401k Beneficiary Form With Example

Description

How to fill out Supplemental Needs Trust For Third Party - Disabled Beneficiary?

Managing legal documents can be exasperating, even for seasoned professionals.

When you are in need of a 401k Beneficiary Form With Example and lack the time to search for the right and current version, the experience can be overwhelming.

Leverage a repository of articles, guides, and resources pertinent to your circumstances and needs.

Save time and effort searching for the documents you require, and use US Legal Forms' sophisticated search and Review feature to find the 401k Beneficiary Form With Example and obtain it.

Enjoy the advantages of the US Legal Forms online catalog, supported by 25 years of expertise and dependability. Streamline your document management into a seamless and user-friendly experience today.

- If you have a monthly subscription, Log In to your US Legal Forms account, look for the form, and retrieve it.

- Visit the My documents section to view the documents you've saved and manage your folders as desired.

- If it's your initial experience with US Legal Forms, create a free account and gain unlimited access to all the platform's benefits.

- Here are the steps to take after locating the desired form.

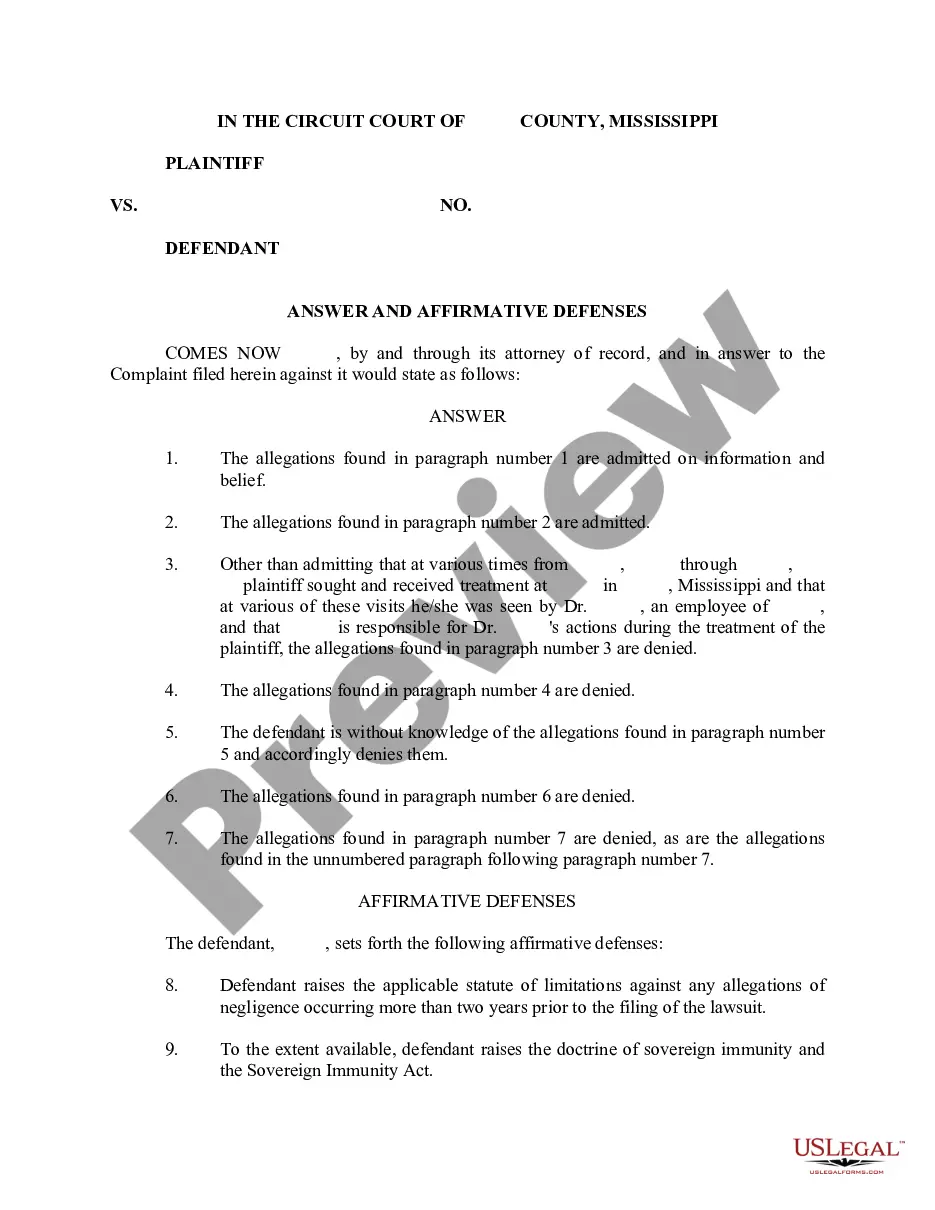

- Confirm it is the correct form by previewing it and examining its details.

- Access state- or county-specific legal and business documents.

- US Legal Forms meets all your requirements, from personal to business documentation, all in one location.

- Utilize cutting-edge tools to complete and manage your 401k Beneficiary Form With Example.

Form popularity

FAQ

Write the names of the first beneficiary(ies) you would like to receive your benefit after you die. You may name an individual(s), entity (such as a charity, business, religious organization, funeral home, etc.), trust, or estate. You may name more than one.

A primary beneficiary is the first person you name to receive the proceeds from your insurance policy upon your death. You can designate 100% of the proceeds to one primary beneficiary or you can divide the proceeds among multiple primary beneficiaries.

If you decide to have more than one beneficiary, you will allocate a percentage of the death benefit for each, so that the total allocation equals 100%. A simple example of this would be allocating 50% to your partner, and 25% to each of your two children, for a total of 100%.

How to name a beneficiary on your 401(k) account. If you name a person as your beneficiary, you should provide their full legal name, mailing address, date of birth, and Social Security number. You may also be asked to explain their relationship to you.

Spouse, partner, children, parents, brothers and sisters, business partner, key employee, trust and charitable organization.