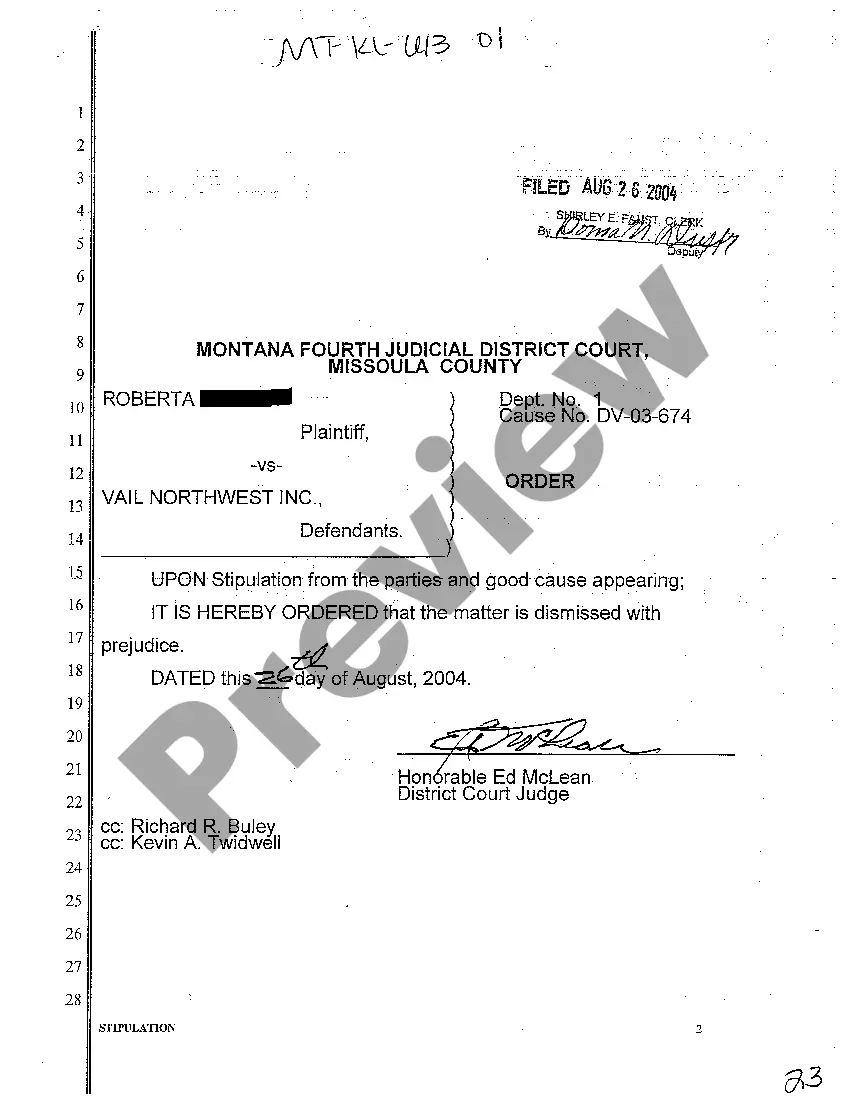

Not Profit Document Format

Description

How to fill out Articles Of Incorporation, Not For Profit Organization, With Tax Provisions?

Whether for business purposes or for individual matters, everybody has to manage legal situations at some point in their life. Filling out legal paperwork demands careful attention, starting with picking the correct form sample. For instance, if you pick a wrong edition of the Not Profit Document Format, it will be rejected once you send it. It is therefore important to get a reliable source of legal documents like US Legal Forms.

If you have to obtain a Not Profit Document Format sample, stick to these easy steps:

- Find the template you need by utilizing the search field or catalog navigation.

- Examine the form’s information to ensure it fits your case, state, and region.

- Click on the form’s preview to see it.

- If it is the incorrect document, go back to the search function to find the Not Profit Document Format sample you need.

- Download the template when it meets your requirements.

- If you have a US Legal Forms account, click Log in to access previously saved files in My Forms.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Select the proper pricing option.

- Complete the account registration form.

- Pick your transaction method: you can use a credit card or PayPal account.

- Select the file format you want and download the Not Profit Document Format.

- When it is saved, you are able to fill out the form by using editing applications or print it and finish it manually.

With a substantial US Legal Forms catalog at hand, you do not need to spend time searching for the appropriate template across the web. Take advantage of the library’s straightforward navigation to get the correct template for any situation.

Form popularity

FAQ

When speaking about NPO's the public spells them many ways. This includes nonprofit, non-profit and also non profit. While it is acceptable to use any of these versions the most widely accepted spelling is nonprofit all one word.

When speaking about NPO's the public spells them many ways. This includes nonprofit, non-profit and also non profit. While it is acceptable to use any of these versions the most widely accepted spelling is nonprofit all one word.

Even though nonprofits are exempt from income tax and not subject to withholding taxes, you must fill out and issue Form W-9 to the requesting business entities. In fact, all nonprofits must submit this form in order to be eligible for the tax-exempt status.

How to fill out a W-9 Enter your name. Write or type your full legal name as shown on your tax return. Enter your business name. ... Choose your federal tax classification. ... Choose your exemptions. ... Enter your street address. ... Enter the rest of your address. ... Enter your requester's information.

We use nonprofit (adj. and n.) to refer to tax-exempt charitable organizations. Not for profit may vary under state laws, but generally means a company must forgo dividends or other cash payments from the operating net.