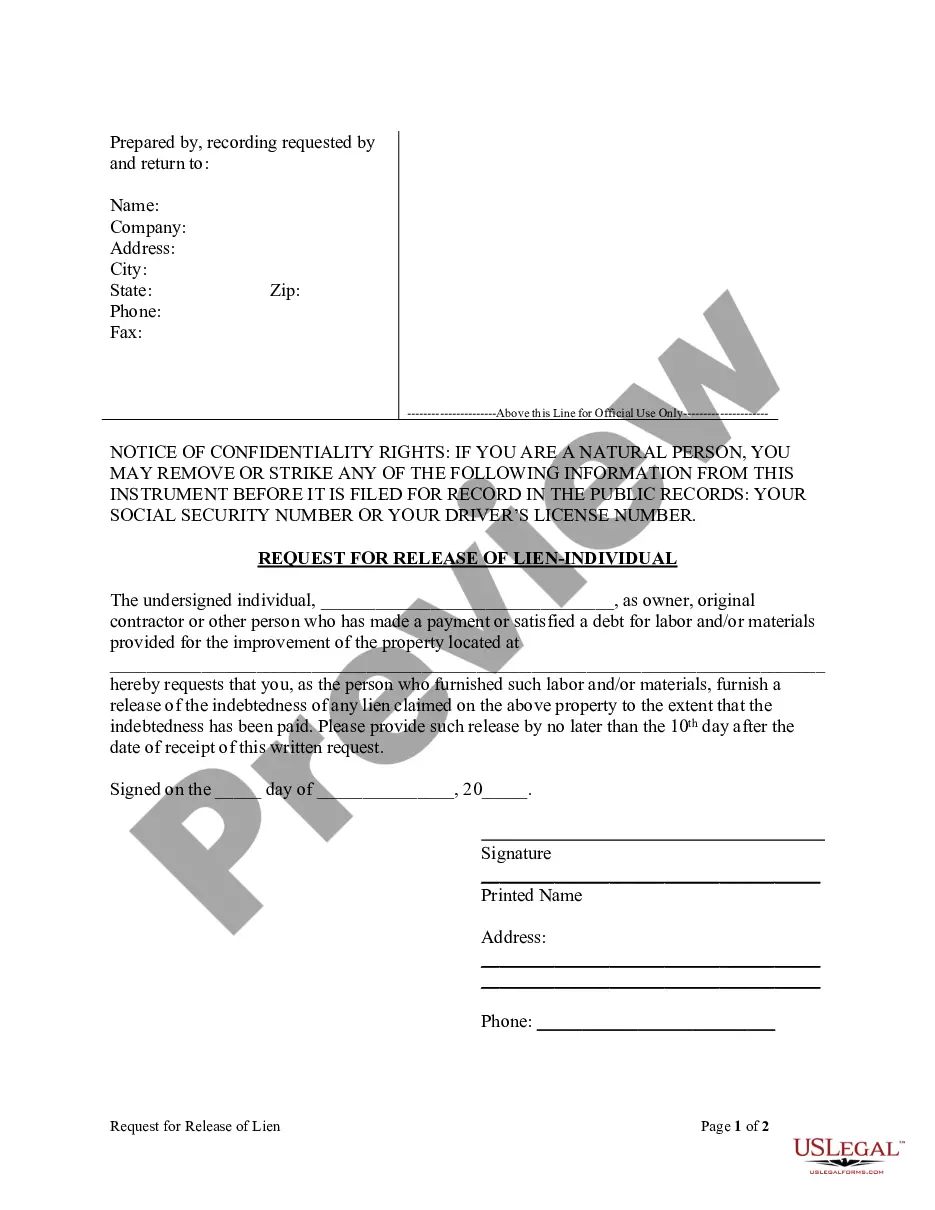

Distribution Estate Form Document Without Comments

Description

How to fill out Petition For Partial And Early Distribution Of Estate?

It’s well-known that you cannot transform into a legal authority instantly, nor can you swiftly learn how to draft a Distribution Estate Form Document Without Comments without a particular expertise.

Assembling legal paperwork is a lengthy process that demands specialized education and abilities. So why not entrust the creation of the Distribution Estate Form Document Without Comments to the professionals.

With US Legal Forms, one of the largest legal document repositories, you can discover everything from judicial documents to formats for internal corporate communication. We recognize the significance of compliance and observance of federal and state regulations.

Click Buy now. Once the transaction is completed, you can download the Distribution Estate Form Document Without Comments, fill it out, print it, and send or mail it to the relevant individuals or organizations.

You can regain access to your documents from the My documents tab at any time. If you’re a current customer, you can just Log In, and find and download the template from the same tab.

- Here’s how to begin using our platform and obtain the document you require in just a few minutes.

- Locate the document you need by utilizing the search bar at the top of the page.

- Preview it (if this option is available) and review the accompanying description to ascertain whether the Distribution Estate Form Document Without Comments is what you’re looking for.

- Restart your search if you require any additional template.

- Create a free account and choose a subscription plan to acquire the form.

Form popularity

FAQ

Per stirpes. One of the simplest strategies for asset distribution among heirs, this method requires that the estate be divided equally among each branch of the family. So, if an heir (a child) should pass away before the parents, their share would be passed along in equal shares to their heirs (the grandchildren).

This is when courts transfer the ownership of assets to beneficiaries or heirs. The final distribution only occurs when the estate is settled, meaning all creditors and taxes have been paid, all disputes have been resolved, and the judge gives final approval.

In its most basic form, a last will and testament is a legal document in which you express your wishes as to how your property will be distributed after your death. A will lets you control what happens to your property and affairs.

Report income distributions to beneficiaries and to the IRS on Schedule K-1 (Form 1041). For calendar year estates and trusts, file Form 1041 and Schedule(s) K-1 on or before April 15 of the following year.

Typically, the easiest solution to these problems is to sell the family home and divide the proceeds equally amongst the heirs. So long as the property is not underwater in debt, selling the house will give each heir their share of the inheritance and prevent further squabbles.