Price Credit Check With Api

Description

How to fill out Sales Receipt?

It’s widely recognized that you cannot transform into a legal expert instantaneously, nor can you master the swift preparation of Price Credit Check With Api without possessing a dedicated set of competencies.

Compiling legal documents is a lengthy undertaking that necessitates specific training and expertise. Therefore, why not entrust the arrangement of the Price Credit Check With Api to experienced professionals.

With US Legal Forms, one of the most extensive legal document repositories, you can find everything from court forms to templates for internal corporate communication.

If you need a different form, start your search again.

Register for a complimentary account and choose a subscription plan to buy the form. Select Buy now. Once the payment is completed, you can obtain the Price Credit Check With Api, fill it out, print it, and deliver or send it to the required individuals or organizations.

- We recognize how vital compliance and adherence to federal and state statutes and regulations are.

- That’s why, on our platform, all forms are tailored to specific locations and updated regularly.

- Begin with our site and acquire the document you require in just a few minutes.

- Use the search bar located at the top of the page to find the document you need.

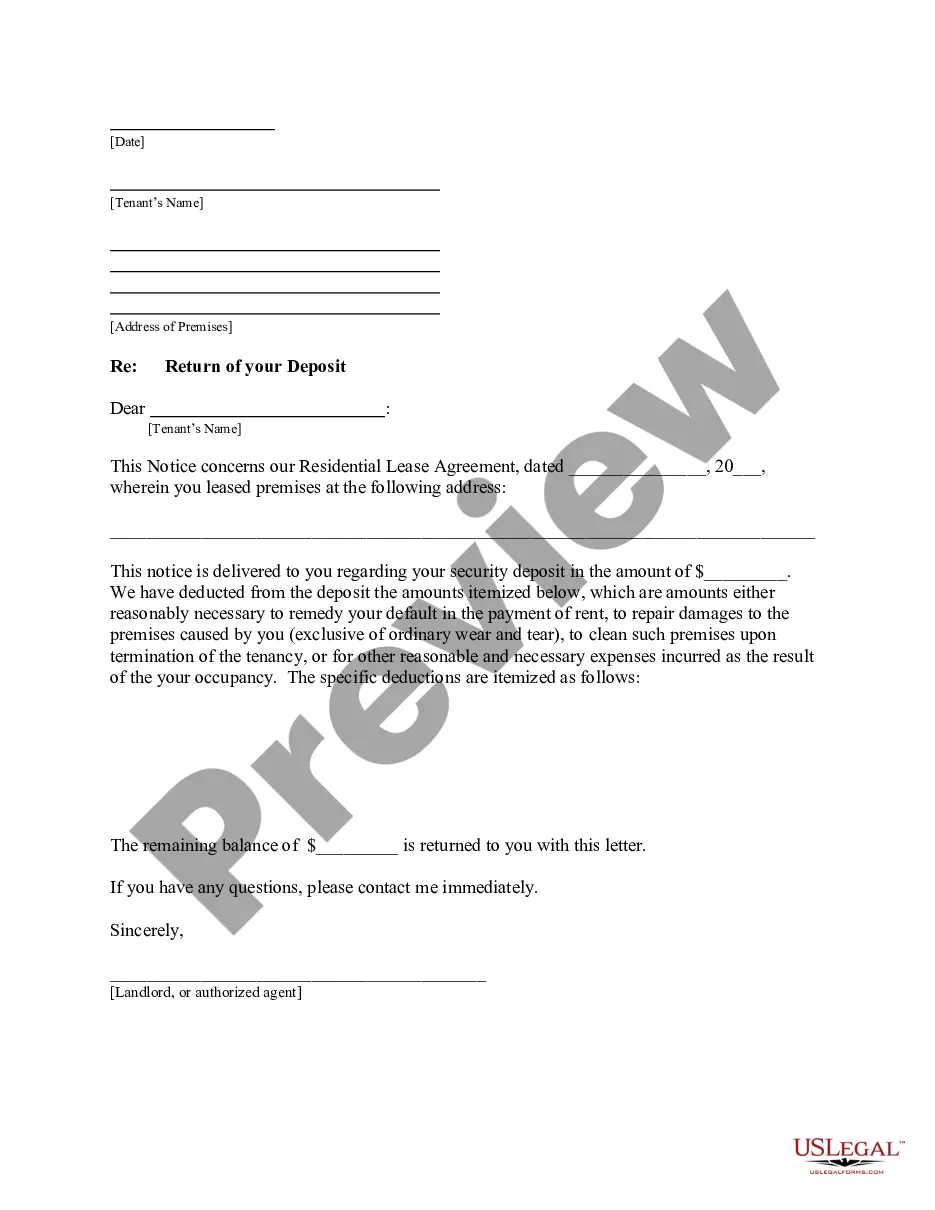

- Preview it (if this feature is available) and review the accompanying description to verify whether Price Credit Check With Api is what you are looking for.

Form popularity

FAQ

The FICO score API provides businesses with access to FICO credit scoring data needed to assess an individual's creditworthiness. When you use this API, you are essentially conducting a price credit check with API functionality that brings valuable insights into a consumer's financial behavior. By integrating this API into your systems, you can enhance underwriting processes and provide personalized service to your customers. The FICO score API is essential for businesses wanting to make data-driven lending decisions.

The CR API refers to a credit report application programming interface that enables users to retrieve credit report data programmatically. If you want to conduct a price credit check with API access, utilizing the CR API can simplify data retrieval and improve accuracy. This API delivers crucial information that helps businesses make informed lending decisions while ensuring compliance with regulations. It's a valuable tool for businesses aiming to improve their credit evaluation process.

Yes, Experian offers an API that allows businesses to integrate credit reporting capabilities directly into their applications. This means you can easily perform a price credit check with API access to Experian's extensive credit data. By leveraging Experian's API, you can streamline your processes and enhance your customer experience. The integration provides real-time results, making it a smart choice for businesses seeking efficient credit solutions.

To run a credit check on someone, begin by obtaining their permission. You can use a price credit check with API to facilitate this process seamlessly. Platforms like US Legal Forms offer user-friendly systems that guide you through the steps of obtaining a credit report. By following the required legal protocols and leveraging reliable technology, you can ensure accurate results while maintaining customer trust.

Yes, you can run a credit check on a customer, provided you obtain their consent. Using a price credit check with API streamlines this process, allowing you to access their credit information securely. It's important to use a compliant platform, like US Legal Forms, that ensures you meet legal standards when conducting these checks. Ensuring the customer understands why you are performing the check can improve transparency and trust.

The time it takes to improve your credit score from 700 to 750 can vary based on several factors, including your credit history and current credit usage. Generally, you can make noticeable improvements within six months to a year, provided you manage your debts wisely. Utilizing a price credit check with API can aid in tracking your progress and identifying areas of improvement. Consider creating a plan with US Legal Forms to help you navigate strategies that can promote your credit score growth effectively.

Experian collects credit obligation information from thousands of businesses nationwide. These businesses are typically the suppliers or lenders with which a company has existing financial relationships. Experian also collects legal filings from the various local, county and state courts across the United States.

Experian API or Application Programming Interface uses Experian data and functionality to build a user's software product. These software products are the result of the delivery of the request from the provider to the user through the Experian API.

CreditAPI is a secure, easy and effective tool to retrieve consumer credit data from Experian, Equifax and Transunion via XML for use within your software application in order to make business decisions.