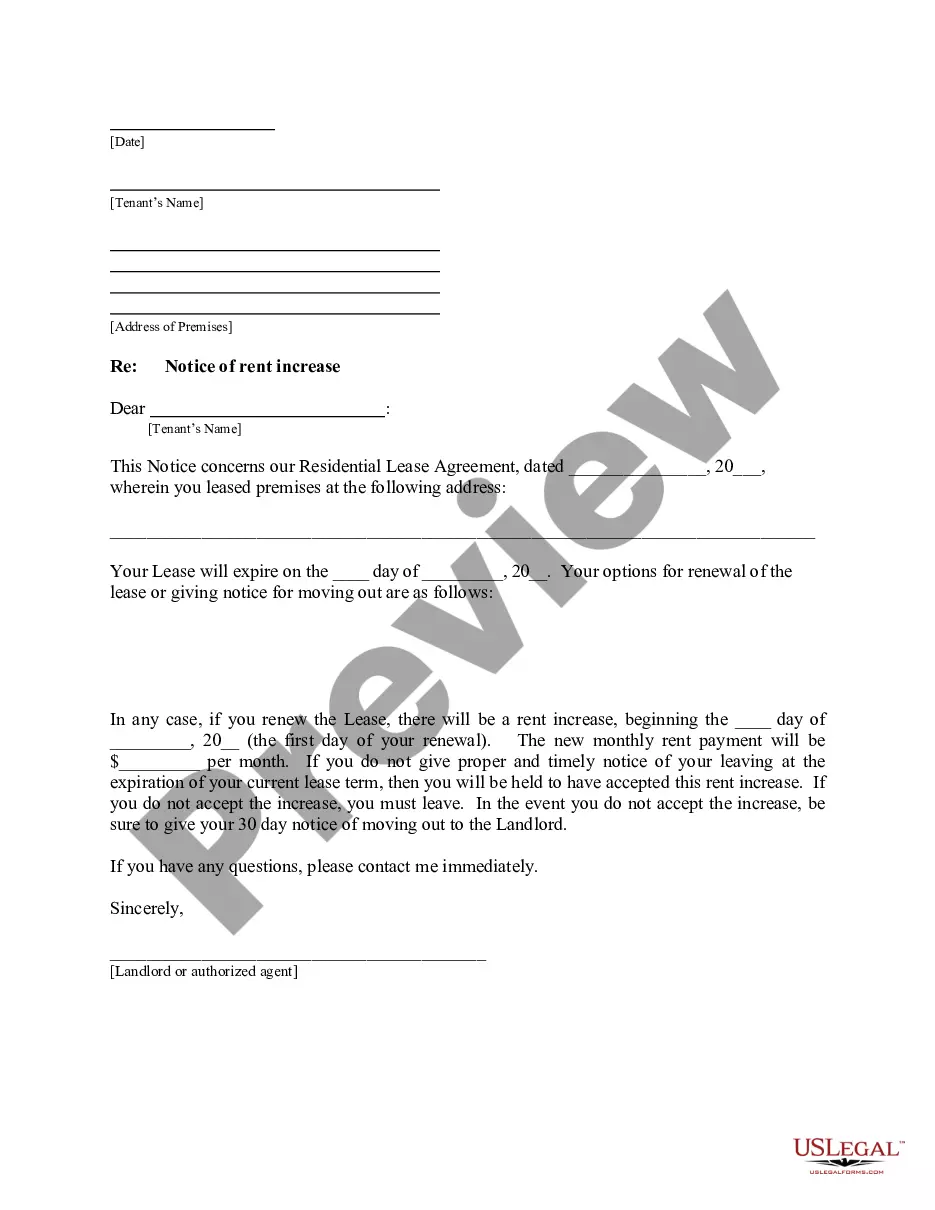

- Click on the form’s preview to inspect it.

- If it is the incorrect document, return to the search option to locate the Distribution Estate Form For Texas sample you need.

- Download the template once it meets your requirements.

- If you possess a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- If you do not have an account yet, you can acquire the form by clicking Buy now.

- Choose the appropriate pricing option.

- Fill out the profile registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the document format you desire and download the Distribution Estate Form For Texas.

- After it is downloaded, you can complete the form using editing software or print it out and fill it in manually.

Form popularity

FAQ

In Texas, if the value of an estate exceeds $75,000, a full probate administration is typically required. This threshold, as stated in the Texas Estates Code, includes the total value of the estate's assets, excluding homestead and exempt property.

The executor generally has three years after their appointment to distribute the remaining assets (after debts and disputes are resolved). The Texas probate process can be fairly simple in most cases.

If the deceased property owner had a Will stating who the property should be transferred to, the Will should be filed for Probate within 4 years of the date of death. The property may subsequently be transferred or sold by the Executor named in the Will ing to the wishes of the deceased owner.

In Texas, if the value of an estate exceeds $75,000, a full probate administration is typically required. This threshold, as stated in the Texas Estates Code, includes the total value of the estate's assets, excluding homestead and exempt property.

An Executor's Deed in Texas is used to transfer real property from the estate of a deceased property owner to the heir or heirs designated in their Will. It is signed by a court appointed Executor, who is the person named in a will to execute the terms of a Will.