Receipt With Purchase

Description

How to fill out Sales Receipt?

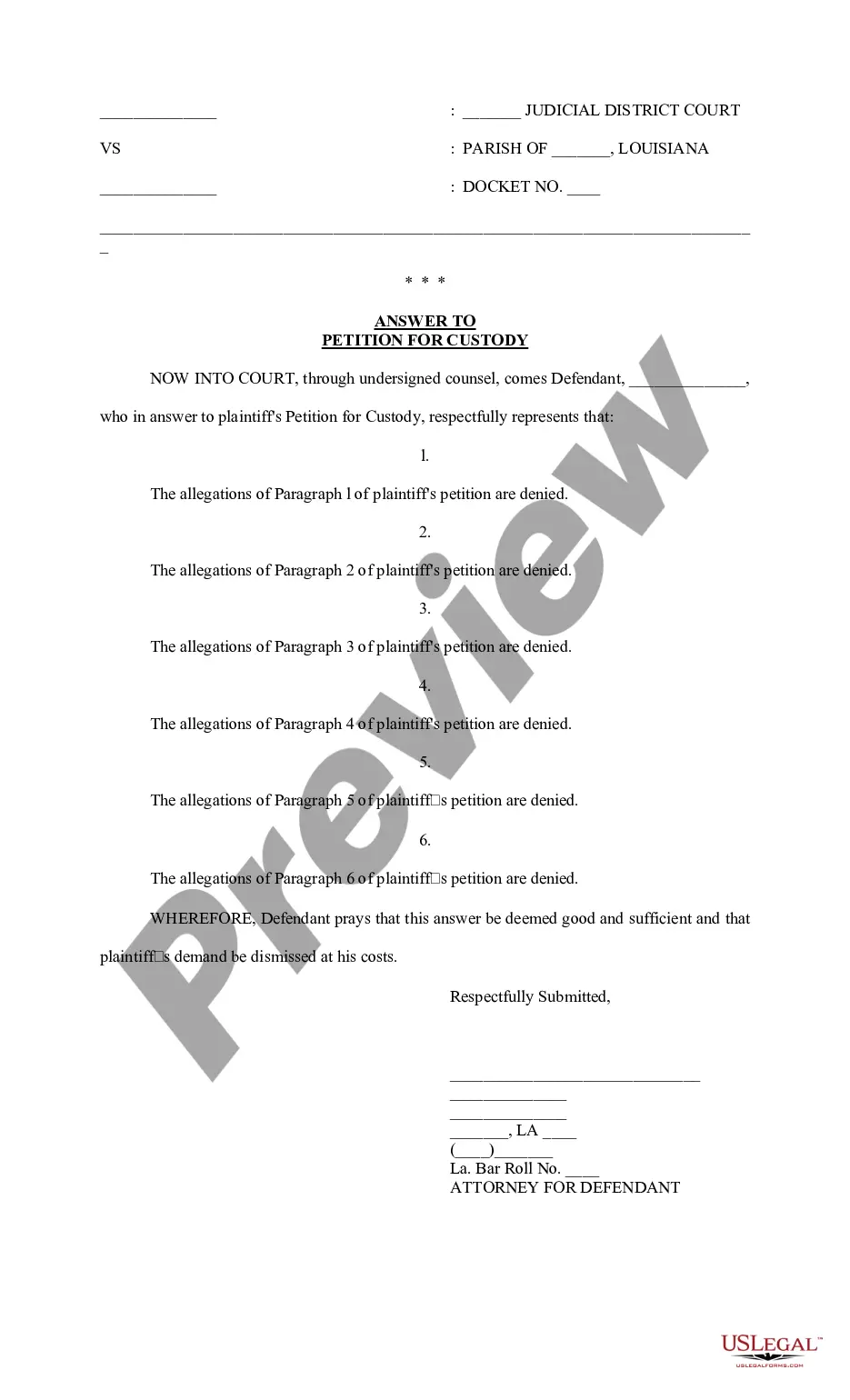

Whether for commercial reasons or for personal matters, everyone must encounter legal circumstances eventually in their life.

Finalizing legal paperwork requires meticulous care, starting with choosing the appropriate form template.

With an extensive US Legal Forms catalog available, you need not spend time searching for the suitable template across the web. Leverage the library’s user-friendly navigation to find the correct template for any situation.

- For instance, if you select an incorrect version of the Receipt With Purchase, it will be rejected once you submit it.

