Website Agreement Document For Payment Agreement

Description

How to fill out Website Linking Agreement?

Regardless of whether it's for corporate reasons or personal matters, everyone encounters legal circumstances at some stage in their life.

Filling out legal documents necessitates meticulous attention, beginning with choosing the suitable form template. For example, if you select an incorrect version of a Website Agreement Document for Payment Agreement, it will be declined upon submission. Thus, it is vital to obtain a reliable source of legal documents like US Legal Forms.

With a comprehensive US Legal Forms catalog available, you do not need to waste time searching for the appropriate template online. Utilize the library’s easy navigation to find the correct form for any circumstance.

- Acquire the template you require via the search field or catalog navigation.

- Review the form’s description to ensure it aligns with your circumstance, state, and region.

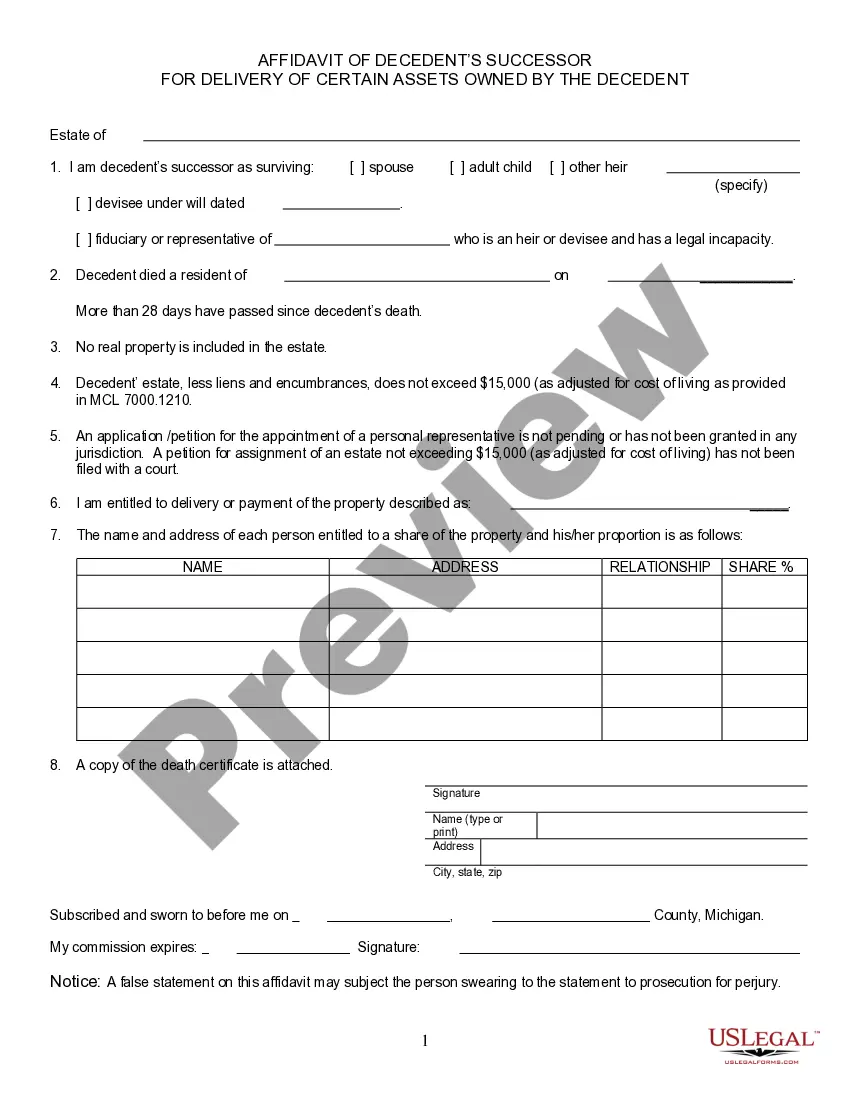

- Click on the form’s preview to analyze it.

- If it is not the correct document, return to the search feature to locate the Website Agreement Document for Payment Agreement sample you need.

- Download the template if it satisfies your criteria.

- If you already possess a US Legal Forms account, simply click Log in to access previously saved files in My documents.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Select the suitable pricing option.

- Complete the profile registration form.

- Choose your payment method: you can utilize a credit card or PayPal account.

- Select the document format you desire and download the Website Agreement Document for Payment Agreement.

- Once it is saved, you can fill out the form using editing applications or print it and complete it manually.

Form popularity

FAQ

Let's look at a quick example to illustrate the nature of a payment agreement. Person A (the debtor) borrows $5,000 from person B (the creditor). Both parties agree that person A must pay person B $1,000 a month over five months to repay the debt.

State what each side agrees to do. Clearly write out the terms of the loan. Include information about the date of the loan, the payment terms, interest, schedule of payments, late charges, default, and any other details in the agreement. Explain that the contract represents the entire agreement.

Payment Agreements outline the important terms and conditions of a loan and help to document money that is owed to you or money that you owe to someone else. These documents typically specify the amount of the loan, the interest rate, the repayment terms and includes other specific provisions.

State what each side agrees to do. Clearly write out the terms of the loan. Include information about the date of the loan, the payment terms, interest, schedule of payments, late charges, default, and any other details in the agreement. Explain that the contract represents the entire agreement.

The payment agreement should include: Creditor's Name and Address; Debtor's Name and Address; Acknowledgment of the Balance Owed; Amount Owed; Interest Rate (if any); Repayment Period; Payment Instructions; Late Payment (if any); and.