Acknowledgment Regarding Sample For Thesis

Description

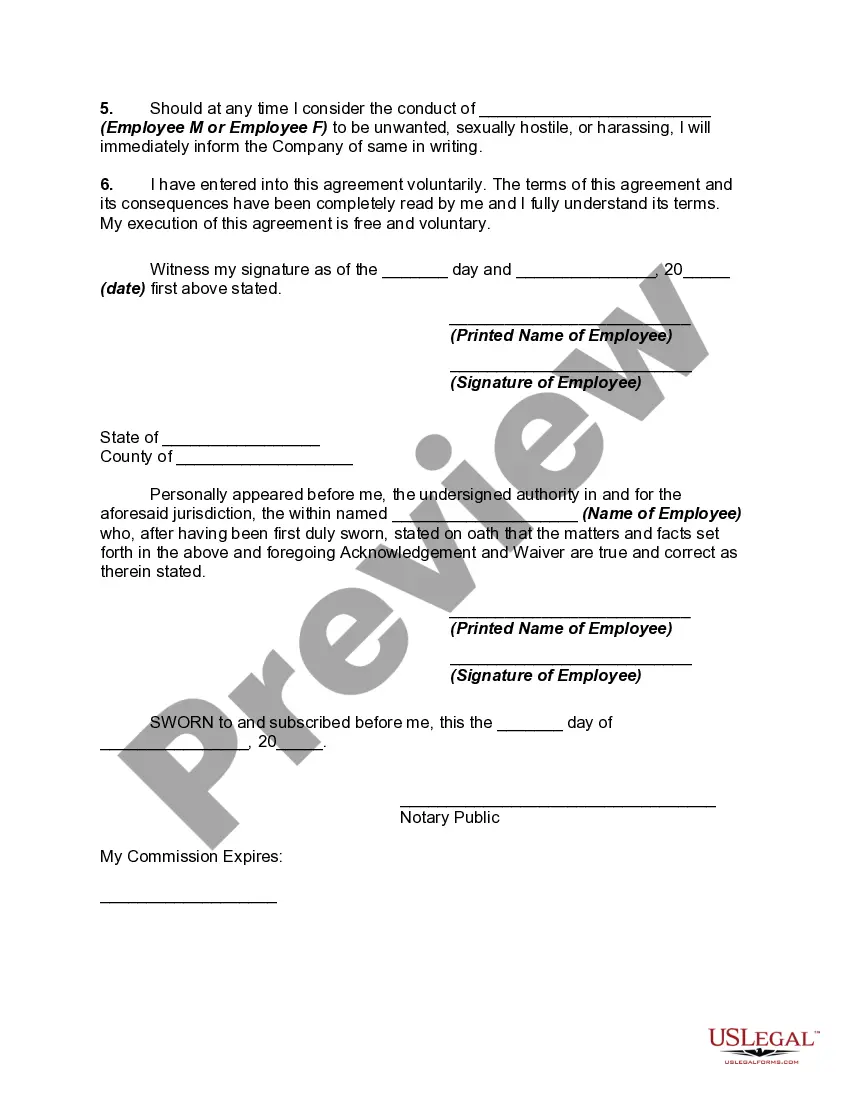

How to fill out Acknowledgment And Waiver Regarding Employee Dating?

