1099 For Tips

Description

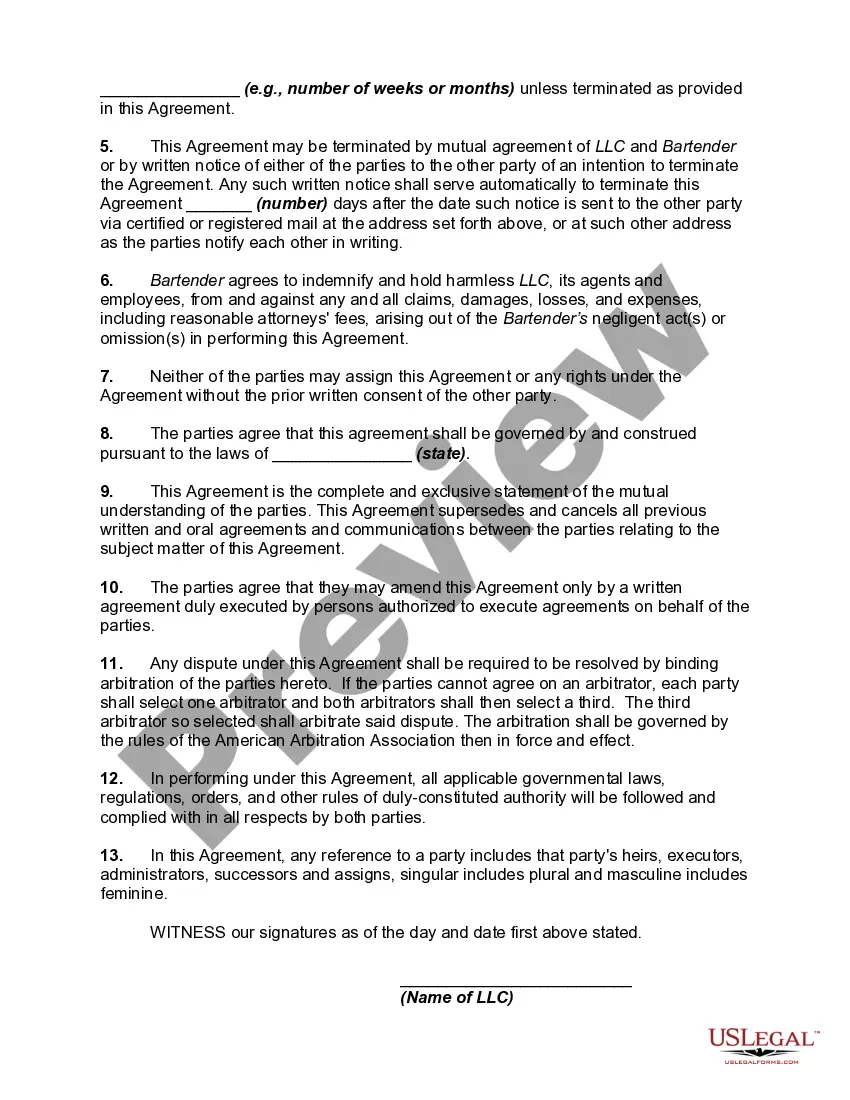

How to fill out Agreement Between A Bartender - As An Independent Contractor - And A Business That Supplies Bartenders To Parties And Special Events?

The 1099 For Tips displayed on this page is a reusable official template crafted by expert attorneys in accordance with federal and local laws.

For over 25 years, US Legal Forms has supplied individuals, enterprises, and legal professionals with more than 85,000 validated, state-specific documents for any business and personal situation. It’s the quickest, simplest, and most reliable method to acquire the papers you require, as the service ensures bank-level data protection and anti-malware safeguards.

Select the format you desire for your 1099 For Tips (PDF, Word, RTF) and download the sample to your device. Print the template to fill it out manually or use an online multifunctional PDF editor to quickly and accurately complete and sign your form with an electronic signature. Re-download your paperwork whenever necessary. Access the My documents tab in your profile to retrieve any previously acquired documents. Register for US Legal Forms to have verified legal templates for every aspect of life readily available.

- Examine the document you require and assess it.

- Browse through the file you searched and preview it or review the form description to verify it meets your requirements. If it doesn’t, utilize the search bar to find the correct one. Click Buy Now when you have located the template you need.

- Select and Log Into your account.

- Choose the pricing plan that fits you and set up an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and check your subscription to proceed.

- Acquire the editable template.

Form popularity

FAQ

You must report tips you received (including both cash and noncash tips) on your income tax return. Any tips you reported to your employer are included in the wages shown in box 1 of your Form W-2, Wage and Tax Statement. Add to the amount in box 1 only the tips you didn't report to your employer as required.

Tips for servers or bartenders at a business meal are deductible, but there's no "tip expense" category on your tax return. Instead, you claim tips as part of your total meal expense. You can also write off tips to cabbies, valets, maids and other non-meal related people as travel expenses.

How do I report tips to the IRS? The IRS requires you to report your total monthly tips to your employer by the 10th of the following month. If your employer doesn't have a process for reporting tip income, any staff member who has received tips can use Form 4070 to report those tips to the employer.

All tips you receive are income and are subject to federal income tax. You must include in gross income all tips you receive directly, charged tips paid to you by your employer, and your share of any tips you receive under a tip-splitting or tip-pooling arrangement.

What can happen if I do not keep a record of my tips? If it is determined in an examination that you underreported your tip income, the IRS will assess the taxes you owe based on the best available records of your employer.