What Is A Time Share

Description

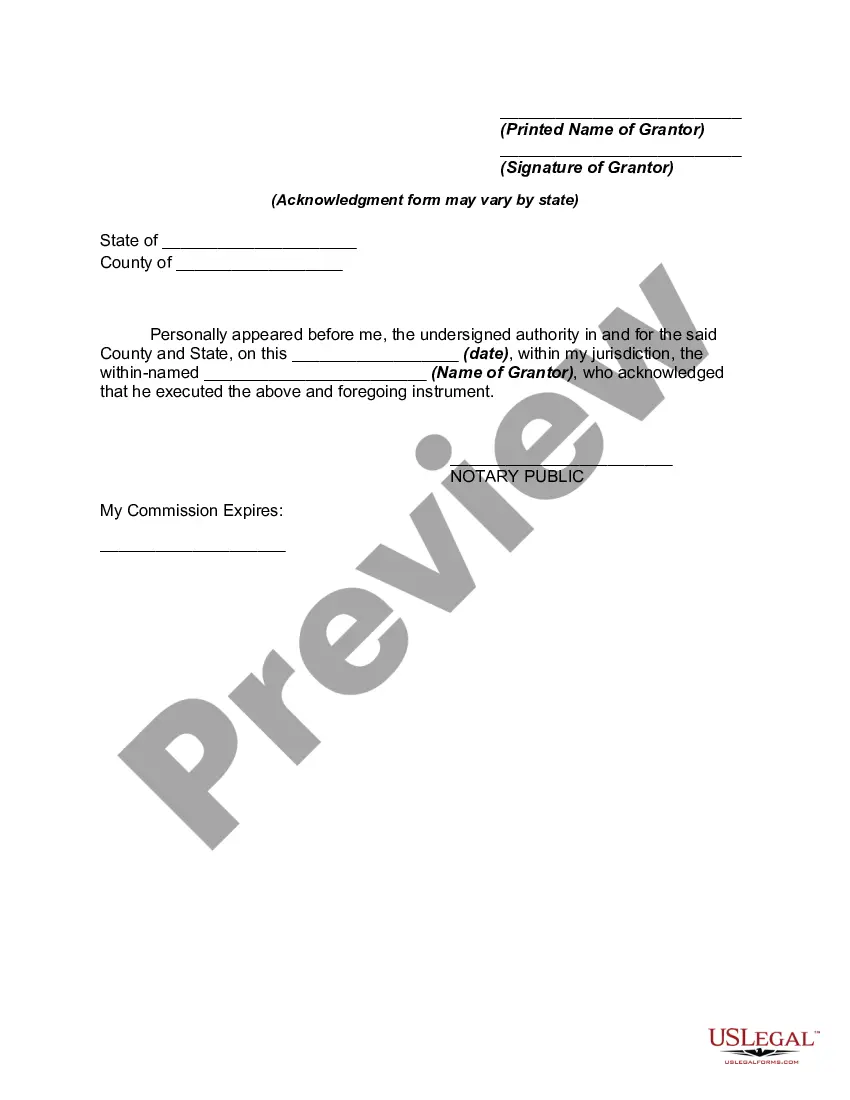

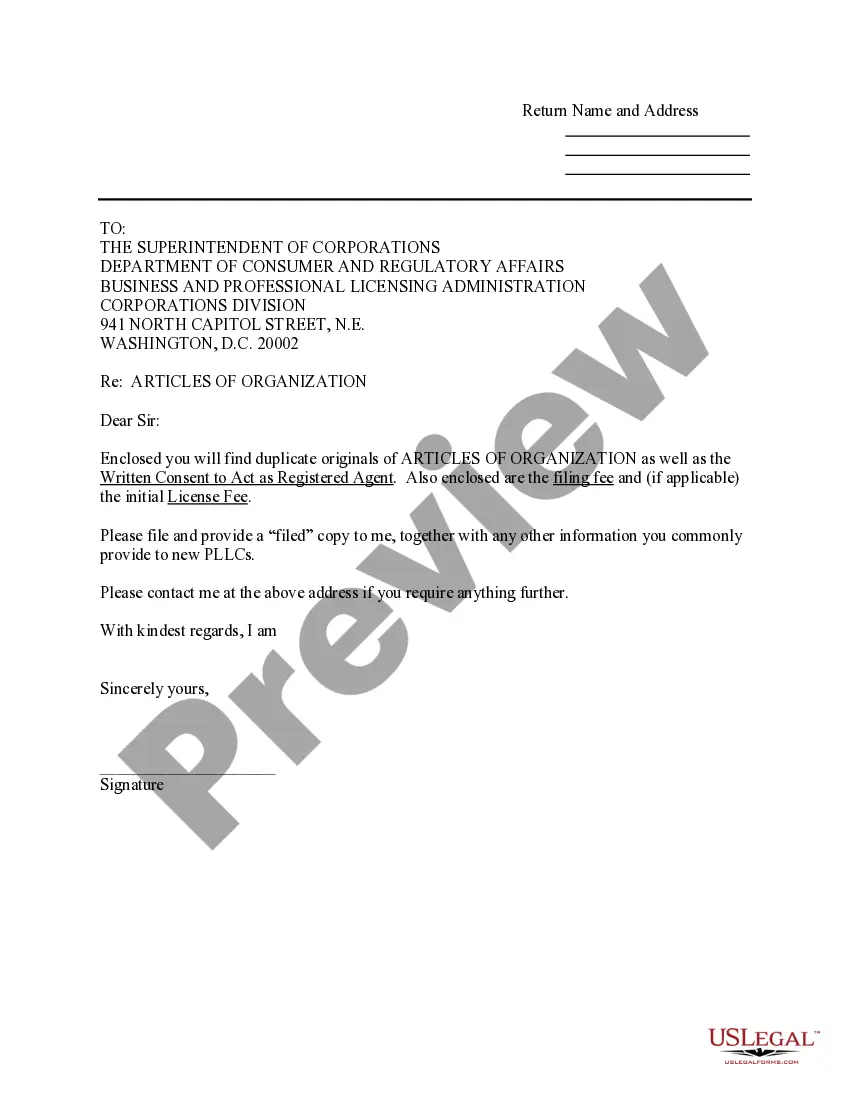

How to fill out Deed To Time Share Condominium With Covenants Of Title?

- If you are an existing user, log into your US Legal Forms account and download the required form template from your dashboard, ensuring your subscription is active. If it’s expired, please renew it based on your payment plan.

- For first-time users, begin by reviewing the form in Preview mode to guarantee it suits your needs and adheres to local jurisdiction standards.

- If the form doesn’t meet your requirements, utilize the Search feature to find the appropriate document. Once you find a suitable template, you can proceed.

- Select the template by clicking the Buy Now button and choose your preferred subscription plan. Creating an account will give you entry to a wealth of resources.

- Complete your purchase by entering your payment details, either through credit card or PayPal.

- Download the form to your device, allowing you to fill it out and access it anytime via the My Forms section of your profile.

US Legal Forms empowers users to swiftly access legal documents through a vast and user-friendly library filled with over 85,000 customizable forms. This ensures that you can find exactly what you need without hassle.

Take advantage of this resource now; whether you're an individual or an attorney, US Legal Forms has you covered for your legal documentation needs. Explore our comprehensive collection today!

Form popularity

FAQ

A timeshare is a shared property arrangement where multiple owners have the right to use the property for a specific time each year. Essentially, it divides the ownership and use of a vacation home or resort in a way that allows individuals to enjoy it without the full financial burden of sole ownership. In simple terms, when you ask, 'What is a time share?' think of it as a way to share vacation time in a desirable location, while benefiting from all the amenities of the property.

A timeshare is a property ownership model that allows multiple people to share the use and costs of a vacation property. Typically, you buy a specific period each year, giving you the right to use the property during that time. Users gain the flexibility of vacationing at a desirable location without full ownership expenses. Understanding the ins and outs of what is a time share can help you make informed decisions about your vacation options.

