Supplemental Needs Trust Account

Description

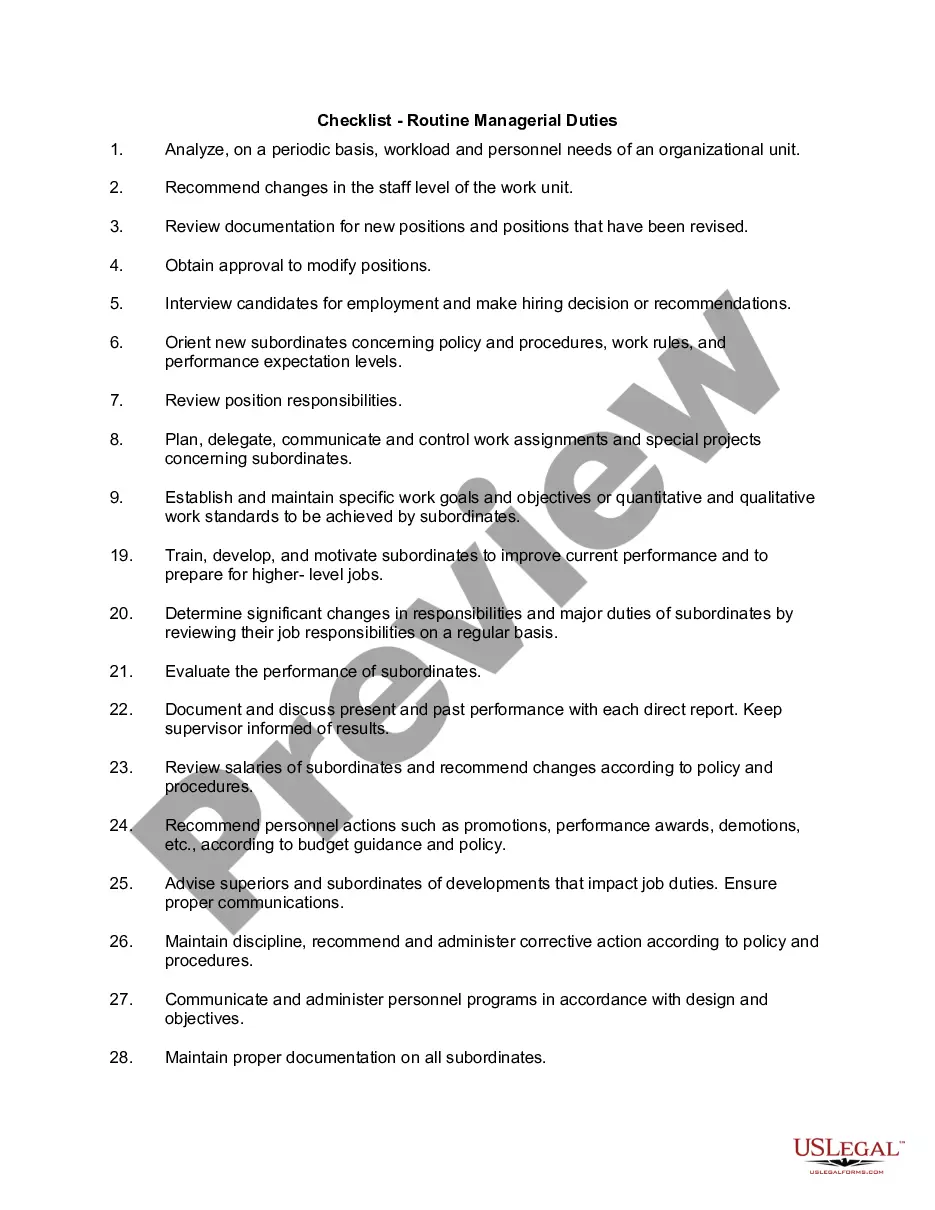

How to fill out Supplemental Needs Trust For Third Party - Disabled Beneficiary?

- If you're a returning user, log into your account and download the required form by selecting the 'Download' button. Ensure your subscription is active; if it has lapsed, renew as required.

