What Is A Time Share House

Description

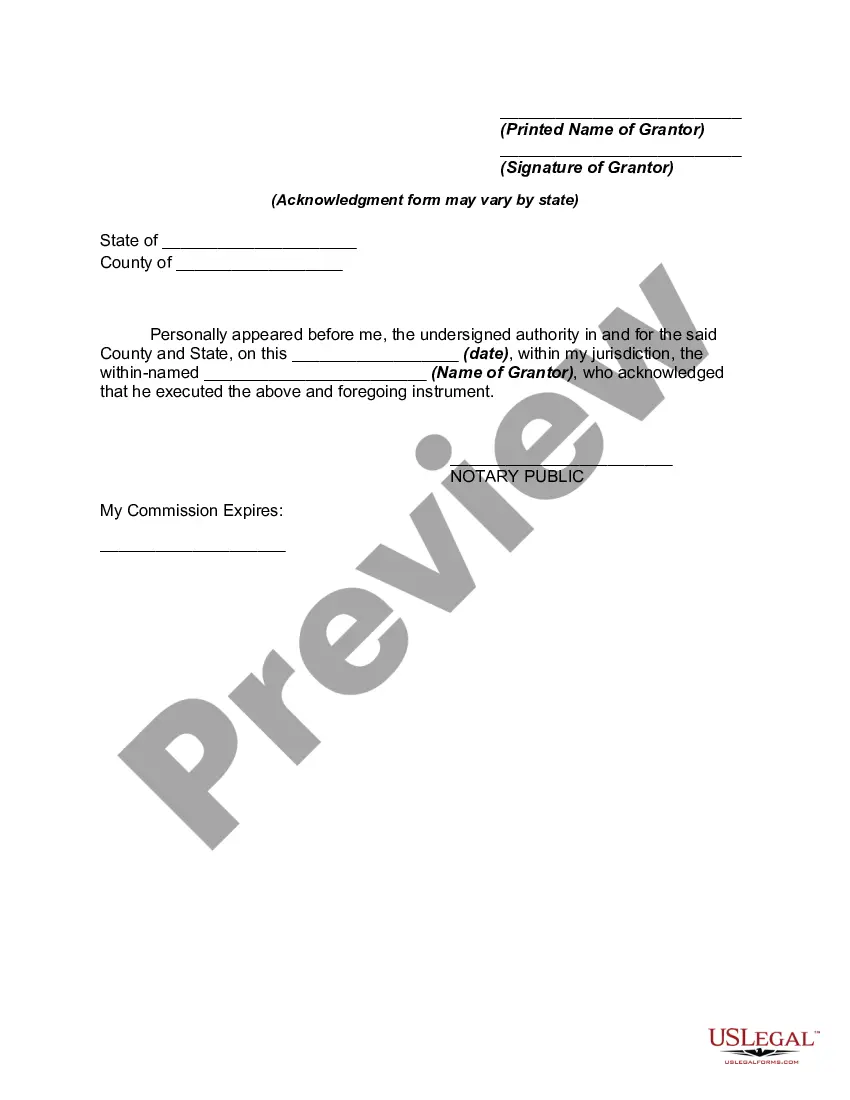

How to fill out Deed To Time Share Condominium With Covenants Of Title?

- If you're a returning user, log in to your account and select the required form template for download, ensuring your subscription is up to date. Renew it if needed.

- For first-time users, begin by browsing the extensive library of legal forms. Check the Preview mode to confirm that the selected document meets your jurisdiction's requirements.

- Should you require a different template, utilize the Search tab to locate the relevant document that aligns with your needs.

- Once you find the appropriate form, proceed by clicking the Buy Now button and choose a subscription plan best suited to your requirements.

- Complete your purchase by entering your payment details via credit card or PayPal.

- Finally, download the template directly to your device for easy access. You can always revisit your downloaded documents in the My Forms section of your profile.

US Legal Forms empowers both individuals and attorneys by providing a diverse array of more than 85,000 fillable legal forms, ensuring you can easily locate what you need.

With unparalleled access to premium expert assistance for form completion, you can rest assured your documents will be accurate and legally sound. Start using US Legal Forms today to simplify your legal documentation needs!

Form popularity

FAQ

Yes, you typically must report your timeshare on your taxes if you generate income from it. Even if you do not rent it out, it's essential to consider any fees or expenses related to ownership. Always keep detailed records, as they will help you with deductions. If you need clarity on these matters, consider exploring the resources available through USLegalForms.

When you receive a 1099-S, it means you've engaged in a real estate transaction, such as selling a timeshare house. You should report this on your tax return to include the proceeds in your income. Depending on your situation, you may also need to consider capital gains tax. If you need assistance with forms like the 1099-S, USLegalForms offers the tools to facilitate proper filing.

To report a timeshare, list any income earned from it on your tax return. You typically report rental income on Schedule E, and you can claim deductions on Schedule A. It's important to track your expenses related to the timeshare, as they may be deductible. USLegalForms can help you navigate the necessary forms for reporting.

Reporting a timeshare on your tax return involves understanding any income or deductions associated with it. If you rent out your timeshare, you need to declare that income. Additionally, you may be able to deduct mortgage interest and property taxes as you would for any other real estate. For tailored assistance with tax forms, USLegalForms offers resources that can simplify the process.

Yes, a timeshare is considered real estate. Essentially, a timeshare house allows multiple owners to possess a property for a specific period each year. When you buy into a timeshare, you own a fraction of the real estate, making it vital to understand your rights and responsibilities. If you have questions about timeshare ownership, consider utilizing USLegalForms for your documentation needs.

A time share house is a property ownership arrangement that allows multiple parties to share the costs and usage of a vacation home. This means you can enjoy the benefits of owning a home without the full financial burden. Typically, each owner receives a specific time period during the year to use the house. Consequently, this setup can make vacationing more affordable and give you a chance to create lasting memories with family and friends.

Generally, timeshares are not considered a traditional investment, as they rarely appreciate in value. Instead, they act more as a prepaid vacation plan. If you're curious about what is a time share house and its potential financial implications, reviewing your goals and exploring options like US Legal Forms can help you navigate this decision effectively.

Yes, many people do find satisfaction in owning a timeshare, particularly if they enjoy returning to the same vacation spot each year. The predictability of having a familiar place to stay can enhance their travel experience. However, it’s vital to weigh the pros and cons before deciding on what is a time share house.

Many individuals do express regret after purchasing a timeshare due to the financial commitments involved. Some feel trapped by the ongoing fees or disappointed by the limited flexibility in vacation choices. If you're contemplating what is a time share house, take time to assess whether it aligns with your lifestyle and budget.

The negatives of a timeshare often include high initial costs and ongoing maintenance fees that can increase over time. Additionally, selling a timeshare can be challenging, and many owners find it difficult to recoup their investment. It's essential to carefully consider these factors when exploring what is a time share house.