- Thus, it is crucial to obtain a trustworthy source of legal documents like US Legal Forms.

- If you need to acquire a Receipt With Purchase template, follow these straightforward steps.

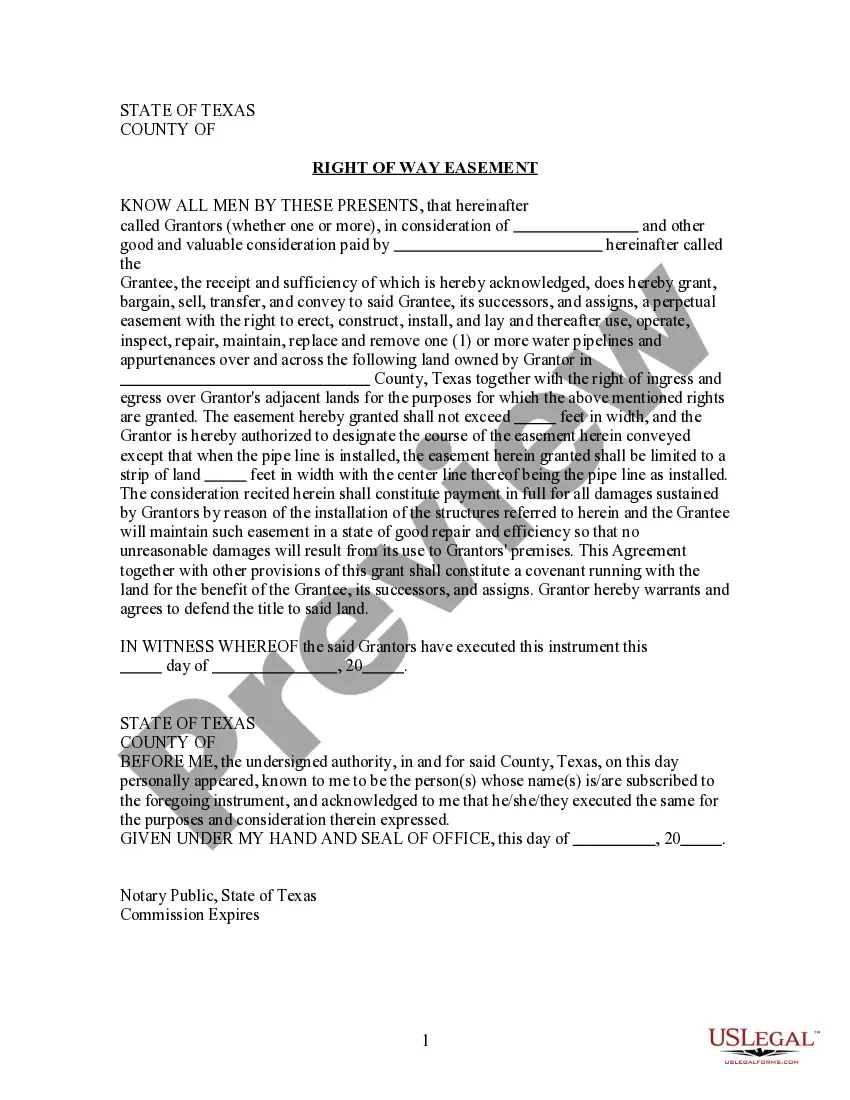

- 1. Obtain the sample you require by using the search field or exploring the catalog.

- 2. Review the form’s details to ensure it aligns with your case, state, and locality.