- For first-time users, start by exploring the Preview mode and form description to ensure the document aligns with your needs and complies with your local jurisdiction.

- If the initial document isn't suitable, utilize the Search tab to find a more appropriate template that fits your requirements.

- Once you've selected the right document, click 'Buy Now' and choose the subscription plan that best suits you. You'll need to create an account to access the vast library.

- Complete your purchase by entering your credit card information or using your PayPal account to finalize the subscription.

- Download your form and save it on your device. You'll also find it accessible in the My Forms section of your profile when you need it later.

US Legal Forms stands out with its impressive collection of over 85,000 legal forms, ensuring users have access to more options at a competitive price.

With the availability of expert assistance for form completion, you can be confident that your documents are both accurate and legally sound. Start your journey today and secure your supplemental needs trust account with US Legal Forms!

Form popularity

FAQ

In a supplemental needs trust, the trust itself is a separate legal entity, which means it does not have a single owner in the traditional sense. Instead, the grantor creates the trust, and the appointed trustee manages the supplemental needs trust account for the benefit of the named beneficiary. This structure helps ensure that the beneficiary receives the best possible support without affecting their eligibility for necessary benefits.

While many use the terms interchangeably, a supplemental needs trust and a special needs trust may have slight variations. Both are designed to benefit individuals with disabilities, allowing them to receive funds without losing government benefits. Ultimately, both concepts help ensure that the supplemental needs trust account serves its purpose effectively.

Establishing a supplemental needs trust involves several key steps. First, you should consult with an attorney who specializes in trust creation to ensure compliance with legal requirements. Next, you will need to draft the trust document, specify the terms, and designate a trustee to manage the supplemental needs trust account, ensuring your loved one receives the intended support.

The grantor of a supplemental needs trust is typically the individual who creates the trust. This person sets the terms and conditions that govern how the supplemental needs trust account will operate. Often, the grantor is a parent or guardian seeking to provide financial support for a child or dependent with disabilities while preserving their eligibility for government benefits.

To set up a trust fund for a special needs child, begin by consulting with a legal professional who specializes in trust and estate planning. The attorney can help you create a supplemental needs trust account tailored to your child's specific circumstances and ensure compliance with legal requirements. Additionally, you’ll need to decide on the source of funding and establish a plan for the trustee to manage the trust effectively.

While a special needs trust can be beneficial, there are some disadvantages to consider. Establishing a trust requires careful planning and legal assistance, which can be costly. Additionally, if the trust is not set up correctly, it may interfere with eligibility for benefits or lead to complications in fund disbursement from the supplemental needs trust account.

A supplemental needs trust account works by holding assets that can be used for the benefit of an individual with disabilities. The trust is funded by family members, friends, or other sources, and the trustee manages the funds according to specific guidelines. Importantly, the funds in a supplemental needs trust account do not count against the beneficiary's resource limit for government assistance programs.

The purpose of a supplemental needs trust account is to enhance the quality of life for individuals with disabilities without affecting their eligibility for government benefits. This type of trust provides financial support for additional needs such as education, healthcare, and recreational activities. By using a supplemental needs trust account, you can ensure that funds are available for your loved one's unique needs while safeguarding essential benefits.

A supplemental needs trust account is a special type of trust designed to benefit individuals with disabilities without affecting their eligibility for government assistance programs. This account allows for the management and disbursement of funds for additional care and services that enhance the beneficiary's quality of life. By setting up a supplemental needs trust account, you ensure that your loved one has access to extra support while still receiving essential benefits like Medicaid and Social Security. If you need assistance creating one, US Legal Forms provides resources and forms to help you navigate the process effectively.

One significant mistake parents make is not consulting legal experts when setting up a trust fund. Without proper guidance, they may unintentionally create a supplemental needs trust account that doesn’t protect their child’s benefits. Additionally, overlooking the necessary legal language can lead to complications in the future. Investing time in legal advice can save families from costly errors.