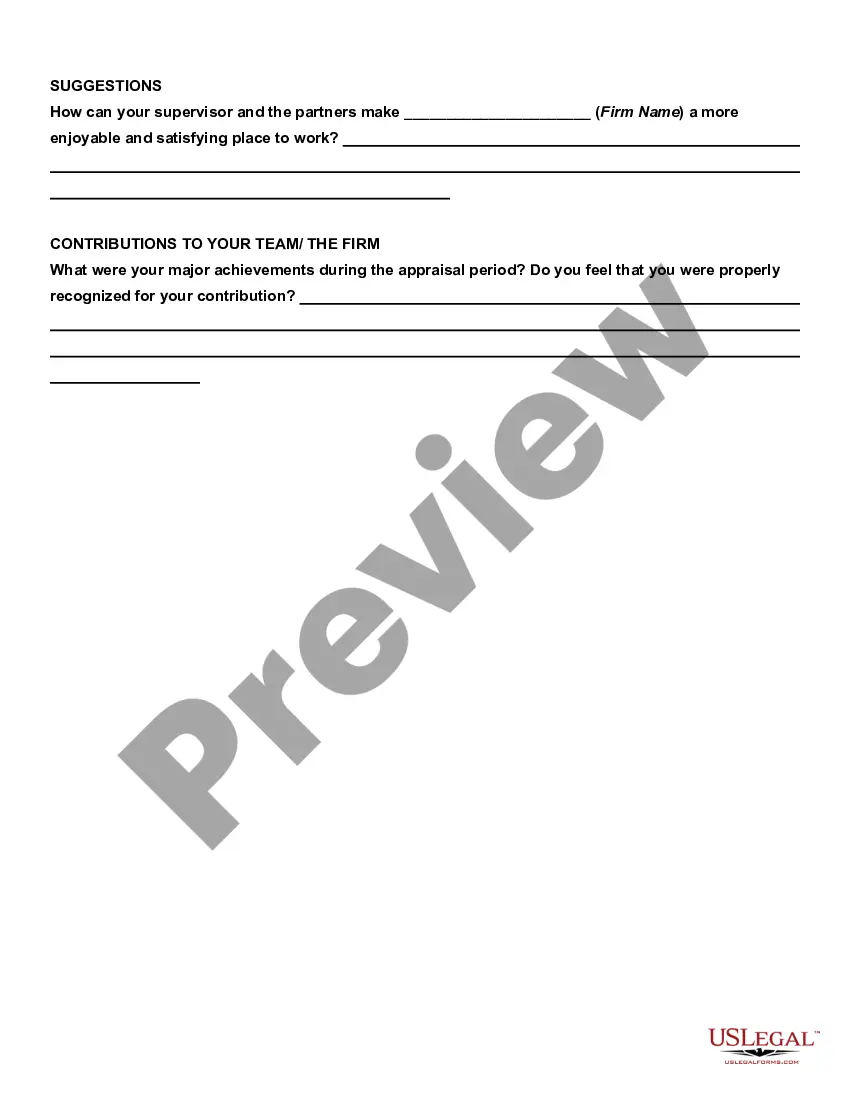

Self Appraisal Form For Software Developer

Description

How to fill out Employee Self-Appraisal Form?

The Self Assessment Document For Software Engineer you observe on this page is a reusable official template crafted by qualified attorneys in accordance with federal and local regulations.

For over 25 years, US Legal Forms has supplied individuals, companies, and legal specialists with more than 85,000 authenticated, state-specific documents for any business and personal circumstances. It’s the fastest, most direct, and most dependable method to acquire the documentation you require, as the service ensures the utmost level of data privacy and anti-malware safeguards.

Register for US Legal Forms to have authenticated legal templates for all of life’s scenarios available at your fingertips.

- Search for the file you require and evaluate it. Browse through the example you sought and preview it or check the document description to confirm it meets your requirements. If it doesn’t, utilize the search option to find the correct one. Click Purchase Now once you have identified the template you need.

- Register and Log In. Select the pricing plan that best fits your needs and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and verify your subscription to continue.

- Obtain the editable template. Choose the format you desire for your Self Assessment Document For Software Engineer (PDF, Word, RTF) and download the example onto your device.

- Complete and sign the file. Print the template to finish it manually. Alternatively, employ an online multifunctional PDF editor to promptly and accurately fill out and sign your form with a valid signature.

- Retrieve your documentation again. Use the same file once more whenever required. Access the My documents tab in your profile to redownload any forms previously retrieved.

Form popularity

FAQ

What Happens If Your Debt Is Sent To Collections? If your debt is sent to collections, you can expect phone calls and emails from the debt collection agency. If debt collectors sue you, be sure to appear in court; otherwise, the judge can automatically rule against you.

You can check for debts in collection on your TransUnion and Equifax credit reports using Intuit Credit Karma: TransUnion. Equifax.

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

Confirm that the debt is yours. ... Check your state's statute of limitations. ... Know your debt collection rights. ... Figure out how much you can afford to pay. ... Ask to have your account deleted. ... Set up a payment plan. ... Make your payment. ... Document everything.

I am writing in response to a letter from you dated [dd/mm/yy], reference number [abc333333]. A copy is attached. I have no knowledge of ever having [a contract with/credit from] [company name]. If you do not stop collection activity whilst investigating my dispute, you are breaking FCA rules and guidance.

How to Find Out Which Collection Agency You Owe Check Your Credit Reports. Reverse-Lookup the Phone Number. Ask the Original Creditor. Wait to Be Contacted.

Under Maryland law debt collectors may not... Use or threaten force or violence. Threaten criminal prosecution, unless a violation of criminal law is involved. Disclose or threaten to disclose information affecting your reputation for credit worthiness if they know the information is false.

Time Limits on Collection The statute of limitations gives creditors 3 years to file a lawsuit against you for the debt you owe. If the case is brought to court and the judge rules in favor of the creditor, they then have only 12 years to collect the settlement.