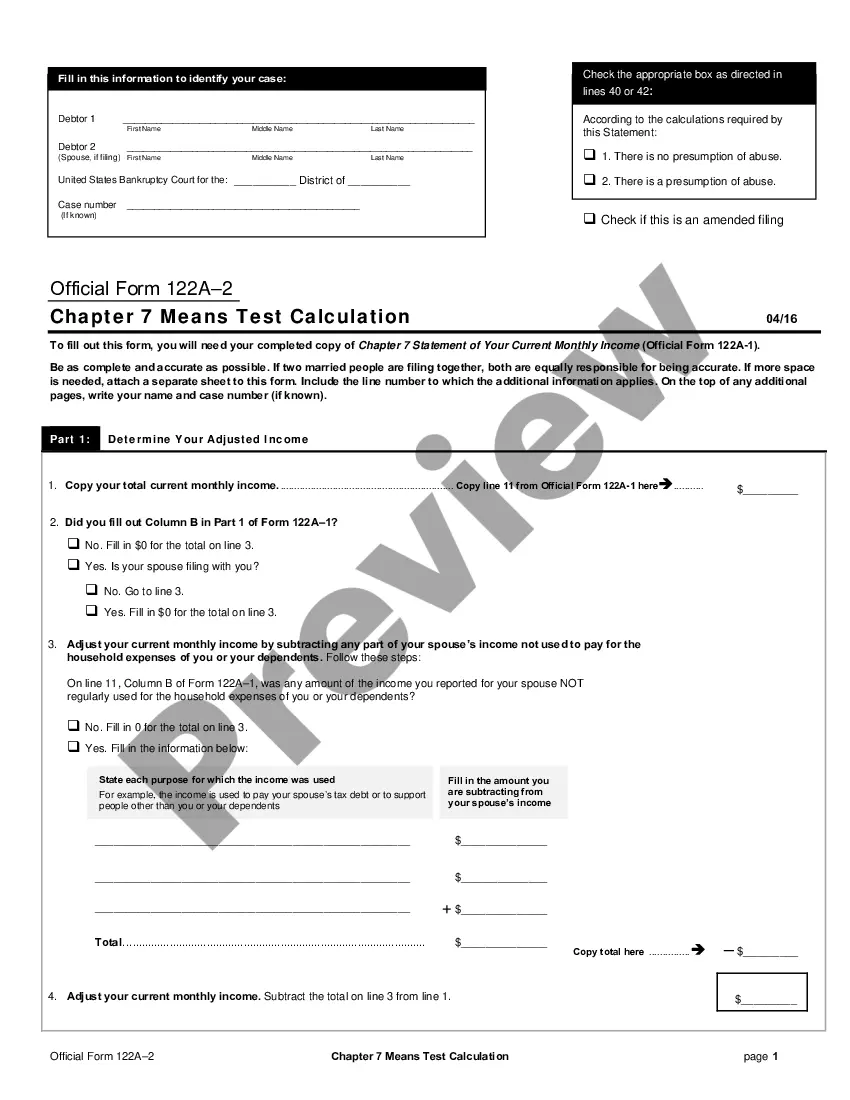

- 3. Click on the form’s preview to examine it.

- 4. If it is not the correct document, return to the search function to locate the Receipt With Purchase sample you need.

- 5. Download the template when it fulfills your specifications.