Determining if timeshares are a good investment depends on individual preferences and financial goals. While you might think about what a time share is in terms of value, the reality is that these properties often do not appreciate like traditional real estate. Instead, they provide guaranteed vacation accommodations, which can be a worthwhile expense for those who prioritize travel. Additionally, platforms like US Legal Forms can help clarify legal aspects related to such investments.

The primary purpose of timeshares is to provide shared ownership of vacation properties. When you understand what a time share is, you realize that it allows multiple owners to enjoy a property while minimizing costs. Each owner pays for a specific period of use, making vacations affordable and accessible. This arrangement gives families the chance to create lasting memories in desirable locations.

To report a timeshare, gather all related income and expense documentation. Use the appropriate forms based on its classification as a rental property or personal residence. If you're unsure about the process, US Legal Forms can provide templates and guidelines to help you accurately report what a timeshare is on your taxes.

In TurboTax, you can enter your timeshare under the 'Investment Income' section. If it's a rental, navigate to the appropriate prompts that allow you to input your income and expenses. Familiarizing yourself with what a timeshare is will help streamline this entry, making tax season less stressful.

Yes, a timeshare does count as owning property, though it functions differently than traditional ownership. You hold a share of the property rather than full ownership. This distinction impacts your financial obligations and benefits, making it essential to recognize what a timeshare means in your overall property portfolio.

To report a 1099-S, which relates to the sale or exchange of real estate, include it with your income when filing your tax return. Ensure the information matches your records for accuracy. If the 1099-S concerns your timeshare, understanding what a timeshare is can assist you in properly reporting it on your tax forms.

Yes, reporting a timeshare on your taxes is typically required. If you earn income from renting it out, you must report that income. Additionally, even if it doesn’t generate income, certain expenses may be deductible, based on how you use the timeshare. Recognizing what a timeshare is helps ensure you follow the correct tax procedures.

When you claim a timeshare on taxes, categorize it based on its use. If you rent it out, report the rental income and deduct related expenses, like maintenance and management. For personal use timeshares, focus on mortgage interest and property taxes. Understanding what a timeshare is can simplify the claiming process.