Donation Contract Template With Builders

Description

How to fill out Equine Or Horse Donation Contract?

There’s no longer a requirement to squander hours searching for legal documents to adhere to your local state regulations.

US Legal Forms has gathered all of them in one location and simplified their accessibility.

Our platform offers over 85,000 templates for any business and individual legal matters categorized by state and usage area.

Use the Search field above to find another template if the previous one didn't meet your needs. Click Buy Now next to the template title when you identify the right one. Select the most suitable subscription plan and register for an account or Log In. Make payment for your subscription with a credit card or via PayPal to proceed. Choose the file format for your Donation Contract Template With Builders and download it to your device. Print your form to complete it manually or upload the sample if you prefer to use an online editor. Preparing official documents under federal and state regulations is quick and easy with our library. Try US Legal Forms today to keep your paperwork organized!

- All documents are correctly drafted and verified for authenticity, so you can be assured of acquiring a current Donation Contract Template With Builders.

- If you are acquainted with our platform and already possess an account, you must ensure your subscription is active before accessing any templates.

- Log In to your account, choose the document, and click Download.

- You can also return to all saved documents at any time by accessing the My documents tab in your profile.

- If you have never utilized our platform before, the procedure will require a few additional steps to finalize.

- Here’s how new users can find the Donation Contract Template With Builders in our inventory.