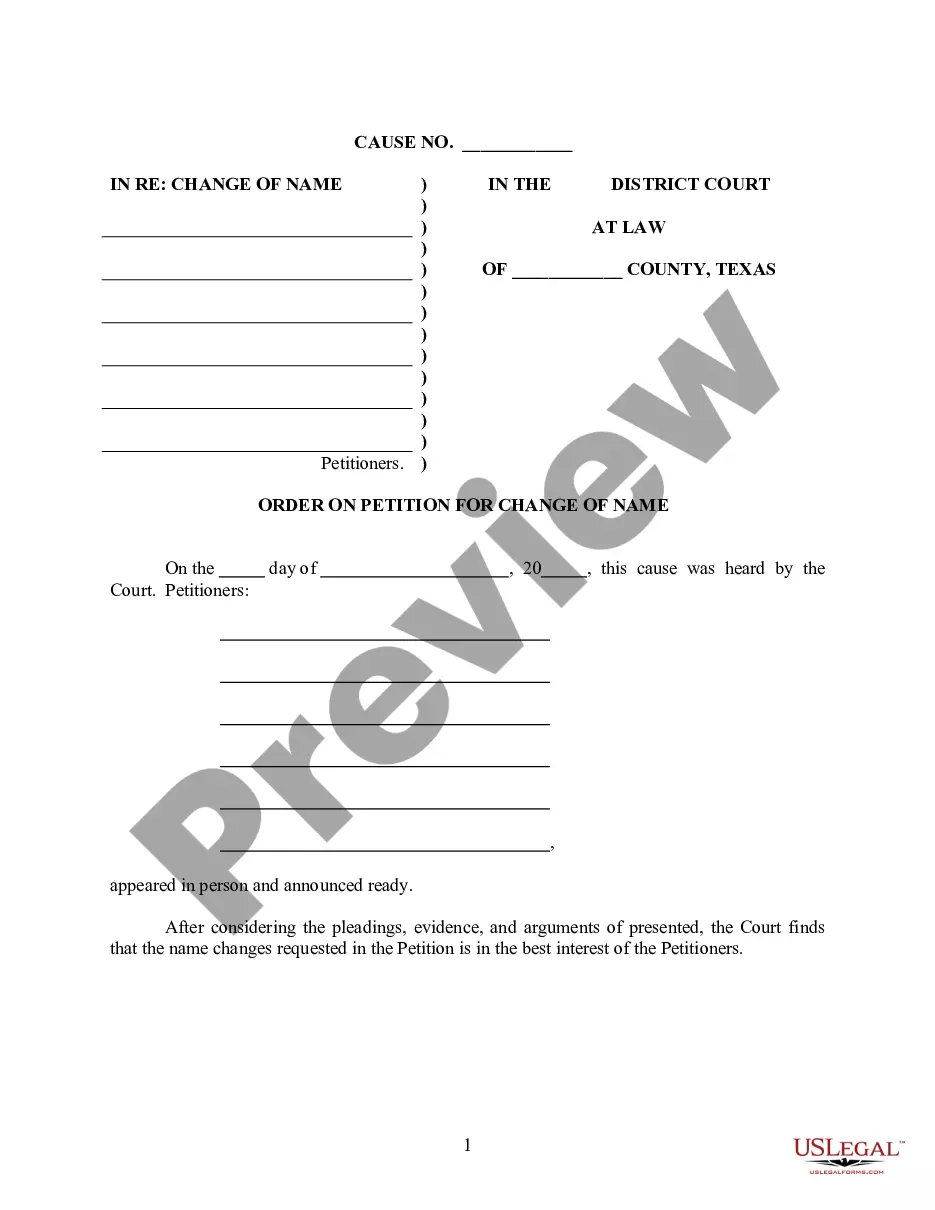

- 6. If you already possess a US Legal Forms account, simply click Log in to access previously saved documents in My documents.

- 7. In case you do not have an account yet, you can acquire the form by clicking Buy now.

- 8. Select the appropriate payment option.

- 9. Complete the account registration form.

- 10. Choose your payment method: utilize a credit card or PayPal account.

- 11. Select the file format you wish and download the Receipt With Purchase.

- 12. Once downloaded, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

An invoice is a request for payment, detailing the goods or services provided, their costs, and payment terms. In contrast, a receipt with purchase serves as proof of payment, confirming the transaction's completion. While both documents are important, an invoice is issued before payment, and a receipt is provided after. Understanding these distinctions helps you manage your finances effectively.

Receipt filing involves organizing and storing your receipts for easy access and reference. Begin by creating a dedicated system, such as folders or a digital application, specifically for your receipts with purchase. Sort the receipts by category, such as business expenses or personal purchases, and ensure they are dated for straightforward tracking. Utilizing tools like those offered by uslegalforms can simplify this process, helping you maintain accurate financial records.

If you lose your receipt with purchase, don’t worry; you can often obtain a duplicate. Start by checking your email for a digital copy if you made an online purchase. If you bought something in-store, contact the retailer’s customer service with details about your transaction. They may require the date of purchase and your payment method to help you retrieve the receipt.

The format of a receipt with purchase typically consists of a header with the seller's information followed by the date, a list of purchased items, their corresponding prices, and a subtotal. After calculating the total, include the payment method and any relevant transaction identifiers. This structure makes the receipt easily understandable and useful for both buyers and sellers.

To fill out a receipt with purchase properly, start by entering the date and transaction number at the top. Next, list the items sold along with their prices, and calculate the total amount. Lastly, indicate the payment method and ensure each party receives a copy for their records. Following this format will help maintain accurate transaction documentation.

When completing a receipt with purchase, it's important to include the date of the transaction, the names of both the buyer and seller, a detailed list of items sold, the total amount due, and a method of payment. Each point ensures clarity and serves as a useful record for both parties. Properly detailing these elements can prevent misunderstandings and disputes in the future.

Choose What Information You Want to Include in Your Cash Receipts Business name and contact information. Customer's contact information. Date of transaction. Time of transaction. Description of the product or service sold. Item quantity. Subtotal. Total.

No matter how you're making your receipt, every receipt you issue should include: The number, date, and time of the purchase. Invoice number or receipt number. The number of items purchased and price totals. The name and location of the business the items have been bought from. Any tax charged. The method of payment.

The receipt should include: The date. The dollar amount. Name of person paying for the transaction. Description of the service or product. Department name. Signature of the cash handler.

When writing in a receipt book, one must include the date of the transaction, contact information, description of products, price, and any applicable taxes or fees. Furthermore, a carbon copy separator should be placed behind the yellow page to complete the receipt.