Term Sheet For Debt Financing

Description

How to fill out Sample Checklist For Contract Term Sheet?

- If you're a returning user, log in to your account and check for your desired term sheet. Download it by clicking the 'Download' button.

- If you’re new to US Legal Forms, begin by reviewing the available documents in Preview mode. Ensure the selected term sheet aligns with your needs and local legal requirements.

- If your initial selection does not meet your criteria, utilize the Search tab to find an alternative template that is suitable.

- Once you've finalized the appropriate document, click the 'Buy Now' button and select your preferred subscription plan. You will need to create an account to access the full library.

- Proceed to checkout by entering your payment information, either via credit card or PayPal, to finalize your subscription.

- After your purchase, download your term sheet and save it on your device. You can access it anytime through the My Forms section of your profile.

By leveraging the comprehensive offerings of US Legal Forms, you can efficiently manage your legal documentation needs with fewer hassles.

Take charge of your financing process today and experience the benefits of US Legal Forms. Start your journey to secure legal documents with confidence!

Form popularity

FAQ

A term sheet in debt financing is essentially a roadmap for financing agreements, laying out key terms before final contracts are drafted. It details essential aspects such as principal amount, interest rates, and repayment terms, which help both lenders and borrowers understand their commitments. Using an effective term sheet for debt financing can streamline negotiations and help align expectations between all parties involved.

The term sheet of the Debt Service Coverage Ratio (DSCR) outlines the metrics used to determine a company's ability to cover its debt obligations. This ratio compares a company's operating income to its debt service, providing insight into financial stability. A comprehensive understanding of DSCR is vital when analyzing any term sheet for debt financing, as it affects a lender's decision-making.

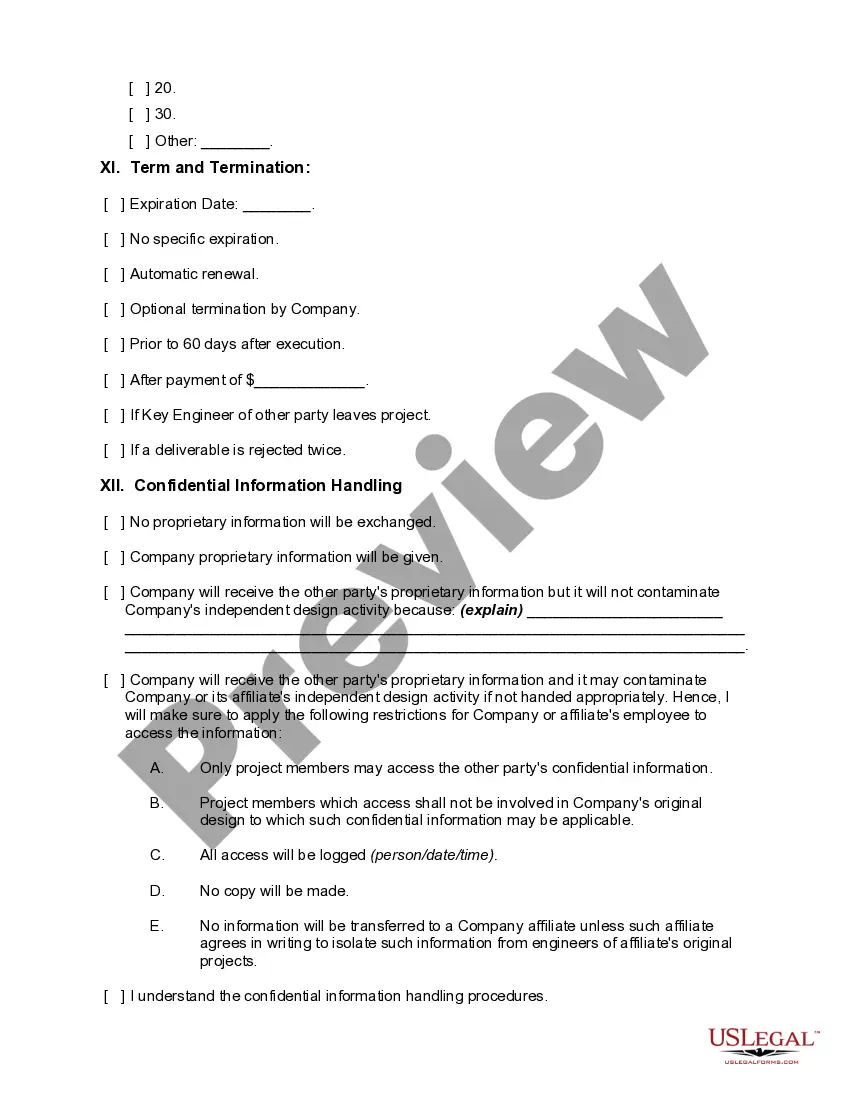

Filling out a term sheet requires you to provide specific details about the financing terms, including the amount, interest rates, and repayment schedule. Start by clearly outlining your business needs and financial terms. Then, include any additional conditions or covenants the lender may require. By using a carefully crafted term sheet for debt financing, you ensure that all parties have a clear understanding of the agreement.

Debt financing on a balance sheet refers to the funds that a company has borrowed to finance its operations, reflected as liabilities. This includes loans, bonds, and other financial obligations. When analyzing a company's financial health, understanding how these debts are structured is crucial. A well-prepared term sheet for debt financing can clarify these obligations and the terms surrounding them.

The term for debt financing typically refers to the length of time a borrower has to repay the borrowed amount. This term can vary based on the agreement and can range from months to several years. Lengthier terms often come with lower monthly payments, while shorter terms may have higher payments. Understanding these terms is crucial when preparing a term sheet for debt financing.

Term sheets are generally not legally binding, but they serve an important purpose in outlining the key points of an agreement. While a term sheet for debt financing reflects the intentions of both parties, only the final signed agreements are legally enforceable. However, some aspects, like confidentiality or exclusivity provisions, might carry enforceability. It is vital to consult with a legal expert to ensure understanding of the implications of a term sheet.

To create a term sheet for debt financing, begin by outlining the basic terms of the financing deal. Gather input from all involved parties to ensure that everyone's interests are reflected. Structuring the document clearly and concisely will help facilitate communication and agreement. For templates and guidance, consider using the US Legal Forms platform, which offers valuable resources to support your needs.

Usually, the term sheet for debt financing is prepared by the lender or the financial institution. However, legal and financial advisors often collaborate to ensure all necessary details are included. This approach enhances clarity and protects the interests of all parties involved. If you need assistance, the US Legal Forms platform can provide templates and resources to help you along the way.

Creating a term sheet for debt financing typically takes a few days to a week, depending on the complexity of the deal. Factors such as the number of parties involved and the specific terms being negotiated can influence the timeline. Having a clear understanding of the key elements can streamline the process. For further guidance, consider exploring the resources on the US Legal Forms platform.