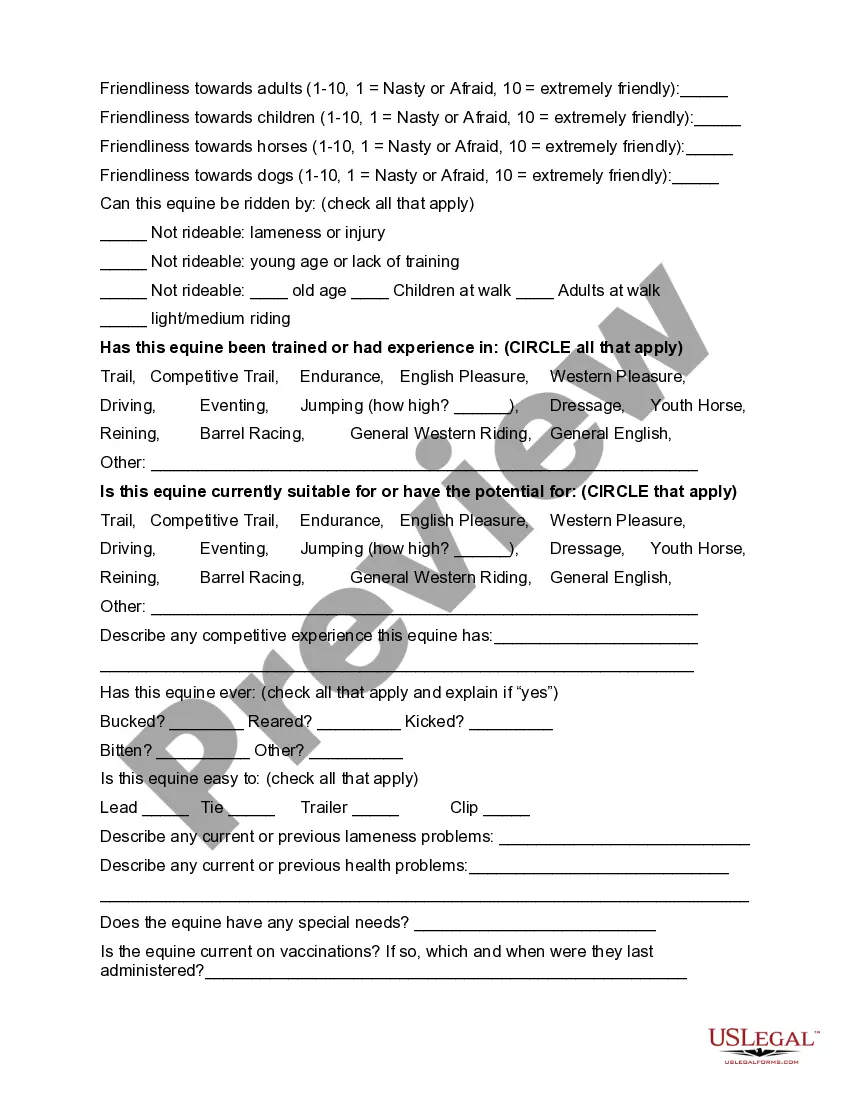

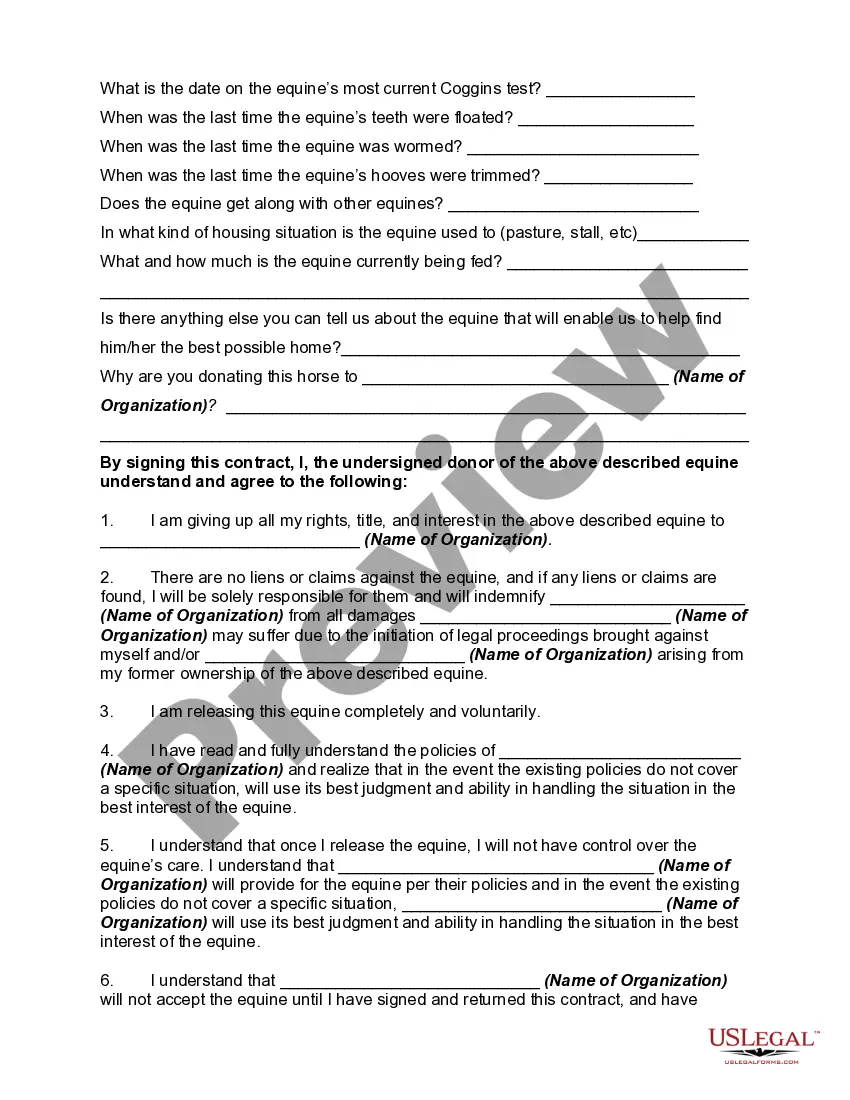

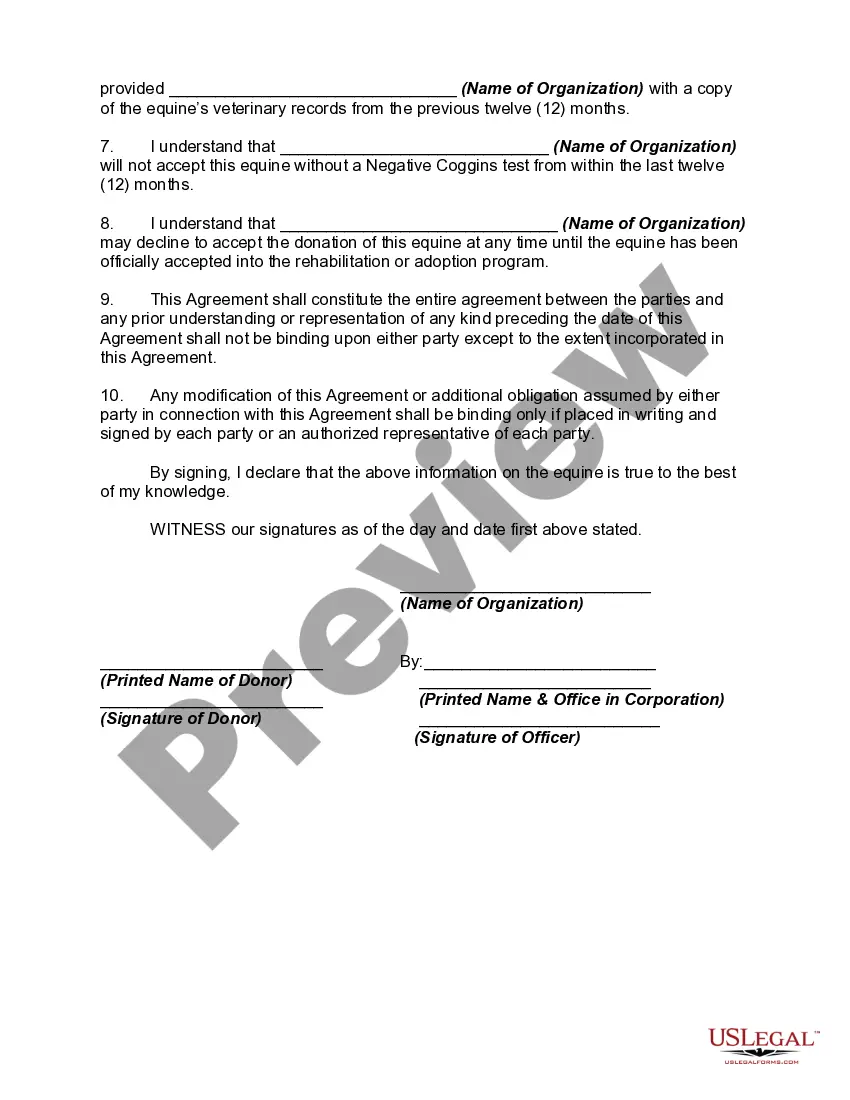

- Examine the page content closely to make certain it features the sample you need.

- To do so, use the form description and preview options if available.

Form popularity

FAQ

By definition, conditional promises to give are donor promises to contribute assets to an organization, assuming a specified future or uncertain event occurs. A condition is not the same as donor-imposed restrictions, but should be considered as a barrier that must be overcome to be considered a contribution.

If there is no acceptance, the donation cannot be formalized. Therefore, any donation contract is subject to these conditions: It is an act free and it is made voluntary. Cannot be done on future goods, i.e. the goods must be currently owned by the donor.

Gift agreements are completed and signed to prevent misunderstandings, and show your donor that you care and that they are valued and important. As a nonprofit organization must keep accurate records on donations received, so must a donor keep records of donations they've made especially when it comes to tax time.

A donation agreement will include the names of the parties, a description of the donation, whether a receipt that was given, and possibly the intended use for the donation. The agreement should also include a revocability (whether the donation can be taken back) section and define expense responsibility.

A Donation Agreement, also sometimes called a Charitable Gift Agreement, provides written proof for a donation, or gift, that has been given to a charitable organization in the United States.