Lessor Lessee Or Without Contrast

Description

How to fill out Notice By Lessee To Lessor Of Exercise Of Option To Purchase?

Locating a reliable source for accessing the most up-to-date and pertinent legal templates is a significant part of managing bureaucracy.

Selecting the appropriate legal documents requires accuracy and meticulousness, which is why it is crucial to obtain samples of Lessor Lessee Or Without Contrast exclusively from trustworthy providers, such as US Legal Forms.

Eliminate the stress associated with your legal documentation. Explore the extensive US Legal Forms catalog where you can discover legal templates, assess their relevance to your situation, and download them instantly.

- A flawed template will squander your time and delay the situation you are facing.

- With US Legal Forms, you have minimal concerns.

- You can access and verify all the details regarding the document’s applicability and relevance for your situation and within your state or county.

- Follow the outlined steps to finalize your Lessor Lessee Or Without Contrast.

- Utilize the catalog navigation or search bar to locate your sample.

- Review the form’s details to ensure it meets the standards of your state and locality.

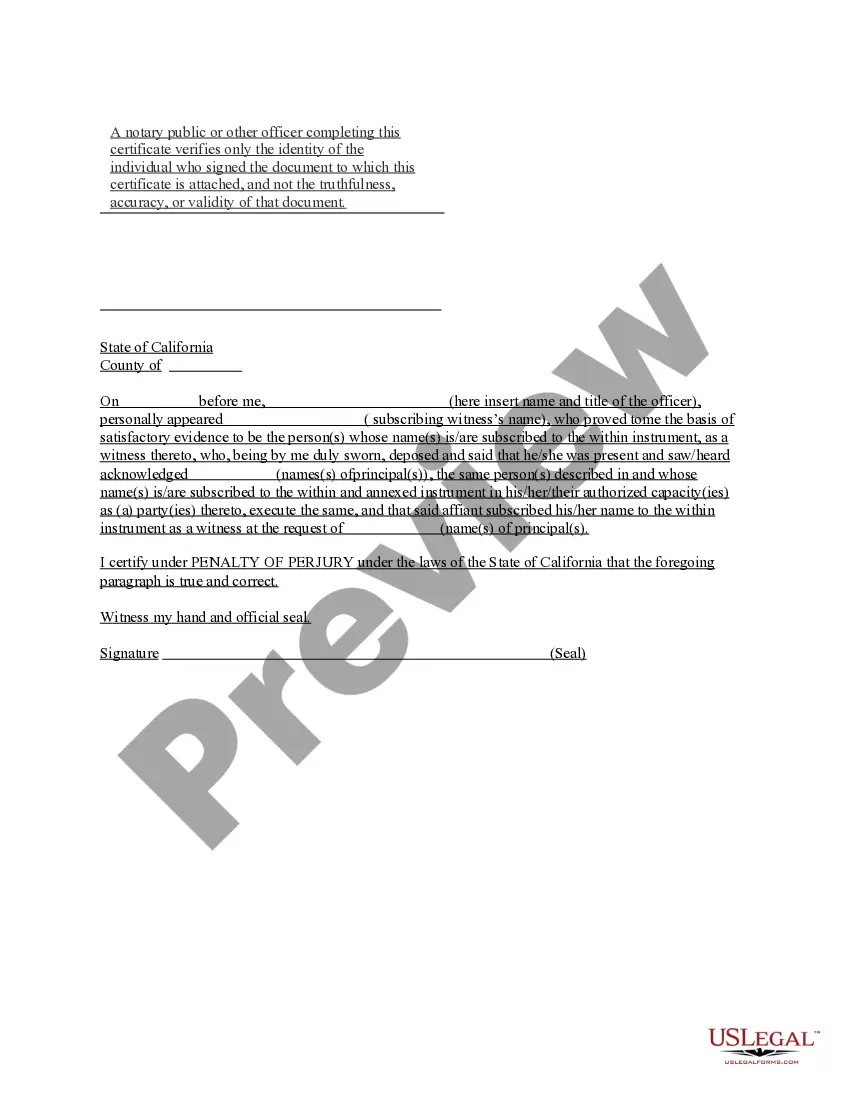

- Examine the form preview, if available, to confirm that the template is indeed the one you seek.

