Loan Between Form Agreement Format

Description

How to fill out Line Of Credit Or Loan Agreement Between Corporate Or Business Borrower And Bank?

Drafting legal documents from scratch can sometimes be a little overwhelming. Some cases might involve hours of research and hundreds of dollars spent. If you’re searching for a more straightforward and more cost-effective way of preparing Loan Between Form Agreement Format or any other paperwork without jumping through hoops, US Legal Forms is always at your disposal.

Our virtual catalog of over 85,000 up-to-date legal documents covers almost every element of your financial, legal, and personal affairs. With just a few clicks, you can instantly get state- and county-specific templates diligently put together for you by our legal specialists.

Use our platform whenever you need a trusted and reliable services through which you can quickly find and download the Loan Between Form Agreement Format. If you’re not new to our services and have previously created an account with us, simply log in to your account, locate the template and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No worries. It takes minutes to set it up and explore the catalog. But before jumping straight to downloading Loan Between Form Agreement Format, follow these recommendations:

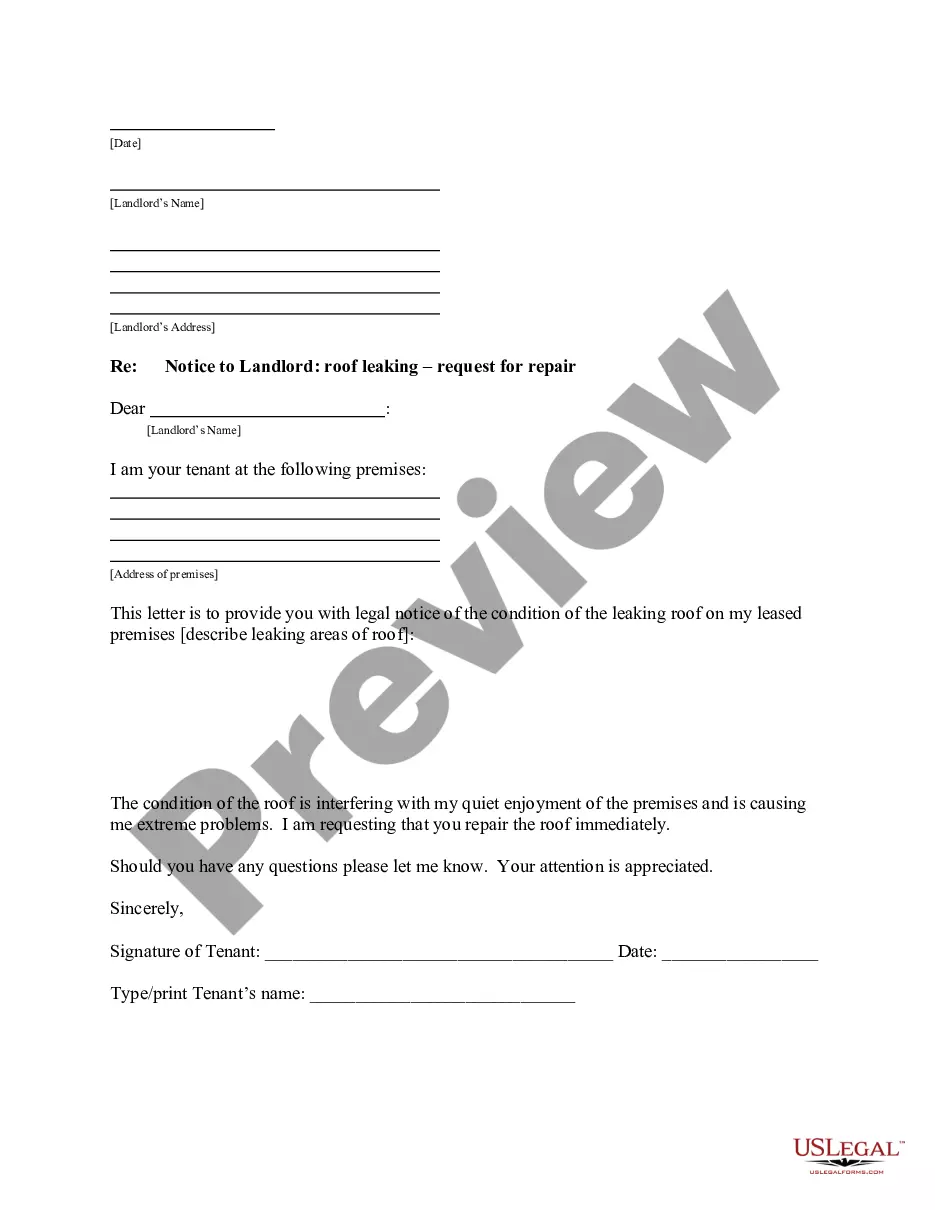

- Review the form preview and descriptions to ensure that you have found the document you are searching for.

- Make sure the template you select conforms with the requirements of your state and county.

- Pick the best-suited subscription option to get the Loan Between Form Agreement Format.

- Download the file. Then complete, sign, and print it out.

US Legal Forms has a spotless reputation and over 25 years of expertise. Join us today and turn document completion into something easy and streamlined!

Form popularity

FAQ

Include key terms of the loan, such as the lender and borrower's contact information, the reason for the loan, what is being loaned, the interest rate, the repayment plan, what would happen if the borrower can't make the payments, and more. The amount of the loan, also known as the principal amount.

A family loan agreement shares the same basic elements with other lending contracts. It should specify a repayment term and payment schedule, an interest rate, and other contingencies, such as how late payments or a default will be handled. Notarizing your agreement is also recommended.

What to include in your loan agreement? The amount of the loan, also known as the principal amount. The date of the creation of the loan agreement. The name, address, and contact information of the borrower. The name, address, and contact information of the lender.

How to Write a Business Loan Agreement Step 1 ? Set an Effective Date. ... Step 2 ? Identify the Parties. ... Step 3 ? Include the Loan Amount. ... Step 4 ? Create a Repayment Schedule. ... Step 5 ? Define Security Interests or Collateral. ... Step 6 ? Set an Interest Rate. ... Step 7 ? Late Payment Fees. ... Step 8 ? Determine Prepayment Options.

A credit agreement is a legally binding contract documenting the terms of a loan, made between a borrower and a lender. A credit agreement is used with many types of credit, including home mortgages, credit cards, and auto loans.