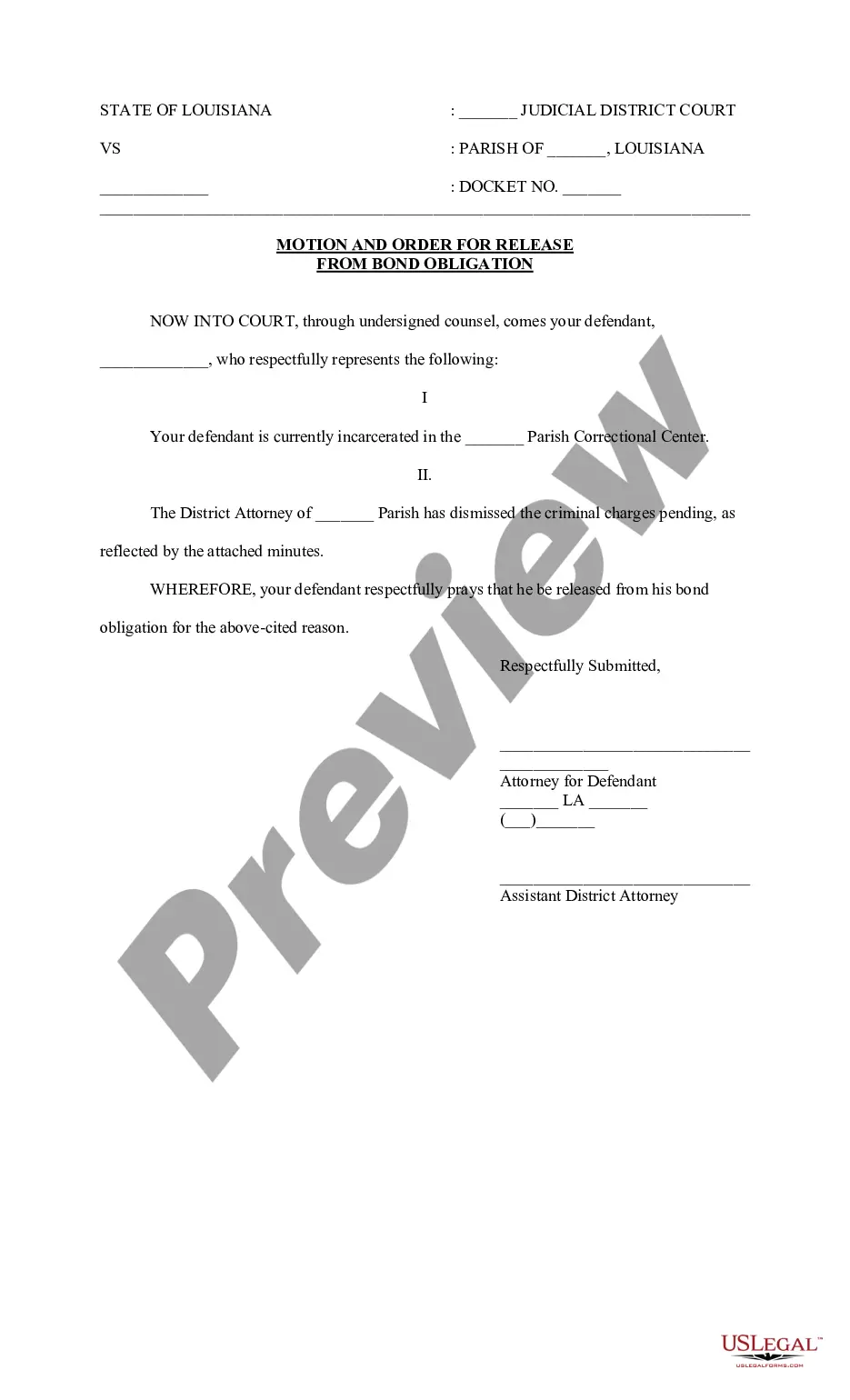

The Recognition Concerning Example For Dissertation you encounter on this site is a reusable official template crafted by seasoned attorneys in accordance with federal and state legislation and statutes.

For over 25 years, US Legal Forms has supplied individuals, enterprises, and legal practitioners with more than 85,000 authenticated, state-specific documents for any business and personal circumstance. It’s the quickest, easiest, and most reliable method to acquire the documentation you require, as the service assures bank-level data protection and anti-malware safeguards.

Register for US Legal Forms to have verified legal templates available for all of life’s circumstances at your fingertips.

- Browse for the document you require and examine it.

- Review the sample you searched for and preview it or assess the form description to confirm it meets your needs. If it doesn’t, utilize the search bar to find the correct one. Hit Buy Now when you locate the template you need.

- Register and Log In.

- Select the pricing plan that matches your preference and set up an account. Employ PayPal or a credit card to complete a quick payment. If you already possess an account, Log In and verify your subscription to continue.

- Acquire the editable template.

- Choose the format you desire for your Recognition Concerning Example For Dissertation (PDF, Word, RTF) and store the sample on your device.

- Fill out and sign the documentation.

- Print the template to fill it out by hand. Alternatively, use an online versatile PDF editor to swiftly and accurately complete and sign your form with a valid.

- Download your documents again.

- Use the same document again whenever necessary. Access the My documents tab in your profile to redownload any previously acquired forms.

Form popularity

FAQ

Florida debt collection laws are governed by the Florida Consumer Collection Practices Act (CCPA) which prohibits both debt collectors and creditors from using certain types of abusive, deceptive, and misleading debt collection tactics.

In the new changes to Regulation F, the frequency at which a collections agency can contact a consumer has changed. This change, presented in Section 1006.14B21A, addresses telephone call frequency and restricts agencies to contacting a consumer seven times within seven consecutive days.

A legitimate debt collector should be able to tell you their company name and mailing address, as well as information about the debt they say you owe. The debt collector should provide information about themselves and their collection agency.

If you get behind in your payments you may be sued or contacted by a debt collector or collection agency. If you are sued and the creditor wins the case, a judgment will be entered against you by a judge at the end of the lawsuit. This information can be reported to a credit bureau.

Florida Legal Collections, P.A., is a licensed collection agency specializing in the recovery of court-ordered financial obligations, including traffic and county/municipal fines and fees.

To take legal action to collect a debt, the creditor (the person or company owed money) files a lawsuit against the debtor (the person who owes the money). Once a debt collection lawsuit is filed with the court, the creditor must give the debtor notice of the lawsuit (service).

Statute of Limitations in Florida for Debt The statute of limitations for debt in Florida is five years. A creditor has five years to sue you for the money you owe. Most debts are based on written agreements and the statute of limitations period for contract actions is five years.

Under this Act (Title VIII of the Consumer Credit Protection Act), third-party debt collectors are prohibited from using deceptive or abusive conduct in the collection of consumer debts incurred for personal, family, or household purposes.