- Return to the search and look for the appropriate document if the Lessor Lessee Or Without Contrast does not meet your needs.

- If you are certain about the form’s applicability, download it.

- As a registered user, click Log in to verify and access your chosen templates in My documents.

- If you do not have an account yet, click Buy now to obtain the template.

- Choose the pricing option that suits your needs.

- Proceed with the registration to complete your transaction.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Lessor Lessee Or Without Contrast.

- Once you have the form on your device, you can modify it using the editor or print it out and complete it manually.

Form popularity

FAQ

When creating a lease agreement, include essential details such as the names of the lessee and lessor, property address, rental amount, and payment terms. Additionally, outline the duration of the lease, maintenance responsibilities, and rules for property use. Including these elements ensures clarity and protects both parties' interests. Our platform provides customizable templates to help you cover all necessary aspects in your lease agreement.

To determine if you are the lessee or the lessor, consider your role in the rental agreement. If you are renting property from someone else, you are the lessee. Conversely, if you own the property and are renting it out, you are the lessor. Knowing your position helps you understand your responsibilities and rights in the agreement, which is crucial for a smooth rental experience.

To fill a lease agreement form, start by entering basic information about both the lessee and lessor, including names and contact details. Next, specify the property details, lease term, rent amount, and any other relevant terms. Make sure to read through the entire agreement to understand your rights and obligations. Our platform offers user-friendly templates to simplify this process while ensuring all necessary information is included.

An example of a lessee is a person renting an apartment, while the lessor is the property owner or landlord. In this scenario, the lessee pays rent to the lessor for the right to occupy and use the property. This relationship is fundamental in rental agreements, ensuring that both parties understand their rights and obligations. Using our platform, you can easily create a lease agreement that formalizes this relationship.

The opposite of a lessee is a lessor. A lessor is the party that owns the property and grants the right to use it to the lessee. In a rental agreement, the lessor is typically the landlord, while the lessee is the tenant. Understanding this relationship helps clarify the roles and responsibilities of each party in a lease agreement.

In a leasing agreement, the lessee is responsible for paying rent to the lessor. This payment grants the lessee the right to use the leased asset for a specified time. The lessor, in turn, receives compensation for the use of their property. Understanding this relationship clarifies financial obligations between lessor and lessee or without contrast, making the leasing process more transparent.

The 90% rule in accounting pertains to lease classification. It states that if the present value of the lease payments is 90% or more of the asset's fair value, the lease qualifies as a finance lease. This classification impacts how assets and liabilities appear on financial statements, influencing financial ratios and decisions. Understanding this rule is crucial for lessor and lessee or without contrast to ensure accurate financial reporting.

In a lease agreement, the lessor is the entity that owns the asset and provides it for use to the lessee. The lessor sets the terms of the lease, including payment amounts and duration. This role is vital because it establishes the framework for the lease relationship. By knowing who the lessor is, lessees can better understand their obligations and rights in the agreement, strengthening the lessor-lessee or without contrast dynamic.

In leasing, the 90% rule refers to the requirement that the present value of lease payments must be at least 90% of the asset's fair value for the lease to be considered a finance lease. This classification affects how both the lessor and lessee report the lease on their financial statements. By understanding this rule, businesses can make informed decisions about leasing arrangements. This clarity benefits both lessor and lessee or without contrast.

The 90% lease rule states that if the present value of lease payments equals or exceeds 90% of the fair market value of the leased asset, the lease may be classified as a finance lease. This rule is essential for both lessors and lessees to determine how to account for the lease on financial statements. By adhering to this rule, companies ensure compliance with accounting standards. Understanding the 90% lease rule helps clarify the financial implications for lessor and lessee or without contrast.