Acknowledgement Letter For Donation In Honor Of

Description

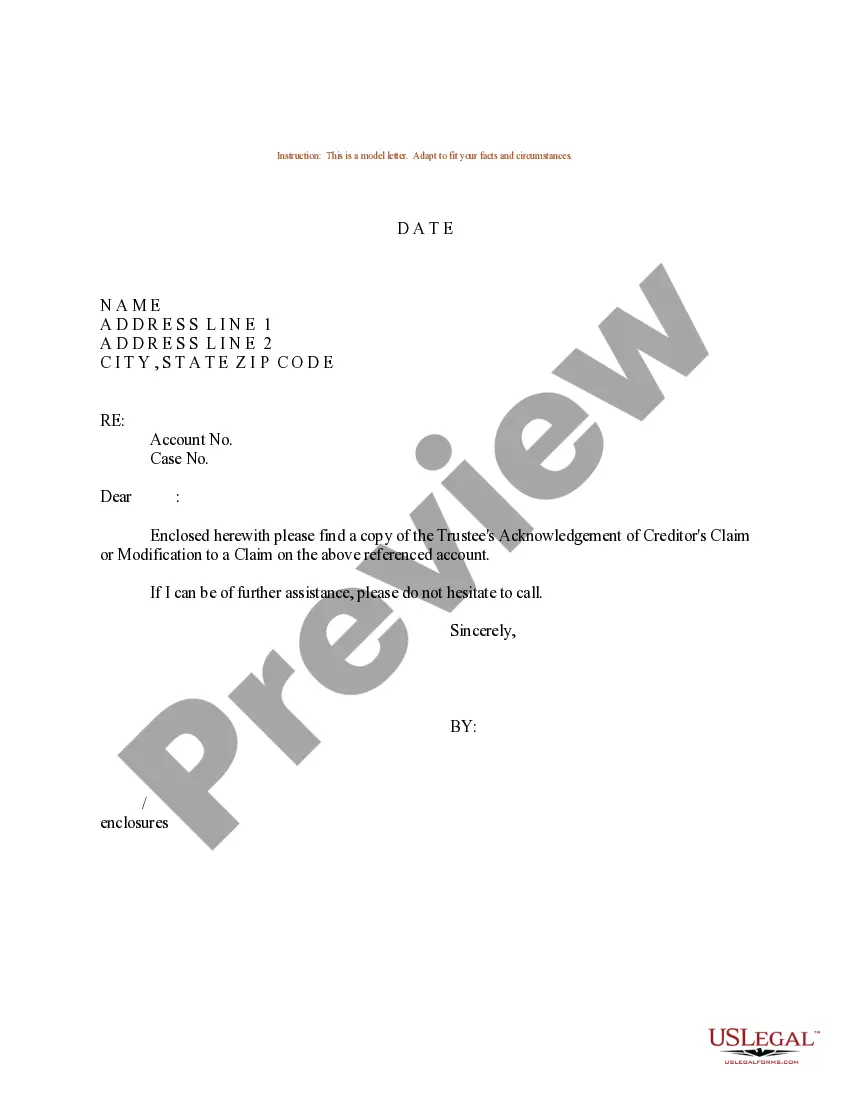

How to fill out Sample Letter For Trustee's Acknowledgment?

Managing legal paperwork and procedures can be an arduous addition to your routine. Correspondence Letter For Contribution In Memory Of and similar documents often demand that you locate them and determine the most efficient way to finalize them properly.

Consequently, if you are managing financial, legal, or personal issues, utilizing a comprehensive and user-friendly online directory of forms whenever necessary will greatly assist you.

US Legal Forms is the premier online resource for legal templates, providing over 85,000 state-specific documents and various tools to help you finalize your paperwork swiftly.

Browse the inventory of relevant forms available to you with just a single click.

Then, follow the instructions outlined below to finalize your form: Ensure you have identified the correct document by using the Review option and examining the form specifics. Choose Buy Now when ready, and select the subscription plan that suits your requirements. Click Download, and then complete, sign, and print the document. US Legal Forms boasts twenty-five years of expertise aiding users in handling their legal documents. Discover the form you seek today and streamline any process effortlessly.

- US Legal Forms provides state- and county-specific documents accessible anytime for download.

- Safeguard your document management tasks with a quality service that enables you to create any form in minutes without additional or hidden fees.

- Simply Log In to your profile, locate Correspondence Letter For Contribution In Memory Of, and obtain it immediately from the My documents section.

- You can also access forms you have previously downloaded.

- Is it your initial experience using US Legal Forms? Register and set up your account in just a few minutes and you will have access to the form catalog and Correspondence Letter For Contribution In Memory Of.

Form popularity

FAQ

Hawaii Small Estate Affidavit - EXPLAINED - YouTube YouTube Start of suggested clip End of suggested clip That person or entity has no choice but to relinquish the property when presented with the affidavitMoreThat person or entity has no choice but to relinquish the property when presented with the affidavit. And a certified copy of the decedent's. Death certificate. So where can you find legal documents.

How to write an affidavit. Title. This is either your name (?Affidavit of Jane Doe?) or the specific case information. Statement of identity. The next paragraph tells the court about yourself. ... Statement of truth. ... Statement of facts. ... Closing statement of truth. ... Sign and notarize.

A Hawaii small estate affidavit can be used to bypass probate and court appearances in the distribution of a small estate. The form can be used by a successor to quickly and efficiently gather and distribute the personal property of a decedent whose estate is worth less than $100,000.

In Hawaii, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

In Hawaii, probate is only required under two circumstances: if the deceased owned any real estate in his or her name alone, no matter how small the value OR. if the total value of the deceased's personal property exceeds $100,000.

Small Estate Affidavit If an Hawaii estate has a gross value <$100,000, you can use the small estate process to settle the estate with no court involvement.